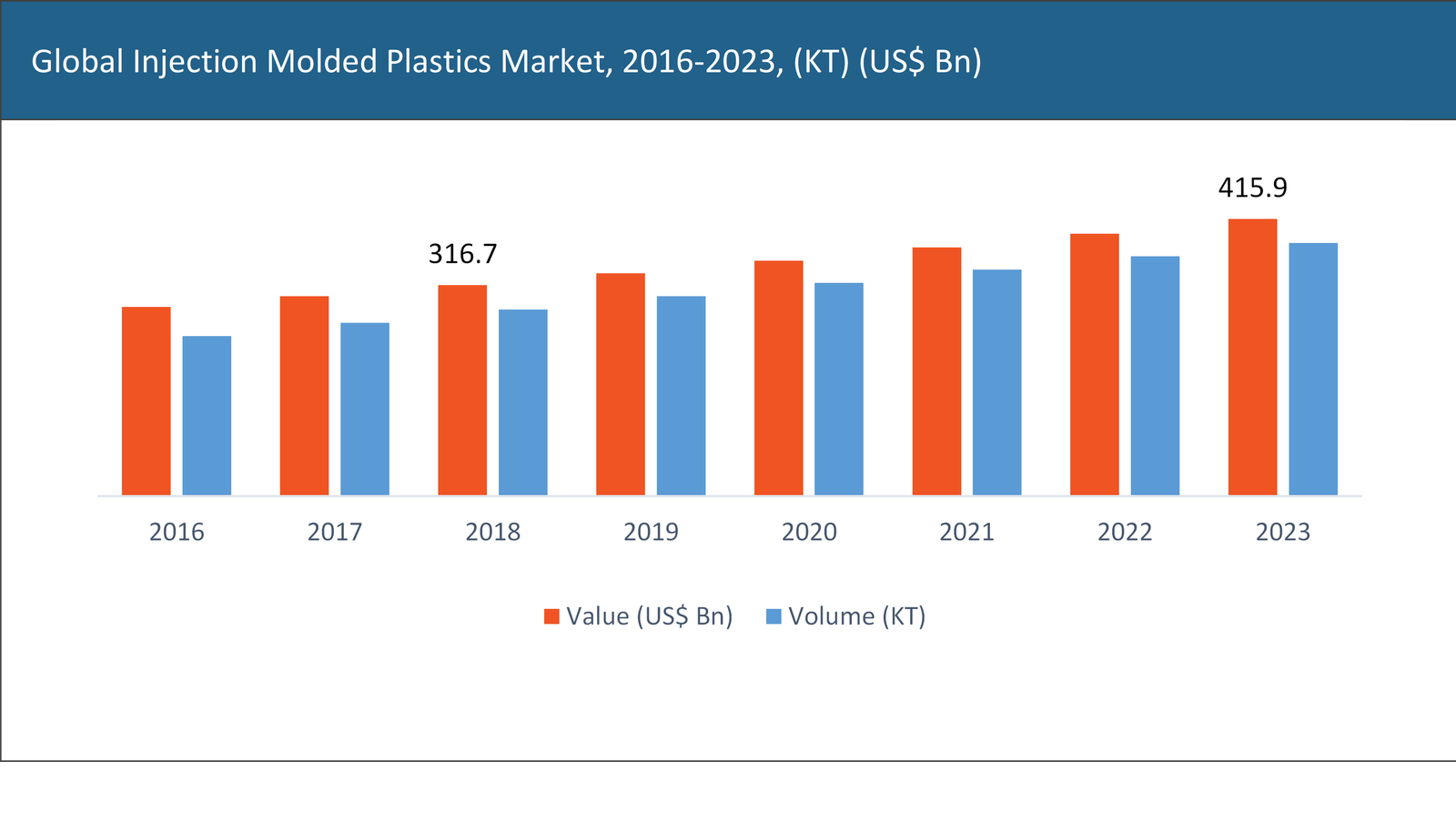

The global injection molded plastic market was valued at US$ 316.7 billion in the year 2018 and is expected to reach US$ 415.9 billion by the year 2023, growing at a CAGR of 5.6%. In terms of volume, the market was valued at XX KT in the year 2018 and is expected to reach XX KT by the year 2023, growing at a CAGR of XX%.

Injection molding is the most commonly used method for manufacturing plastics products in which plastics are heated until they are converted into a liquid form, and then with the help of the injection molding machine, they are injected into a mold of the final desired part. In the mold, the plastics solidifies to form the final desired product.

The injection molding process allows the use of multiple plastics at the same time and the creation of intricate and complex parts of high strength. Injection molded plastic products require less finishing which helps in cost reduction. Apart from this, the process is quick and has a high output rate, and can be automated, which further reduces the overall cost of the manufactured products. All these benefits of the injection molding process will help drive the growth of the injection molded plastic market.

The increasing demand for plastic components from various end-user industries such as packaging, automotive, and medical is expected to drive the growth of the injection molded plastic market during the forecast period. However, rising environmental concerns regarding the use of plastics and volatile prices of raw materials are expected to hinder market growth.

The injection molded plastic market report covers an in-depth analysis of the market including statistical and subjective data points, along with the key market drivers and opportunities & restraints that have positive or negative effects on the overall global market. Exclusive coverage has been provided for market drivers, restraints, challenges & opportunities for a country-level market in the respective regional segments. The report comprises a competitive analysis of the key players functioning in the market and covers in-depth data related to the competitive landscape of the market and the recent strategies & products that will assist or affect the market in the near future.

Based on raw materials, the injection molded plastic market has been segmented into polypropylene, Acrylonitrile butadiene styrene (ABS), polystyrene, and polyethylene. Polypropylene accounted for the largest share in the market. The high demand for polypropylene products from various end-user industries such as automobile, packaging, and household products is one of the key reasons for its large share in the injection molded plastic market. ABS accounted for the second largest share in the injection molded plastic material based on raw materials.

By Raw Material

By Application

Based on application, the packaging segment accounted for the largest share in the market. The automobile application is expected to show tremendous potentials for growth in the injection molded plastic market. The automobile industry is increasingly focusing on reducing the overall weight of vehicles in order to improve fuel efficiency.

The growth in the adoption of electric vehicles will further require a reduction in vehicle weight. All these factors are expected to drive the demand for injection molded plastics for automobile applications. Another lucrative application segment is the medical sector. The strict regulatory guidelines regarding the use of medical grade polymers are expected to positively impact the market.

Geographically, Asia-Pacific accounted for the largest share in terms of demand in the global injection molded plastics market. The growing automobile and electronics industry in countries like China, India, and Indonesia is expected to drive the growth of the injection molded plastics in this region. The availability of cheap labour and various tax benefits provided to manufacturers by governments in this region are expected to drive the demand further. Apart from this, many plastic manufacturers are starting new operations or increasing the capacity of their plants in this region, which is expected to positively impact the market.

Europe is also a major market for injection molded plastics. The rising automobile sector and the increasing demand for electronics from countries such as France, Germany, and the UK are expected to drive the European injection molded plastics market.

Company Profiles covered in Injection Molded Plastic Market:

The major players operating in the injection molded plastics market include

Companies are increasingly focusing on ramping-up their current manufacturing capacity in order to meet Injection Molded Plastic Market demand. For instance, in 2017, Dow Chemical completed the construction of the company’s new polyethylene manufacturing plant in Houston, Texas. The plant has a capacity of around 400,000 metric tons per year. Apart from this, companies are also focusing on developing new products, particularly for use in specific end-use industries. They are also opening up new manufacturing facilities in the Asia-Pacific region in order to cater to the rising demand in this region.

Geographies covered in Injection Molded Plastic Market:

North America

Europe

Asia Pacific

Latin America

Middle East and Africa

Key Questions Answered:

Ask for free product review call with the author

Share your specific research requirements for a customized report

Request for due diligence and consumer centric studies

Request for study updates, segment specific and country level reports

Table of Content

Chapter 1 Preface

1.1 Report Description

1.1.1 Purpose of the Report

1.1.2 Target Audience

1.1.3 USP and Key Offerings

1.2 Research Scope

1.3 Research Methodology

1.3.1 Phase I – Secondary Research

1.3.2 Phase II – Primary Research

1.3.3 Phase III – Expert Panel Review

1.3.4 Approach Adopted

1.3.4.1 Top-Down Approach

1.3.4.2 Bottom-Up Approach

1.3.5 Assumptions

1.4 Market Segmentation Scope

Chapter 2 Executive Summary

2.1 Market Summary

2.1.1 Global Injection Molded Plastics Market, 2016-2023, (KT) (US$ Mn)

2.1 Market Snapshot: Global Injection Molded Plastics Market

2.2 Market Dynamics

2.3 Global Injection Molded Plastics Market, by Segment, 2018

2.3.1 Global Injection Molded Plastics Market, by Raw Material, 2018, (KT) (US$ Mn)

2.3.2 Global Injection Molded Plastics Market, by End-user, 2018 (KT) (US$ Mn)

2.3.3 Global Injection Molded Plastics Market, by Region, 2018 (KT) (US$ Mn)

2.4 Premium Insights

2.4.1 Injection Molded Plastics Market In Developed Vs. Developing Economies, 2018 vs 2023

2.4.2 Global Injection Molded Plastics Market: Regional Life Cycle Analysis

Chapter 3 Market Dynamics

3.1 Market Overview

3.2 Market Drivers

3.2.1 Increasing Demand for injection molded plastics from automotive and packaging industry

3.2.2 Technological Advancements in Defibrillators

3.3 Market Restraints

3.3.1 Rising environmental concerns regarding the use of plastics

3.3.2 Volatile Raw Material Prices

3.4 Market Opportunities

3.4.1 Opportunity 1

3.4.1 Opportunity 2

3.5 Industry Value Chain Analysis

3.5.1 Analyst’s Views

3.6 Industry SWOT Analysis

Chapter 4 Global Injection Molded Plastics Market, by Raw Material

4.1 Market Overview, by Raw Material

4.1.1 Global Injection Molded Plastics Market, by Raw Material, 2016-2023 (KT) (US$ Mn)

4.1.2 Incremental Opportunity, by Raw Material, From 2018-2023

4.2 Polypropylene

4.2.1 Global Injection Molded Plastics Market, by Polypropylene, 2016-2023, (KT) (US$ Mn)

4.3 Acrylonitrile butadiene styrene (ABS)

4.3.1 Global Injection Molded Plastics Market, by Acrylonitrile butadiene styrene (ABS), 2016-2023, (KT) (US$ Mn)

4.4 Polystyrene

4.4.1 Global Injection Molded Plastics Market, by Polystyrene, 2016-2023, (KT) (US$ Mn)

4.5 Polyethylene

4.5.1 Global Injection Molded Plastics Market, by Polyethylene, 2016-2023, (KT) (US$ Mn)

Chapter 5 Global Injection Molded Plastics Market, by Application

5.1 Market Overview, by Application

5.1.1 Global Injection Molded Plastics Market, by Application, 2016-2023 (KT) (US$ Mn)

5.1.2 Incremental Opportunity, by Application, From 2018-2023

5.2 Automotive and transportation

5.2.1 Global Injection Molded Plastics Market, by Automotive and transportation, 2016-2023, (KT) (US$ Mn)

5.3 Electronics and Consumer goods

5.3.1 Global Injection Molded Plastics Market, by Electronics and Consumer goods, 2016-2023, (KT) (US$ Mn)

5.4 Packaging

5.4.1 Global Injection Molded Plastics Market, by Packaging, 2016-2023, (KT) (US$ Mn)

5.5 Building and Construction

5.5.1 Global Injection Molded Plastics Market, by Building and Construction, 2016-2023, (KT) (US$ Mn)

5.6 Medical

5.6.1 Global Injection Molded Plastics Market, by Medical, 2016-2023, (KT) (US$ Mn)

5.8 Others

5.8.1 Global Injection Molded Plastics Market, by Others, 2016-2023, (KT) (US$ Mn)

Chapter 6 Global Injection Molded Plastics Market, by Region

6.1 Market Overview, by Region

6.1.1 Global Injection Molded Plastics Market, by Region, 2016-2023, (KT) (US$ Mn)

6.2 Attractive Investment Opportunity, by Region, 2018

6.3 North America Injection Molded Plastics Market

6.3.1 North America Injection Molded Plastics Market, by Raw Material, 2016-2023 (KT) (US$ Mn)

6.3.2 North America Injection Molded Plastics Market, by Application, 2016-2023 (KT) (US$ Mn)

6.3.3 United States Country Profile

6.3.3.1 United States Injection Molded Plastics Market, 2016-2023 (KT) (US$ Mn)

6.3.4 Canada Country Profile

6.3.4.1 Canada Injection Molded Plastics Market, 2016-2023 (KT) (US$ Mn)

6.4 Europe Injection Molded Plastics Market

6.4.1 Europe Injection Molded Plastics Market, by Raw Material, 2016-2023 (KT) (US$ Mn)

6.4.2 Europe Injection Molded Plastics Market, by Application, 2016-2023 (KT) (US$ Mn)

6.4.3 United Kingdom Country Profile

6.4.3.1 United Kingdom Injection Molded Plastics Market, 2016-2023 (KT) (US$ Mn)

6.4.4 Germany Country Profile

6.4.4.1 Germany Injection Molded Plastics Market, 2016-2023 (KT) (US$ Mn)

6.4.5 France Country Profile

6.4.5.1 France Injection Molded Plastics Market, 2016-2023 (KT) (US$ Mn)

6.4.6 Italy Country Profile

6.4.6.1 Italy Injection Molded Plastics Market, 2016-2023 (KT) (US$ Mn)

6.4.7 Spain Country Profile

6.4.7.1 Spain Injection Molded Plastics Market, 2016-2023 (KT) (US$ Mn)

6.4.8 Rest of Europe

6.4.8.1 Rest of Europe Injection Molded Plastics Market, 2016-2023 (KT) (US$ Mn)

6.5 Asia Pacific Injection Molded Plastics Market

6.5.1 Asia Pacific Injection Molded Plastics Market, by Raw Material, 2016-2023 (KT) (US$ Mn)

6.5.2 Asia Pacific Injection Molded Plastics Market, by Application, 2016-2023 (KT) (US$ Mn)

6.5.3 China Country Profile

6.5.3.1 China Injection Molded Plastics Market, 2016-2023 (KT) (US$ Mn)

6.5.4 Japan Country Profile

6.5.4.1 Japan Injection Molded Plastics Market, 2016-2023 (KT) (US$ Mn)

6.5.5 India Country Profile

6.5.5.1 India Injection Molded Plastics Market, 2016-2023 (KT) (US$ Mn)

6.5.6 Rest of Asia Pacific

6.5.6.1 Rest of Asia Pacific Injection Molded Plastics Market, 2016-2023 (KT) (US$ Mn)

6.6 Latin America Injection Molded Plastics Market

6.6.1 Latin America Injection Molded Plastics Market, by Product Type, 2016-2023 (KT) (US$ Mn)

6.6.2 Latin America Injection Molded Plastics Market, by End-user, 2016-2023 (KT) (US$ Mn)

6.6.3 Brazil Country Profile

6.6.3.1 Brazil Injection Molded Plastics Market, 2016-2023 (KT) (US$ Mn)

6.6.4 Mexico Country Profile

6.6.4.1 Mexico Injection Molded Plastics Market, 2016-2023 (KT) (US$ Mn)

6.6.5 Rest of Latin America

6.6.5.1 Rest of Latin America Injection Molded Plastics Market, 2016-2023 (KT) (US$ Mn)

6.7 Middle East & Africa Injection Molded Plastics Market

6.7.1 Middle East & Africa Injection Molded Plastics Market, by Product Type, 2016-2023 (KT) (US$ Mn)

6.7.2 Middle East & Africa Injection Molded Plastics Market, by End-user, 2016-2023 (KT) (US$ Mn)

6.7.3 GCC

6.7.3.1 GCC Injection Molded Plastics Market, 2016-2023 (KT) (US$ Mn)

6.7.4 Rest of Middle East & Africa

6.7.4.1 Rest of Middle East & Africa Injection Molded Plastics Market, 2016-2023 (KT) (US$ Mn)

Chapter 7 Competitive Intelligence

7.1 Market Players Present in Market Life Cycle

7.2 Top 5 Players Comparison

7.3 Market Positioning of Key Players, 2018

7.4 Market Players Mapping

7.4.1 By Raw Material

7.4.2 By Application

7.4.3 By Region

7.5 Strategies Adopted by Key Market Players

7.6 Recent Developments in the Market

7.6.1 Mergers & Acquisitions, Partnership, New Product Developments

7.7 Operational Efficiency Comparison by Key Players

Chapter 8 Company Profiles

8.1 BASF SE

8.1.1 BASF SE Overview

8.1.2 Key Stakeholders/Person in BASF SE

8.1.3 BASF SE Products Portfolio

8.1.4 BASF SE Financial Overview

8.1.5 BASF SE News/Recent Developments

8.2 Chevron Phillips Chemical Company

8.2.1 Chevron Phillips Chemical Company Overview

8.2.2 Key Stakeholders/Person in Chevron Phillips Chemical Company

8.2.3 Chevron Phillips Chemical Company Products Portfolio

8.2.4 Chevron Phillips Chemical Company Financial Overview

8.2.5 Chevron Phillips Chemical Company News/Recent Developments

8.3 Eastman Chemical Company

8.3.1 Eastman Chemical Company Overview

8.3.2 Key Stakeholders/Person in Eastman Chemical Company

8.3.3 Eastman Chemical Company Products Portfolio

8.3.4 Eastman Chemical Company Financial Overview

8.3.5 Eastman Chemical Company News/Recent Developments

8.4 Dow Chemical Company

8.4.1 Dow Chemical Company Overview

8.4.2 Key Stakeholders/Person in Dow Chemical Company

8.4.3 Dow Chemical Company Products Portfolio

8.4.4 Dow Chemical Company Financial Overview

8.4.5 Dow Chemical Company News/Recent Developments

8.5 Exxon Mobil Corporation

8.5.1 Exxon Mobil Corporation Overview

8.5.2 Key Stakeholders/Person in Exxon Mobil Corporation

8.5.3 Exxon Mobil Corporation Products Portfolio

8.5.4 Exxon Mobil Corporation Financial Overview

8.5.5 Exxon Mobil Corporation News/Recent Developments

8.6 Huntsman Corporation

8.6.1 Huntsman Corporation Overview

8.6.2 Key Stakeholders/Person in Huntsman Corporation

8.6.3 Huntsman Corporation Products Portfolio

8.6.4 Huntsman Corporation Financial Overview

8.6.5 Huntsman Corporation News/Recent Developments

8.7 INEOS Group

8.7.1 INEOS Group Overview

8.7.2 Key Stakeholders/Person in INEOS Group

8.7.3 INEOS Group Products Portfolio

8.7.4 INEOS Group Financial Overview

8.7.5 INEOS Group News/Recent Developments

8.8 LyondellBasell Industries N.V.

8.8.1 LyondellBasell Industries N.V. Overview

8.8.2 Key Stakeholders/Person in LyondellBasell Industries N.V.

8.8.3 LyondellBasell Industries N.V. Products Portfolio

8.8.4 LyondellBasell Industries N.V. Financial Overview

8.8.5 LyondellBasell Industries N.V. News/Recent Developments

8.9 SABIC

8.9.1 SABIC Overview

8.9.2 Key Stakeholders/Person in SABIC

8.9.3 SABIC Products Portfolio

8.9.4 SABIC Financial Overview

8.9.5 SABIC News/Recent Developments