Emulsifiers are substances that are used to combine water and oils to form an emulsion. Emulsifiers present in food enhances the suspension of water and oil, mainly in foods like ice-cream, margarine, and salad dressing, among others.

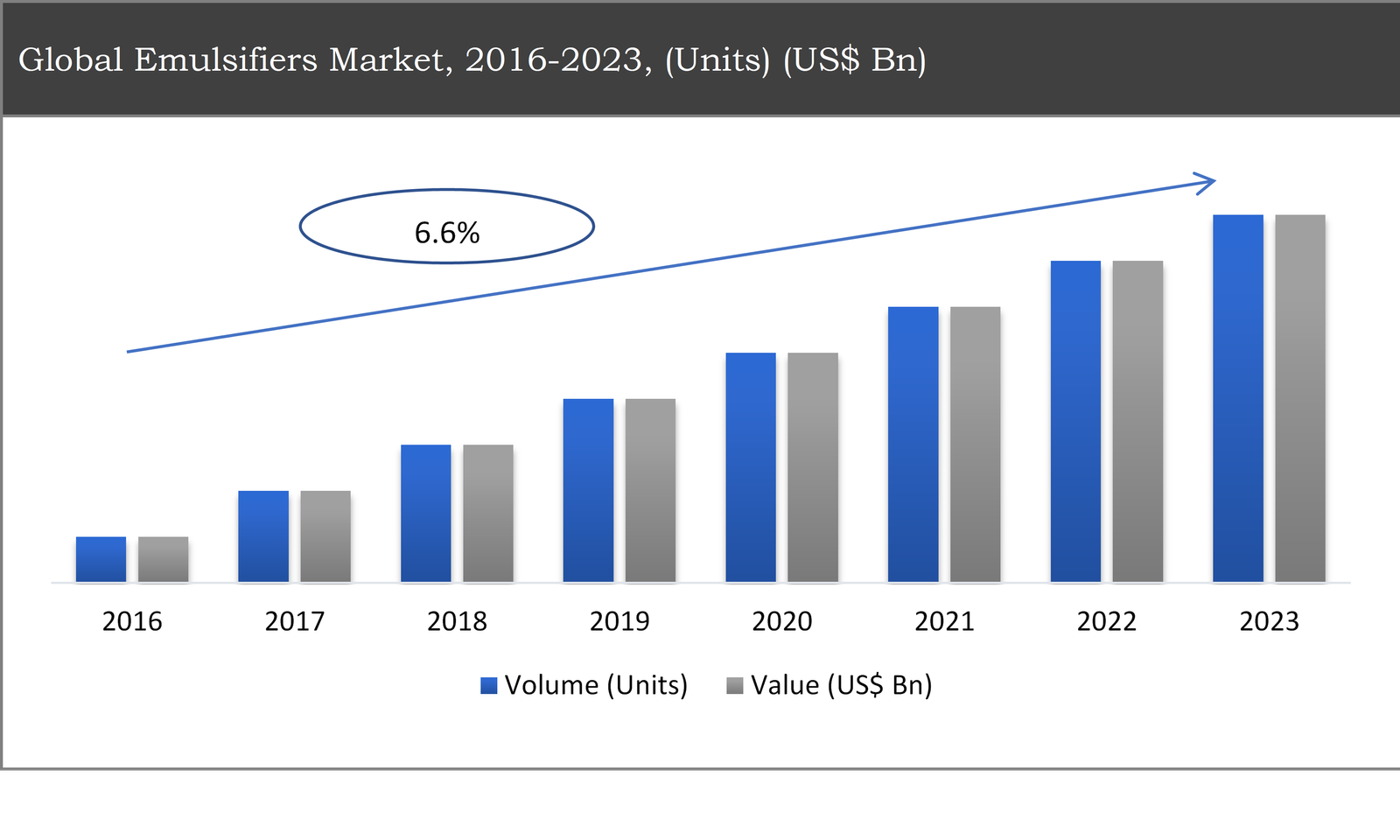

Emulsifiers are increasingly used in food in order to make it more appetizing in terms of appearance and consistency. This emulsifiers market report provides an analysis for the period from 2016 to 2023, where 2018 to 2023 is the forecast period and 2017 is the base year. This report on emulsifiers covers an in-depth analysis of the market including statistical and subjective data points, along with the key market drivers and opportunities & restraints that have positive or negative effects on the overall global market. Exclusive coverage has been provided for market drivers and challenges & opportunities for a country-level market in the respective regional segments. The report comprises a competitive analysis of the key players functioning in the market and covers in-depth data related to the competitive landscape of the market and the recent strategies & products that will assist or affect the market in the coming years.

The global emulsifiers market has been segmented based on different type and end-use. Based on different types, the market is segmented into Lecithin, Esters of monoglycerides of fatty acids, Esters of monoglycerides of fatty acids, Polyglycerol Esters, Polysorbates, Polyglycerol Polyricinoleate, and Lactic esters of fatty acids. By different end-use, the market is segmented into personal care and cosmetics, food & beverages, pharmaceuticals, and others.

The Lecithin segment dominated the market in 2018 and is expected to display a similar trend in the coming years

In 2018, the lecithin segment accounted for a majority of the market share and is expected to retain its dominance by 2023. The emulsifying properties of lecithin is fuelling its demand in many food and industrial applications. Further, the multifunctional nature of lecithin is expected to play a vital role in augmenting its demand over the years. Lecithin belongs to the group of yellowish-brown fatty substances that naturally occur in animal and plant tissues. Lecithins are amphiphilic in nature and can attract water and fatty substances. They are widely used in emulsifiers in several commercial products such as foods, paints, and pharmaceuticals, among others.

The Food & Beverage segment dominated the market in 2018 and is expected to display a similar trend in the coming years

In 2018, the food & beverage segment accounted for the majority of market share and is expected to retain its dominance in the coming years. Emulsifiers consist of multifunctional ingredients that are heavily used in bakery products. Emulsifiers are widely used in the food industry to emulsify and blend ingredients, improve the properties of the shortening, as well as to interact with the flour components present in the mix.

In the food industry, emulsifiers are used in margarine and ice-creams in order to form stable emulsions in fat and water, as large crystals of water give an uneven and rough consistency to food.

By Product Type

By End User

North America

Europe

Asia Pacific

LATAM

Middle East Africa

Europe dominated the market in 2018 and expected to display a similar trend in the coming years

In terms of different regions, Europe dominated the market in 2018 and is expected to retain its dominance in the coming years. This is mainly due to the presence of modern food processing techniques, leading to the expansion of food production and product development in several end-use industries such as confectionery, dairy, and oil. The market for emulsifiers in the European region is mainly driven by the increasing consumer interest towards trans-fat products and low-calorie foods. Further, increasing consumption of processed foods and rising innovations in end-use applications such as bakery products, are encouraging manufacturers to focus on new product launches and innovations in order to grab more customer attention.

Asia Pacific is expected to witness the fastest growth during the forecast period

The Asia-Pacific region is expected to witness the fastest growth during the forecast period, owing to the development of the food & beverage industry in this region. Changing lifestyles, the rising demand for convenience food and growing health consciousness are the factors that are driving the overall market growth in the Asia-Pacific region.

The major players operating in the global emulsifiers are Archer Daniels Midland (ADM), Akzo Nobel N.V, BASF SE, Cargill Incorporated, DowDuPont, Evonik Industries AG, Estelle Chemicals Pvt. Ltd., Kerry Group, Gattefossé SAS, Lonza Group, Puratos, Royal DSM, and Solvay S.A., among others. The players have stepped up new product innovations and new product launches, in order to gain more attention from the customers. Moreover, the market growth is attributed to strategic mergers & acquisitions, geographical expansions, and joint ventures & partnerships that are undertaken to ensure long-term sustenance in the market. For instance, Multec, a range of emulsifiers offered by Puratos, is designed to enhance the volume of foods that are baked, by softening the crumb and also by improving the aeration capacity.

Ask for free product review call with the author

Share your specific research requirements for a customized report

Request for due diligence and consumer centric studies

Request for study updates, segment specific and country level reports

Chapter 1 Preface

1.1 Report Description

1.1.1 Purpose of the Report

1.1.2 Target Audience

1.1.3 USP and Key Offerings

1.2 Research Scope

1.3 Research Methodology

1.3.1 Phase I – Secondary Research

1.3.2 Phase II – Primary Research

1.3.3 Phase III – Expert Panel Review

1.3.4 Approach Adopted

1.3.4.1 Top-Down Approach

1.3.4.2 Bottom-Up Approach

1.3.5 Assumptions

1.4 Market Segmentation Scope

Chapter 2 Executive Summary

2.1 Market Summary

2.1.1 Global Emulsifiers Market, 2016-2023, (Mn Units) (US$ Mn)

2.1 Market Snapshot: Global Emulsifiers Market

2.2 Market Dynamics

2.3 Global Emulsifiers Market, by Segment, 2018

2.3.1 Global Emulsifiers Market, by Type, 2018, (Mn Units) (US$ Mn)

2.3.2 Global Emulsifiers Market, by End-use, 2018, (Mn Units) (US$ Mn)

2.3.3 Global Emulsifiers Market, by Region, 2018 (Mn Units) (US$ Mn)

2.4 Premium Insights

2.4.1 Emulsifiers Market In Developed Vs. Developing Economies, 2018 vs 2023

2.4.2 Global Emulsifiers Market: Regional Life Cycle Analysis

Chapter 3 Market Dynamics

3.1 Market Overview

3.2 Market Drivers

3.2.1 Increasing awareness regarding consumption of low-fat foods is resulting to the rise in the demand for emulsifiers

3.2.2 Driver 2

3.2.3 Driver 3

3.3 Market Restraints

3.3.1 Restraint 1

3.3.2 Restraint 2

3.4 Market Opportunities

3.4.1 Opportunity 1

3.4.2 Opportunity 2

3.5 Industry Value Chain Analysis

3.5.1 Analyst’s Views

3.6 Industry SWOT Analysis

Chapter 4 Global Emulsifiers Market, by Type

4.1 Market Overview, by Type

4.1.1 Global Emulsifiers Market, by Type, 2016-2023 (Mn Units) (US$ Mn)

4.1.2 Incremental Opportunity, by Type, From 2018-2023

4.2 Lecithin

4.2.1 Global Emulsifiers Market, by Lecithin, 2016-2023, (Mn Units) (US$ Mn)

4.3 Mono & Di - glycerides of fatty acid

4.3.1 Global Emulsifiers Market, by Mono & Di - glycerides of fatty acid, 2016-2023, (Mn Units) (US$ Mn)

4.4 Esters of monoglycerides of fatty acids

4.4.1 Global Emulsifiers Market, by Esters of monoglycerides of fatty acids, 2016-2023, (Mn Units) (US$ Mn)

4.5 Polyglycerol Esters

4.5.1 Global Emulsifiers Market, by Polyglycerol Esters, 2016-2023, (Mn Units) (US$ Mn)

4.6 Polysorbates

4.6.1 Global Emulsifiers Market, by Polysorbates, 2016-2023, (Mn Units) (US$ Mn)

4.7 Polyglycerol

4.7.1 Global Emulsifiers Market, by Polyglycerol , 2016-2023, (Mn Units) (US$ Mn)

4.8 Polyglycerol Polyricinoleate

4.8.1 Global Emulsifiers Market, by Polyglycerol Polyricinoleate, 2016-2023, (Mn Units) (US$ Mn)

4.9 Lactic esters of fatty acids

4.9.1 Global Emulsifiers Market, by Lactic esters of fatty acids, 2016-2023, (Mn Units) (US$ Mn)

Chapter 5 Global Emulsifiers Market, by End-use

5.1 Market Overview, by End-use

5.1.1 Global Emulsifiers Market, by End-use, 2016-2023 (Mn Units) (US$ Mn)

5.1.2 Incremental Opportunity, by End-use, From 2018-2023

5.2 Personal Care and Cosmetics

5.2.1 Global Emulsifiers Market, by Personal Care, 2016-2023, (Mn Units) (US$ Mn)

5.3 Food & Beverages

5.3.1 Global Emulsifiers Market, by Food & Beverages, 2016-2023, (Mn Units) (US$ Mn)

5.4 Pharmaceuticals

5.4.1 Global Emulsifiers Market, by Pharmaceuticals, 2016-2023, (Mn Units) (US$ Mn)

5.5 Others

5.5.1 Global Emulsifiers Market, by Others, 2016-2023, (Mn Units) (US$ Mn)

Chapter 6 Global Emulsifiers Market, by Region

6.1 Market Overview, by Region

6.1.1 Global Emulsifiers Market, by Region, 2016-2023, (Mn Units) (US$ Mn)

6.2 Attractive Investment Opportunity, by Region, 2018

6.3 North America Emulsifiers Market

6.3.1 North America Emulsifiers Market, by Type, 2016-2023 (Mn Units) (US$ Mn)

6.3.2 North America Emulsifiers Market, by End-use, 2016-2023 (Mn Units) (US$ Mn)

6.3.3 United States Country Profile

6.3.3.1 United States Emulsifiers Market, 2016-2023 (Mn Units) (US$ Mn)

6.3.4 Canada Country Profile

6.3.4.1 Canada Emulsifiers Market, 2016-2023 (Mn Units) (US$ Mn)

6.3.5 Mexico Country Profile

6.3.5.1 Mexico Emulsifiers Market, 2016-2023 (Mn Units) (US$ Mn)

6.4 Europe Emulsifiers Market

6.4.1 Europe Emulsifiers Market, by Type, 2016-2023 (Mn Units) (US$ Mn)

6.4.2 Europe Emulsifiers Market, by End-use, 2016-2023 (Mn Units) (US$ Mn)

6.4.3 United Kingdom Country Profile

6.4.3.1 United Kingdom Emulsifiers Market, 2016-2023 (Mn Units) (US$ Mn)

6.4.4 Germany Country Profile

6.4.4.1 Germany Emulsifiers Market, 2016-2023 (Mn Units) (US$ Mn)

6.4.5 France Country Profile

6.4.5.1 France Emulsifiers Market, 2016-2023 (Mn Units) (US$ Mn)

6.4.6 Italy Country Profile

6.4.6.1 Italy EmulsifiersMarket, 2016-2023 (Mn Units) (US$ Mn)

6.4.7 Spain Country Profile

6.4.7.1 Spain Emulsifiers Market, 2016-2023 (Mn Units) (US$ Mn)

6.4.8 Rest of Europe

6.4.8.1 Rest of Europe Emulsifiers Market, 2016-2023 (Mn Units) (US$ Mn)

6.5 Asia Pacific Emulsifiers Market

6.5.1 Asia Pacific Emulsifiers Market, by Type, 2016-2023 (Mn Units) (US$ Mn)

6.5.2 Asia Pacific Emulsifiers Market, by End-use, 2016-2023 (Mn Units) (US$ Mn)

6.5.3 China Country Profile

6.5.3.1 China Emulsifiers Market, 2016-2023 (Mn Units) (US$ Mn)

6.5.4 Japan Country Profile

6.5.4.1 Japan Emulsifiers Market, 2016-2023 (Mn Units) (US$ Mn)

6.5.5 India Country Profile

6.5.5.1 India Emulsifiers Market, 2016-2023 (Mn Units) (US$ Mn)

6.5.6 South Korea Country Profile

6.5.6.1 South Korea Emulsifiers Market, 2016-2023 (Mn Units) (US$ Mn)

6.5.7 Southeast Asia Country Profile

6.5.7.1 Southeast Asia Emulsifiers Market, 2016-2023 (Mn Units) (US$ Mn)

6.5.8 Rest of Asia Pacific

6.5.8.1 Rest of Asia Pacific Emulsifiers Market, 2016-2023 (Mn Units) (US$ Mn)

6.6 Latin America Emulsifiers Market

6.6.1 Latin America Emulsifiers Market, by Type, 2016-2023 (Mn Units) (US$ Mn)

6.6.2 Latin America Emulsifiers Market, by End-use, 2016-2023 (Mn Units) (US$ Mn)

6.6.3 Brazil Country Profile

6.6.3.1 Brazil Emulsifiers Market, 2016-2023 (Mn Units) (US$ Mn)

6.6.4 Argentina Country Profile

6.6.4.1 Argentina Emulsifiers Market, 2016-2023 (Mn Units) (US$ Mn)

6.6.5 Rest of Latin America

6.6.5.1 Rest of Latin America Emulsifiers Market, 2016-2023 (Mn Units) (US$ Mn)

6.7 Middle East & Africa EmulsifiersMarket

6.7.1 Middle East & Africa Emulsifiers Market, by Type, 2016-2023 (Mn Units) (US$ Mn)

6.7.2 Middle East & Africa Emulsifiers Market, by End-use, 2016-2023 (Mn Units) (US$ Mn)

6.7.3 Southern Africa

6.7.3.1 Southern Africa Emulsifiers Market, 2016-2023 (Mn Units) (US$ Mn)

6.7.4 Northern Africa

6.7.4.1 Northern Africa Emulsifiers Market, 2016-2023 (Mn Units) (US$ Mn)

6.7.5 GCC

6.7.5.1 GCC Emulsifiers Market, 2016-2023 (Mn Units) (US$ Mn)

6.7.6 Rest of Middle East & Africa

6.7.6.1 Rest of Middle East & Africa Emulsifiers Market, 2016-2023 (Mn Units) (US$ Mn)

Chapter 7 Competitive Intelligence

7.1 Market Players Present in Market Life Cycle

7.2 Top 5 Players Comparison

7.3 Market Positioning of Key Players, 2018

7.4 Market Players Mapping

7.4.1 By Type

7.4.2 By End-use

7.4.3 By Region

7.5 Strategies Adopted by Key Market Players

7.6 Recent Developments in the Market

7.6.1 Mergers & Acquisitions, Partnership, New Product Developments

7.7 Operational Efficiency Comparison by Key Players

Chapter 8 Company Profiles

8.1 Archer Daniels Midland (ADM)

8.1.1 Archer Daniels Midland (ADM) Overview

8.1.2 Key Stakeholders/Person in Archer Daniels Midland (ADM)

8.1.3 Archer Daniels Midland (ADM) Co. Products Portfolio

8.1.4 Archer Daniels Midland (ADM) Financial Overview

8.1.5 Archer Daniels Midland (ADM) Co. News/Recent Developments

8.2 Akzo Nobel N.V

8.2.1 Akzo Nobel N.V Overview

8.2.2 Key Stakeholders/Person in Akzo Nobel N.V

8.2.3 Akzo Nobel N.V Products Portfolio

8.2.4 Akzo Nobel N.V Financial Overview

8.2.5 Akzo Nobel N.V News/Recent Developments

8.3 BASF SE

8.3.1 BASF SE Overview

8.3.2 Key Stakeholders/Person in BASF SE

8.3.3 BASF SE Products Portfolio

8.3.4 BASF SE Financial Overview

8.3.5 BASF SE News/Recent Developments

8.4 Cargill Incorporated

8.4.1 Cargill Incorporated Overview

8.4.2 Key Stakeholders/Person in Cargill Incorporated

8.4.3 Cargill Incorporated Products Portfolio

8.4.4 Cargill Incorporated Financial Overview

8.4.5 Cargill Incorporated News/Recent Developments

8.5 DowDuPont

8.5.1 DowDuPont Overview

8.5.2 Key Stakeholders/Person in DowDuPont

8.5.3 DowDuPont Products Portfolio

8.5.4 DowDuPont Financial Overview

8.5.5 DowDuPont News/Recent Developments

8.6 Evonik Industries AG

8.6.1 Evonik Industries AG Overview

8.6.2 Key Stakeholders/Person in Evonik Industries AG

8.6.3 Evonik Industries AG Products Portfolio

8.6.4 Evonik Industries AG Financial Overview

8.6.5 Evonik Industries AG News/Recent Developments

8.7 Estelle Chemicals Pvt. Ltd.

8.7.1 Estelle Chemicals Pvt. Ltd. Overview

8.7.2 Key Stakeholders/Person in Estelle Chemicals Pvt. Ltd.

8.7.3 Estelle Chemicals Pvt. Ltd. Products Portfolio

8.7.4 Estelle Chemicals Pvt. Ltd. Financial Overview

8.7.5 Estelle Chemicals Pvt. Ltd. News/Recent Developments

8.8 Kerry Group

8.8.1 Kerry Group Overview

8.8.2 Key Stakeholders/Person in Kerry Group

8.8.3 Kerry Group Products Portfolio

8.8.4 Kerry Group Financial Overview

8.8.5 Kerry Group News/Recent Developments

8.9 Gattefossé SAS

8.9.1 Gattefossé SAS Overview

8.9.2 Key Stakeholders/Person in Gattefossé SAS

8.9.3 Gattefossé SAS Products Portfolio

8.9.4 Gattefossé SAS Financial Overview

8.9.5 Gattefossé SAS News/Recent Developments

8.10 Lonza Group

8.10.1 Lonza Group Overview

8.10.2 Key Stakeholders/Person in Lonza Group

8.10.3 Lonza Group Products Portfolio

8.10.4 Lonza Group Financial Overview

8.10.5 Lonza Group News/Recent Developments