Camera lenses are an important component of Head-up Displays and Head-Mounted Displays used for providing the AR and VR experience. The increasing investment in AR VR, coupled with the rising demand for AR VR in healthcare, retail, and the consumer industry, is driving the growth of the augmented reality and virtual reality lenses market ecosystem.

The companies operating in the augmented reality and virtual reality lens market ecosystem are continuously investing in technologies to make the lenses lighter, thinner, and cost-effective. In 2019, Digilens, one of the major players in the market, revealed an affordable and sturdy plastic lens that could compete with the precision glass in terms of brightness, clarity, and color. Companies are also entering into strategic partnerships with raw material suppliers and product manufacturers.

Manufacturers are also evaluating advanced technologies such as 3D printing for the manufacturing of augmented reality and virtual reality lenses. In October 2017, Luxexcel, a Dutch lens 3D printer maker, secured US$ 4.7 million equity investment from Innovation Industries.

The outbreak of COVID-19 has bought along with a global recession, which has impacted several industries. Along with this impact, COVID Pandemic has also generated a few new business opportunities for the Augmented Reality and Virtual Reality Lens market. The overall competitive landscape and market dynamics of Augmented Reality and Virtual Reality Lens have been disrupted due to this pandemic. All these disruptions and impacts have been analyzed quantifiably in this report, which is backed by market trends, events, and revenue shift analysis. COVID impact analysis also covers strategic adjustments for Tier 1, 2, and 3 players of the Augmented Reality and Virtual Reality Lens Market.

In the Products, Parts & Devices segment, Head Mounted Displays have accounted for the highest share in 2018. The HMDs market is expected to grow at a CAGR of 25.48% between 2018 and 2023, mainly driven by the adoption of HMDs in the automotive, gaming, and healthcare industry. This, in turn, will drive the growth of the Augmented Reality and Virtual Reality Lens market.

| Raw Materials | Product, Parts & Devices | End-User |

| Silicon | Head-Up Displays | Automotive |

| GaN | Head-Mounted Displays | Aerospace |

| Glass | Smart Glass | Defense |

| Plastic | Hand-Held Devices | Logistics |

| SiC | AR Screens | Retail |

| Metals | Healthcare | |

| Others | Consumer Industry | |

| Others |

Augmented reality and virtual reality lenses have several applications in end-use industries such as consumer, healthcare, automotive, and retail. The consumer end-use industry, which includes gaming, entertainment, sports, etc., dominated the Virtual Reality and Augmented Reality Lens Market Ecosystem in 2018.

The augmented reality and virtual reality gaming market was valued at US$ 1,340.2 million in 2018 and is expected to grow at a CAGR of around 26.6% between 2018 and 2023. This, in turn, will drive the growth of the Virtual Reality and Augmented Reality Lens Market Ecosystem. Additionally, there is an increasing demand for high-resolution lenses for gaming applications.

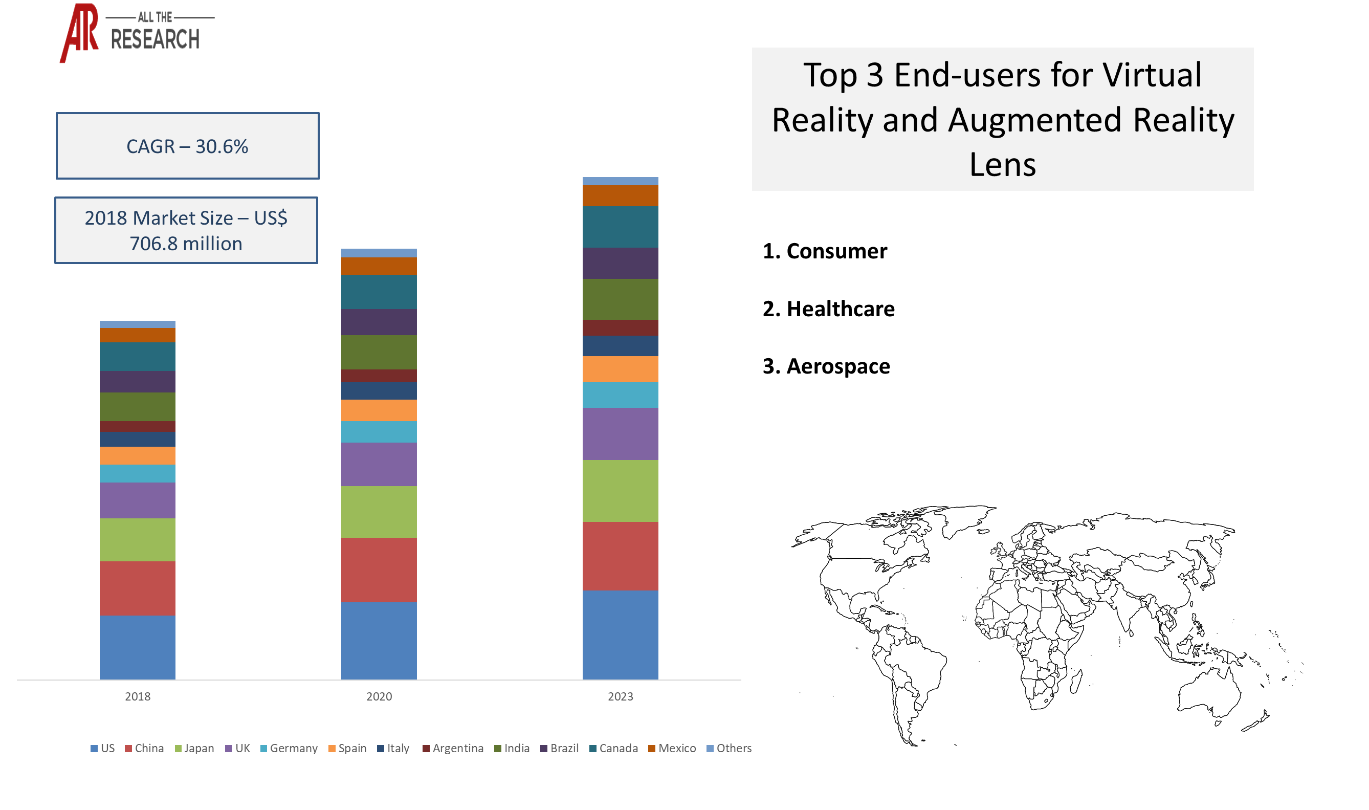

The global augmented reality and virtual reality lenses market ecosystem was valued at US$ 706.8 million and is expected to reach US$ 2,687.7 million by the year 2023, growing at a CAGR of 30.6% during the forecast period. Advancements in technology, increasing digitization, and the increasing use of HMDs in the gaming industry are some of the factors that are driving the growth of the augmented reality and virtual reality lens market.

North America dominated the market in the base year 2018. The global AR VR devices shipments were around 13 million in 2018. North America held around a 35% share of the total shipments. This is one of the major reasons for the dominance of this region in the ecosystem. However, in terms of investment in VR, it is expected that China will overtake the US to take the top spot in the coming years.

| Company | Ecosystem Positioning | Total Revenue-2018 | Industry | Region |

| Canon | Component Provider | US$ 35.60 bn | AR VR | Global |

| Zeiss International | Component Provider | US$ 7.09 bn | AR VR | Global |

| Nikon Corporation | Component Provider | US$ 6.46 bn | AR VR | Global |

| Largan Precision | Component Provider | US$ 1.65 bn | AR VR | Global |

| Samsung Electronics | Component Provider | US$ 221.57 bn | AR VR | Global |

Very few markets have interconnectivity with other markets like augmented reality and virtual reality lenses. Our Interconnectivity module focuses on the key nodes of heterogeneous markets in detail. Artificial Intelligence, Internet of Things, Autonomous Vehicles, and AR VR in Healthcare markets are some of our key researched markets.

| Trends | Products, Parts & Devices | Impact |

| Lenses that consist of unique optical design integrated with augmented reality and virtual reality technologies are anticipated to be replaced by metalenses. Metalenses will reduce the size of VR headsets. | HMDs | 0.29% |

| Increasing usage of Fresnel lenses in AR VR headsets, which make them lighter and thinner, will lead to increasing adoption of AR VR devices, thus driving the market. | xx | xx% |

Ask for free product review call with the author

Share your specific research requirements for a customized report

Request for due diligence and consumer centric studies

Request for study updates, segment specific and country level reports

Table of Content