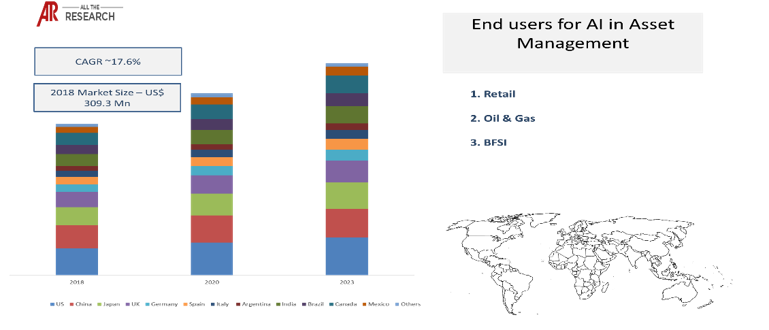

The global AI in Asset Management Market Ecosystem was valued at US$ 309.3 Mn in 2018 and is expected to grow at a CAGR of 17.6% during the forecast period. Increasing implementation of artificial intelligence in asset management in order to provide accurate and faster services to clients, is driving the growth of the AI in Asset Management Market Ecosystem. This is because AI helps organizations in increasing their productivity and efficiency of work. Predictive analysis is mainly used to analyze unexpected breakdown. So, companies mainly focus on providing industrial predictive monitoring and management.

AI-powered predictive asset management software has capabilities to detect anomalies from the data collected by company sensors. Oil & gas companies frequently suffer from unexpected replacements and breakdowns and thus, expected to create demand for of AI in asset management in order to reduce this cost. According to a market study in 2019, the eastern US oil refinery companies saved US$ 7 million due to the use of predictive analysis.

AI in asset management is also being increasingly used in the automotive sector for tracking the downtime of vehicles by manufacturers. Cooper Standard Automotive uses artificial intelligence for pooling data in order to track the global production plants. This gives the management a view of the asset in order to move it to the right plant in real time. At the same time, General Motors have deployed a cloud-based image classification tool on 7000 robots in order to detect issues before they happen, which in turn helps reduce unplanned production delays.

AI in asset management is also deployed in the financial sector for personal financial management, fraud detection, and investment banking. This enables financial institutions to effectively manage assets and meet the expectation of changing customer behavior by leveraging technologies such as predictive maintenance, AI, and machine learning. Companies such as IBM, Genpact, and Infosys are the key vendors that are providing artificial intelligence solutions for financial asset management.

|

Technology |

Deployment |

End-users |

|

Machine Learning |

Cloud |

Retail |

|

Deep Learning |

On-Premise |

BFSI |

|

NLP |

|

Oil & Gas |

|

Computer Vision |

|

Automotive |

|

Predictive Analytics |

|

Aerospace |

|

Others |

|

Others |

Global AI in Asset Management Market Ecosystem

Based on regions, North America dominated the market in 2018 and is expected to show similar trends in the coming years. Increasing number of connected devices and growing number of internet users, coupled with the rising investment by big technocrats, are expected to drive the AI in asset management market in the region. At the same time, the collaboration between Massachusetts Institute of Technology US and IBM to promote research on different aspects of artificial intelligence is one of the major factors in accentuating market growth. The Asia Pacific region is expected to grow at the fastest pace during the forecast period. According to a study in 2019, 43% of Asia Pacific companies consider AI important for their business future, which is driving the growth of AI in asset ecosystem in the region.

The major players in AI-enabled smart trackers are Microsoft, Google, Infosys, IBM, Amazon, Apple, and others. The market players are mainly focusing on mergers and acquisitions, product expansions, partnerships, and other such strategies for increasing their market share. In 2019, BlackRock announced the launch of a new center dedicated to research in AI, in order to meet the changing industrial conditions.

There are many trends that are having an impact on the market forecast. These, when evaluated from a company’s perspective, can drive growth. Our numerous consulting projects have generated sizeable synergies across all regions and all sizes of companies.

|

Company |

Ecosystem Positioning |

Total Revenue |

Industry |

Region |

|

Microsoft |

Software provider |

$110.4 Billion |

Artificial intelligence |

Global |

|

Google LLC

|

Software provider |

$136.22 Billion |

Artificial intelligence |

Global |

|

IBM |

Software provider |

$ 79.591 Billion |

Artificial intelligence |

Global |

|

Amazon |

Software provider |

$ 232.887 Billion |

Artificial intelligence |

Global |

|

Apple |

Software provider |

$ 258.49 Billion |

Artificial intelligence |

Global |

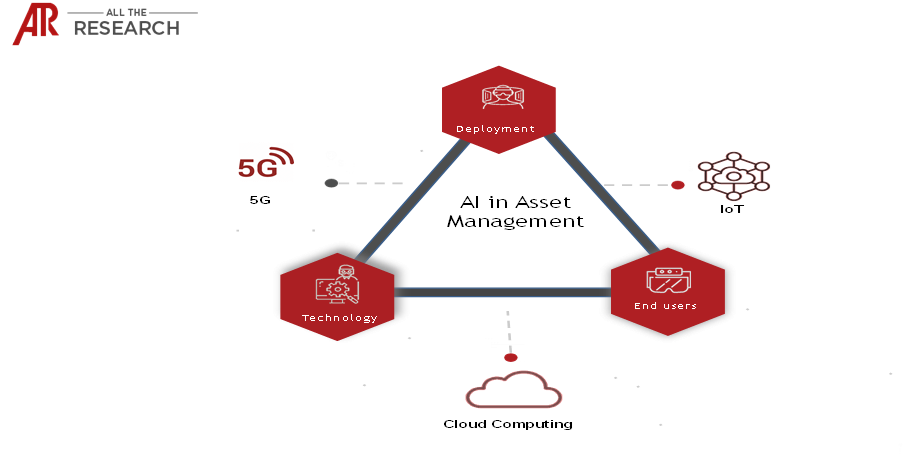

Very few markets have the interconnectivity with other markets like AI. Our Interconnectivity module focuses on the key nodes of heterogenous markets in detail. Internet of things, cloud computing, and 5G integration markets are some of our key researched markets

|

Trends |

End-users |

Impact value |

|

Predictive analytics software helps predict asset failures by monitoring the mechanical systems in an aircraft, whilst also being able to recommend best corrective actions. Artificial intelligence will help reduce delays caused by unexpected maintenance-related issues |

Aerospace |

0.12% |

|

Asset management using AI helps identify equipment failure by analyzing the operating conditions by using IoT sensors |

Oil and Gas |

0.1% |

Ask for free product review call with the author

Share your specific research requirements for a customized report

Request for due diligence and consumer centric studies

Request for study updates, segment specific and country level reports

Ecosystem Report – Table of Content

AI in asset management Ecosystem Positioning

AI in asset management Ecosystem Trend Analysis

AI in asset management Ecosystem Regulatory Analysis

AI in asset management ecosystem Sizing, Volume and ASP Analysis & Forecast

AI in asset management Ecosystem Competitive Intelligence

AI in asset management Ecosystem Company Profiles

AI in asset management Ecosystem Developments

Customizations