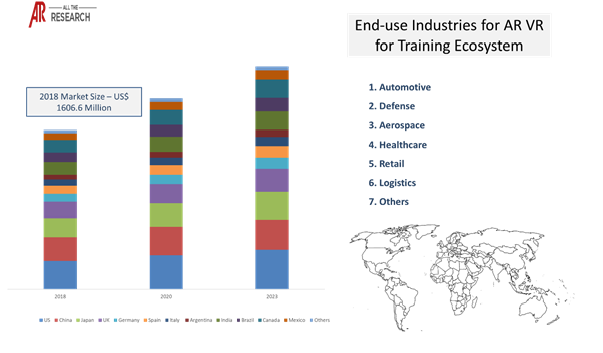

Global AR VR for training market ecosystem was valued at US$ 1,606.6 Mn in 2018 and is expected to reach US$ XX Mn by the end of the forecast period, expanding at a CAGR of 44.10% during the period from 2019 to 2026. Simulation and training exercises have evolved rapidly over the past few years. The evolution was imperative in order to provide the workforce with a more holistic experience that would ultimately result in a better final output. AR VR are examples of technologies that have contributed to the evolution of training & simulation exercises over the past few years. Industries such as aerospace, defense, retail, and healthcare, among others, account for a greater market share in the AR VR for training market ecosystem.

For instance, The Camfil Group, a manufacturer of clean air products and air filters, joined hands with Mersus Technologies to develop ‘The Camfil Experience’, which is an immersive virtual reality environment used for technical training that features a digital twin of Camfil’s products. Using Oculus Go VR headsets, maintenance engineers can learn to identify, install, and maintain air filters with greater efficiency and safety. Further, The Raymond Corporation, a provider of lift trucks, uses virtual reality learning tools to improve the trainer and trainee experience. The VR simulator allows lift truck operators to learn in a virtual environment using an actual truck and controls that are plugged into Raymond’s Simulation Port (sPort). This entire exercise is performed under expert guidance. Real-time experience has garnered much popularity, especially in terms of training. This helps personnel train and work more productively. These factors are greatly contributing to the growth of the AR VR for training market ecosystem.

Get a Sample Copy of the report at https://www.alltheresearch.com/sample-request/364

Based on products, head-mounted displays captured the major chunk of the market in 2018 and are expected to display similar trends in the coming years as well. HMDs are considered appropriate for training and simulation purposes, as they provide a superior degree of realism for training and simulation applications. They are lightweight, rugged, and easy to adjust, and they provide superior image quality and performance.

The defense industry is one of the largest end-users of AR VR for training purposes. Owing to the high demand for AR VR in the defense industry, in 2017, Kopin Corporation, an electronics manufacturer based in Massachusetts, launched the ‘Brillian LCD Microdisplay’, mainly for defense applications. Further, in September 2019, they announced the maiden design win for the display for an augmented reality HMD, which is to be used for army helicopter pilots. However, smart glasses are expected to display a CAGR of XX% during the forecast period.

|

Products |

Solutions & Services |

Components |

Raw Materials |

End-use Industries |

|

Handheld Devices |

Documentation |

Sensors |

Silicon |

Automotive |

|

Head-Mounted Displays |

Visualization |

Camera |

GaN |

Defense |

|

Smart Glass |

3D Modeling |

IMU |

Glass |

Aerospace |

|

|

Navigation |

Processor |

Plastic |

Healthcare |

|

|

Workflow Optimization |

Graphics (Cards) |

SiC |

Retail |

|

|

Others |

Audio IC’s |

Metal |

Transport & Logistics |

|

|

|

Memory |

Others |

Others |

|

|

|

Displays |

|

|

|

|

|

Modules |

|

|

|

|

|

Others |

|

|

Based on regions, North America is expected to display the fastest growth during the forecast period. Owing to its technological superiority, the U.S. is expected to maintain the lead throughout the forecast period. However, China is closing in on the U.S. to become the world leader in technology in the coming years. The Chinese market spending on augmented and virtual reality is expected to cross the US$ 66.32 Bn mark by 2022, with the CAGR expected to lie somewhere between 85% to 90%. Training and industrial maintenance are the major areas of applications for the augmented reality and virtual reality market in China.

The major players in the AR VR in training industry are mainly focusing on mergers and acquisitions, product expansion, partnerships, and other such strategies for strengthening their market presence. Sony dominated the VR technology and had accounted for 1.7 million shipments in 2017, followed by Oculus and HTC. HTC accounted for a shipment of approximately 800,000 units of VR devices, while Oculus accounted for the sale of approximately 1.7 million units of VR products in 2019.

There are many trends that are having an impact on the market forecast. These, when evaluated from a company’s perspective, can drive growth. Our numerous consulting projects have generated sizeable synergies across all regions and all sizes of companies.

|

Company |

Ecosystem Positioning |

Total Revenue |

Industry |

Region |

|

Microsoft |

Product Manufacturer |

$110.4 Billion |

AR VR Industry |

Global |

|

Google LLC |

Product Manufacturer |

$136.22 Billion |

AR VR Industry |

Global |

|

Lenovo |

Product Manufacturer |

$14 Billion |

AR VR Industry |

Global |

|

HTC Corporation |

Product Manufacturer |

$0.73 Billion |

AR VR Industry |

Global |

|

|

Product Manufacturer |

$55 Billion |

AR VR Industry |

Global |

Very few markets have interconnectivity with other markets like AR VR. Our Interconnectivity module focuses on the key nodes of heterogenous markets in detail. Smart Sensors, 3D modeling, Silicon, and Head-Mounted Displays are some of our key researched markets

|

Trends |

End-use Industries |

|

Virtual reality and augmented reality tools are used by fortune 500 companies to upskill their workforce. For instance, this may include training the drivers by using virtual headsets for tackling hazardous situations |

Logistics |

Ask for free product review call with the author

Share your specific research requirements for a customized report

Request for due diligence and consumer centric studies

Request for study updates, segment specific and country level reports