Regulatory Technology (RegTech) is used for regulating the processes in the financial industry, primarily for monitoring, reporting, and compiling of data, identity management, and risk management. RegTech is primarily a cloud-based or software-as-a-service (Saas)-based application, which is a transparent, consistent, and standardized way of providing higher quality and low-cost solutions to the financial sector. It is attracting the interests of investors due to its feature of developing innovative digital solutions. With the increasing cases of money laundering and terror funding, various new rules and regulations are being implemented by governments to maintain a safe environment, which can be made possible by using regulatory technology tools.

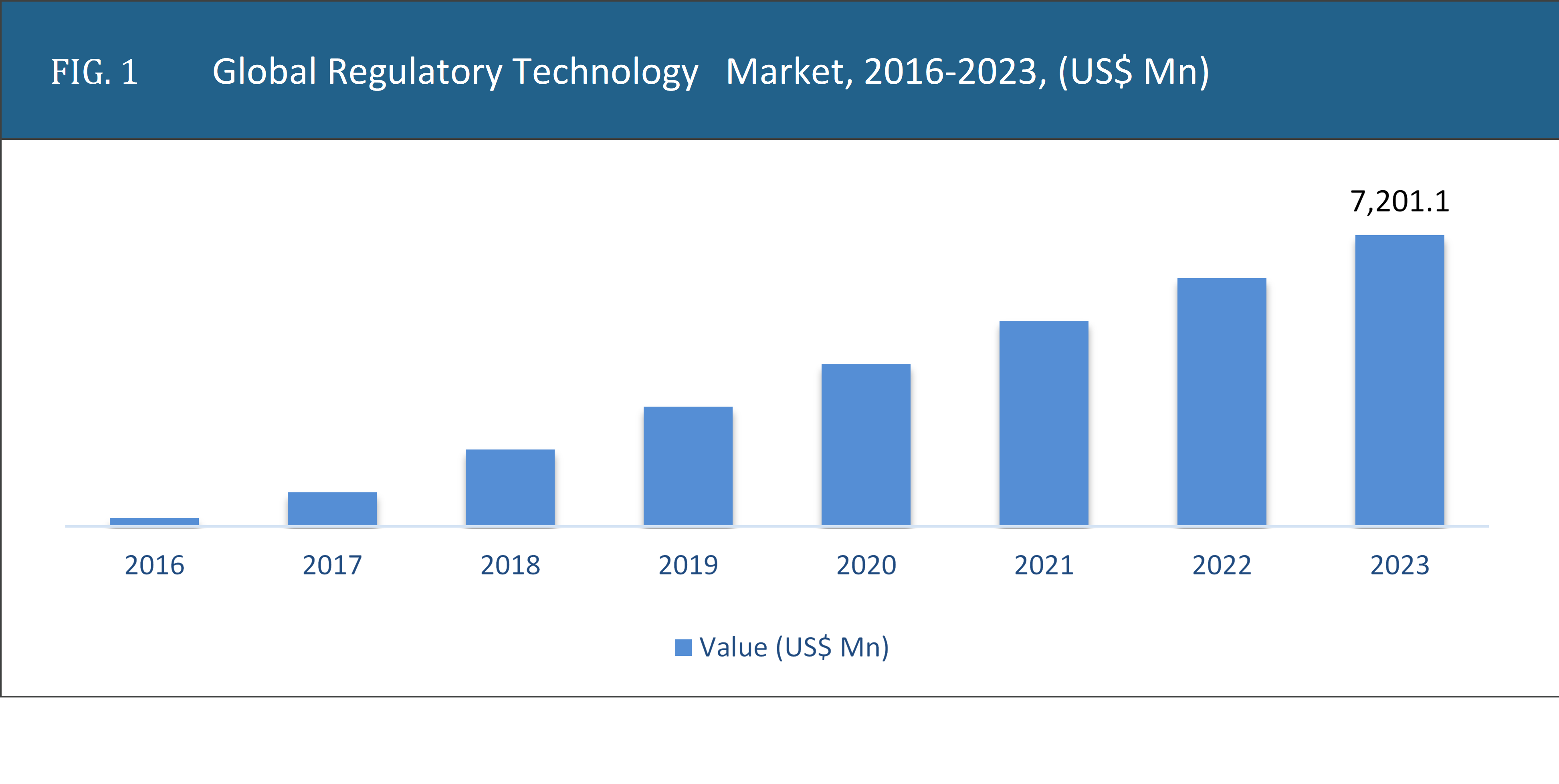

The global RegTech market revenue is expected to reach $7,201.1 million by 2023, growing at a high CAGR during the forecast period. The market is witnessing growth as this technology is highly being adopted across various organizations. Due to the increasing focus on data protection rules, they have to monitor transparency in money transactions, and strictly follow compliance rules laid down by the regulatory bodies, in order to avoid high penalties. Regulatory technology primarily focuses on the digitalization of the compliance process and manual reporting to know the customer details. Financial institutions primarily work in a highly regulated environment and continuously deal with new regulations.

This RegTech market report covers an in-depth analysis of the market including statistical and subjective data points, along with the key market drivers and opportunities & restraints that have positive or negative effects on the overall global market. Exclusive coverage has been provided for market drivers and challenges & opportunities for a country-level market in the respective regional segments. The report comprises a competitive analysis of the key players functioning in the market and covers in-depth data related to the competitive landscape of the market and the recent strategies & products that will assist or affect the market in the near future.

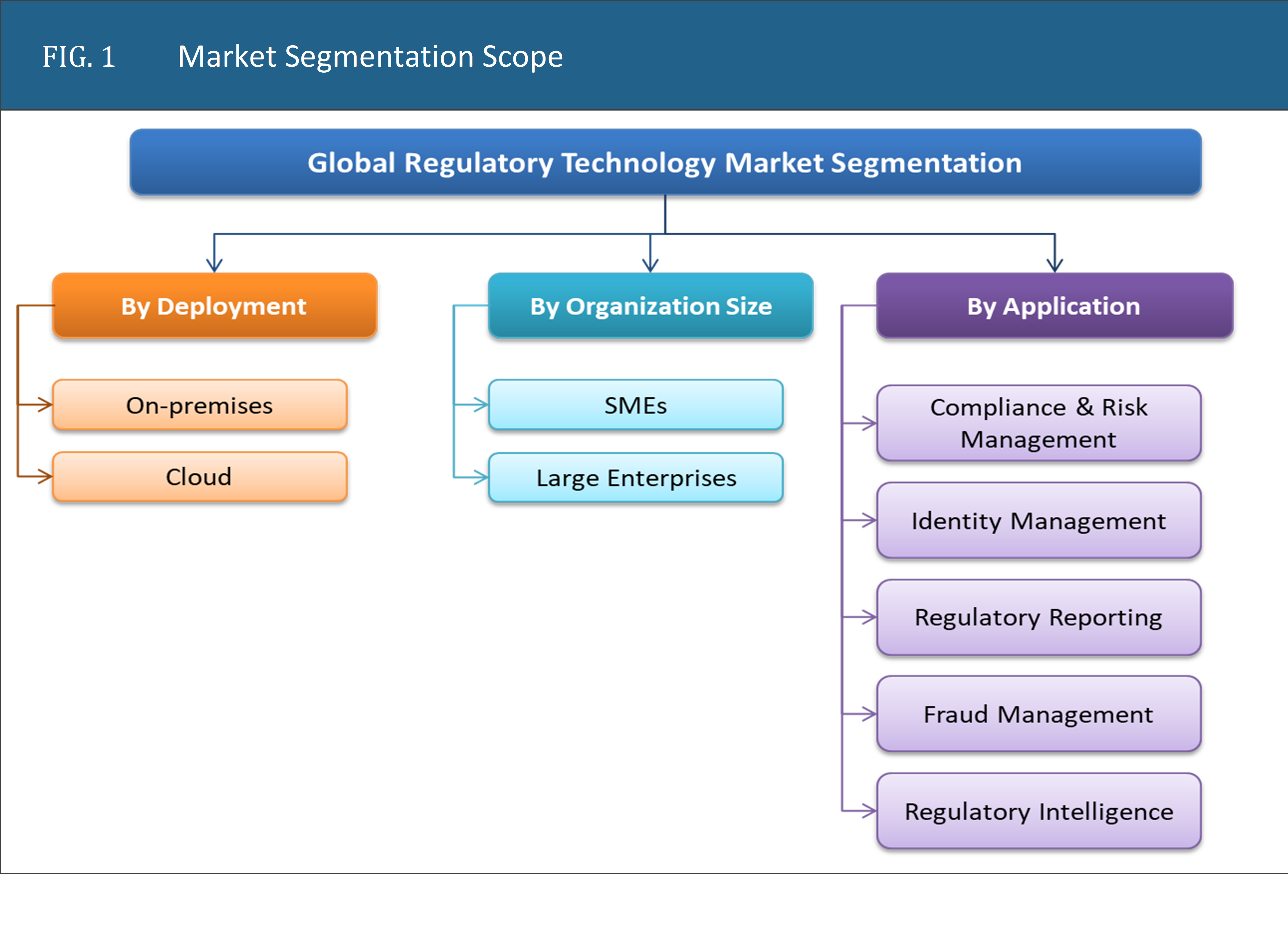

The regulatory technology market is segmented based on deployment, organization size, applications, and region. On the basis of the organization size, the market has been segmented as large enterprises and SMEs. The large enterprises are dominating the market in 2018. However, SMEs are expected to grow with a high CAGR during the forecast years. The cloud migration of SMEs is primarily being easier than the large enterprises, which is further accelerating the growth of SaaS adoption. Organizations are deploying RegTech solutions owing to the increasing focus on accelerating the regulatory operations and for reducing the complexities associated with risk assessment.

Large enterprises segment is accelerating the market during the forecast period

The large enterprises segment is expected to dominate the market during the forecast period due to the adoption of regulatory programs that various publicly traded companies are required to adopt. Various service and consulting companies such as Deloitte, IBM, Thomson Reuters, and PwC primarily assist large enterprises by providing the benefits of efficiently managed business functions to effectively implement RegTech solutions as per their business requirements.

Regulatory Intelligence Application is expected to grow with a high CAGR over the coming years

Based on the application type, regulatory compliance and risk management is growing at a higher rate, owing to the increasing compliance cost and risk factors in the banking sector. The US-based company Continuity, a provider of compliance services, customizes the services according to their clients’ needs. Their system monitors the US Federal Register and interprets the changes in rules and regulations, along with providing the appropriate solution to the client company. The client needs to schedule the compliance tasks to automate the compliance management process.

North America

US

Canada

Mexico

Europe

UK

Germany

France

Italy

Spain

Rest of Europe

Asia Pacific

China

Japan

India

Indonesia

Thailand

Rest of APAC

Latin America

Brazil

Argentina

Rest of Latin America

Middle East & Africa

Southern Africa

Northern Africa

GCC

Rest of Middle East & Africa

North America is dominating the RegTech Market

North America is expected to dominate the market during the forecast period due to the early adoption of RegTech solutions by the various financial institutions across the U.S. and Canada. This is done to reduce the associated compliance cost by leveraging advanced technologies such as Artificial Intelligence (AI), Machine Learning (ML), blockchain, Big Data, and cloud computing. These countries are advanced in terms of technology and application deployments. Moreover, increasing stringent regulations are expected to foster market growth in the North American region.

Europe is adopting RegTech on a large scale due to the mandatory rules and regulations drafted by the European governments on data protection and financial transactions. Moreover, organizations are complying with these rules and regulations due to penalties imposed by the regulators. The larger enterprises had a significant market share in 2018, while the market share of SMEs is expected to grow at a higher rate, as cloud migration is comparatively easier in SMEs as compared to larger enterprises owing to fewer complexities.

The global RegTech market is characterized to be a highly competitive market due to the presence of various international and regional vendors. The demand for regulatory technology is expected to grow due to the rising investments in R&D by key players, such as Algoreg, Clarus, and others. To expand the market, the majority of vendors are adopting new technologies and product launches to gain a competitive advantage in the global market. Companies with a high geographical presence, irrespective of their market capitalization, are dominating the market.

The competition in the global RegTech market is intense as various vendors are providing the technology to several end-use industries for market expansion. The competition in this market will further strengthen in the coming years with an increase in new product launches, innovations in technology, and M&A. The international players are expected to grow by acquiring regional or local players in the RegTech market. For instance, in April 2017, Wolters Kluwer, a global information services company has acquired Tagetik, a provider of corporate performance management solutions. The Wolters Kluwer has made this acquisition to make a new business unit, named Corporate Performance Solutions, for the expansion of the company across the globe.

Key questions answered

Ask for free product review call with the author

Share your specific research requirements for a customized report

Request for due diligence and consumer centric studies

Request for study updates, segment specific and country level reports

Table of Content

Chapter 1 Preface

1.1 Report Description

1.1.1 Purpose of the Report

1.1.2 Target Audience

1.1.3 USP and Key Offerings

1.2 Research Scope

1.3 Research Methodology

1.3.1 Phase I – Secondary Research

1.3.2 Phase II – Primary Research

1.3.3 Phase III – Expert Panel Review

1.3.4 Approach Adopted

1.3.4.1 Top-Down Approach

1.3.4.2 Bottom-Up Approach

1.3.5 Assumptions

1.4 Market Segmentation Scope

Chapter 2 Executive Summary

2.1 Market Summary

2.1.1 Global Regulatory Technology (RegTech) Market, 2016-2023, (US$ Mn)

2.1 Market Snapshot: Global Regulatory Technology (RegTech) Market

2.2 Market Dynamics

2.3 Global Regulatory Technology (RegTech) Market, by Segment, 2018

2.3.1 Global Regulatory Technology (RegTech) Market, by Deployment, 2018, (US$ Mn)

2.3.2 Global Regulatory Technology (RegTech) Market, by Organization Size, 2018,(US$ Mn)

2.3.3 Global Regulatory Technology (RegTech) Market, by Application, 2018 (US$ Mn)

2.3.4 Global Regulatory Technology (RegTech) Market, by Region, 2018 (US$ Mn)

2.4 Premium Insights

2.4.1 Regulatory Technology (RegTech) Market In Developed Vs. Developing Economies, 2018 vs 2023

2.4.2 Global Regulatory Technology (RegTech) Market: Regional Life Cycle Analysis

Chapter 3 Market Dynamics

3.1 Market Overview

3.2 Market Drivers

3.2.1 Improve focus on financial regulations

3.2.2 Enhancement in transparency and monitor banking transactions

3.2.3 Driver 3

3.3 Market Restraints

3.3.1 Lack of awareness

3.3.2 Restraint 2

3.4 Market Opportunities

3.4.1 Growth in the GDPR concerns to adopt regulatory software across financial institutions

3.4.2 Opportunity 2

3.5 Industry Value Chain Analysis

3.5.1 Analyst’s Views

3.6 Industry SWOT Analysis

Chapter 4 Global Regulatory Technology (RegTech) Market, by Deployment

4.1 Market Overview, by Deployment

4.1.1 Global Regulatory Technology (RegTech) Market, by Deployment, 2016-2023 (US$ Mn)

4.1.2 Incremental Opportunity, by Deployment, From 2018-2023

4.2 Cloud based

4.2.1 Global Regulatory Technology (RegTech) Market, by Cloud based , 2016-2023, (US$ Mn)

4.3 On-Premises

4.3.1 Global Regulatory Technology (RegTech) Market, by On-Premises, 2016-2023, (US$ Mn)

Chapter 5 Global Regulatory Technology (RegTech) Market, by Organization Size

5.1 Market Overview, by Organization Size

5.1.1 Global Regulatory Technology (RegTech) Market, by Organization Size , 2016-2023 (US$ Mn)

5.1.2 Incremental Opportunity, by Organization Size , From 2018-2023

5.2 SMEs

5.2.1 Global Regulatory Technology (RegTech) Market, by SMEs, 2016-2023, (US$ Mn)

5.3 Large Enterprises

5.3.1 Global Regulatory Technology (RegTech) Market, by Large Enterprises, 2016-2023, (US$ Mn)

Chapter 6 Global Regulatory Technology (RegTech) Market, by Application

6.1 Market Overview, by Application

6.1.1 Global Regulatory Technology (RegTech) Market, by Application, 2016-2023 (US$ Mn)

6.1.2 Incremental Opportunity, by Application, From 2018-2023

6.2 Compilance & Risk Management

6.2.1 Global Regulatory Technology (RegTech) Market, by Compilance & Risk Management, 2016-2023, (US$ Mn)

6.3 Identity Management

6.3.1 Global Regulatory Technology (RegTech) Market, by Identity Management, 2016-2023, (US$ Mn)

6.4 Regulatory Reporting

6.4.1 Global Regulatory Technology (RegTech) Market, by Regulatory Reporting, 2016-2023, (US$ Mn)

6.5 Fraud Management

6.5.1 Global Regulatory Technology (RegTech) Market, by Fraud Management, 2016-2023, (US$ Mn)

6.6 Regulatory Intelligence

6.6.1 Global Regulatory Technology (RegTech) Market, by Regulatory Intelligence, 2016-2023, (US$ Mn)

Chapter 7 Global Regulatory Technology (RegTech) Market, by Region

7.1 Market Overview, by Region

7.1.1 Global Regulatory Technology (RegTech) Market, by Region, 2016-2023, (US$ Mn)

7.2 Attractive Investment Opportunity, by Region, 2018

7.3 North America Regulatory Technology (RegTech) Market

7.3.1 North America Regulatory Technology (RegTech) Market, by Deployment, 2016-2023 (US$ Mn)

7.3.2 North America Regulatory Technology (RegTech) Market, by Organization Size , 2016-2023 (US$ Mn)

7.3.3 North America Regulatory Technology (RegTech) Market, by Application, 2016-2023 (US$ Mn)

7.3.4 United States Country Profile

7.3.4.1 United States Regulatory Technology (RegTech) Market, 2016-2023 (US$ Mn)

7.3.5 Canada Country Profile

7.3.5.1 Canada Regulatory Technology (RegTech) Market, 2016-2023 (US$ Mn)

7.3.6 Mexico Country Profile

7.3.6.1 Mexico Regulatory Technology (RegTech) Market, 2016-2023 (US$ Mn)

7.4 Europe Regulatory Technology (RegTech) Market

7.4.1 Europe Regulatory Technology (RegTech) Market, by Deployment, 2016-2023 (US$ Mn)

7.4.2 Europe Regulatory Technology (RegTech) Market, by Organization Size , 2016-2023 (US$ Mn)

7.4.3 Europe Regulatory Technology (RegTech) Market, by Application, 2016-2023 (US$ Mn)

7.4.4 United Kingdom Country Profile

7.4.4.1 United Kingdom Regulatory Technology (RegTech) Market, 2016-2023 (US$ Mn)

7.4.5 Germany Country Profile

7.4.5.1 Germany Regulatory Technology (RegTech) Market, 2016-2023 (US$ Mn)

7.4.6 France Country Profile

7.4.6.1 France Regulatory Technology (RegTech) Market, 2016-2023 (US$ Mn)

7.4.7 Italy Country Profile

7.4.7.1 Italy Regulatory Technology (RegTech) Market, 2016-2023 (US$ Mn)

7.4.8 Spain Country Profile

7.4.8.1 Spain Regulatory Technology (RegTech) Market, 2016-2023 (US$ Mn)

7.4.9 Rest of Europe

7.4.9.1 Rest of Europe Regulatory Technology (RegTech) Market, 2016-2023 (US$ Mn)

7.5 Asia Pacific Regulatory Technology (RegTech) Market

7.5.1 Asia Pacific Regulatory Technology (RegTech) Market, by Deployment, 2016-2023 (US$ Mn)

7.5.2 Asia Pacific Regulatory Technology (RegTech) Market, by Organization Size , 2016-2023 (US$ Mn)

7.5.3 Asia Pacific Regulatory Technology (RegTech) Market, by Application, 2016-2023 (US$ Mn)

7.5.4 China Country Profile

7.5.4.1 China Regulatory Technology (RegTech) Market, 2016-2023 (US$ Mn)

7.5.5 Japan Country Profile

7.5.5.1 Japan Regulatory Technology (RegTech) Market, 2016-2023 (US$ Mn)

7.5.6 India Country Profile

7.5.6.1 India Regulatory Technology (RegTech) Market, 2016-2023 (US$ Mn)

7.5.7 South Korea Country Profile

7.5.7.1 South Korea Regulatory Technology (RegTech) Market, 2016-2023 (US$ Mn)

7.5.8 Southeast Asia Country Profile

7.5.8.1 Southeast Asia Regulatory Technology (RegTech) Market, 2016-2023 (US$ Mn)

7.5.9 Rest of Asia Pacific

7.5.9.1 Rest of Asia Pacific Regulatory Technology (RegTech) Market, 2016-2023 (US$ Mn)

7.6 Latin America Regulatory Technology (RegTech) Market

7.6.1 Latin America Regulatory Technology (RegTech) Market, by Deployment, 2016-2023 (US$ Mn)

7.6.2 Latin America Regulatory Technology (RegTech) Market, by Organization Size , 2016-2023 (US$ Mn)

7.6.3 Latin America Regulatory Technology (RegTech) Market, by Application, 2016-2023 (US$ Mn)

7.6.4 Brazil Country Profile

7.6.4.1 Brazil Regulatory Technology (RegTech) Market, 2016-2023 (US$ Mn)

7.6.5 Argentina Country Profile

7.6.5.1 Argentina Regulatory Technology (RegTech) Market, 2016-2023 (US$ Mn)

7.6.6 Rest of Latin America

7.6.6.1 Rest of Latin America Regulatory Technology (RegTech) Market, 2016-2023 (US$ Mn)

7.7 Middle East & Africa Regulatory Technology (RegTech) Market

7.7.1 Middle East & Africa Regulatory Technology (RegTech) Market, by Deployment, 2016-2023 (US$ Mn)

7.7.2 Middle East & Africa Regulatory Technology (RegTech) Market, by Organization Size , 2016-2023 (US$ Mn)

7.7.3 Middle East & Africa Regulatory Technology (RegTech) Market, by Application, 2016-2023 (US$ Mn)

7.7.4 Southern Africa

7.7.4.1 Southern Africa Regulatory Technology (RegTech) Market, 2016-2023 (US$ Mn)

7.7.5 Northern Africa

7.7.5.1 Northern Africa Regulatory Technology (RegTech) Market, 2016-2023 (US$ Mn)

7.7.6 GCC

7.7.6.1 GCC Regulatory Technology (RegTech) Market, 2016-2023 (US$ Mn)

7.7.7 Rest of Middle East & Africa

7.7.7.1 Rest of Middle East & Africa Regulatory Technology (RegTech) Market, 2016-2023 (US$ Mn)

Chapter 8 Competitive Intelligence

8.1 Market Players Present in Market Life Cycle

8.2 Top 5 Players Comparison

8.3 Market Positioning of Key Players, 2018

8.4 Market Players Mapping

8.4.1 By Deployment

8.4.2 By Organization Size

8.4.3 By Application

8.4.4 By Region

8.5 Strategies Adopted by Key Market Players

8.6 Recent Developments in the Market

8.6.1 Mergers & Acquisitions, Partnership, New Product Developments

8.7 Operational Efficiency Comparison by Key Players

Chapter 9 Company Profiles

9.1 Algoreg

9.1.1 Algoreg Overview

9.1.2 Key Stakeholders/Person in Reportix

9.1.3 Algoreg Co. Products Portfolio

9.1.4 Algoreg Financial Overview

9.1.5 Algoreg Co. News/Recent Developments

9.2 Clarus

9.2.1 Clarus Overview

9.2.2 Key Stakeholders/Person in Clarus

9.2.3 Clarus Products Portfolio

9.2.4 Clarus Financial Overview

9.2.5 Clarus News/Recent Developments

9.3 Reportix

9.3.1 Reportix Overview

9.3.2 Key Stakeholders/Person in Reportix

9.3.3 Reportix Products Portfolio

9.3.4 Reportix Financial Overview

9.3.5 Reportix News/Recent Developments

9.4 NEX Regulatory Reporting

9.4.1 NEX Regulatory Reporting Overview

9.4.2 Key Stakeholders/Person in NEX Regulatory Reporting

9.4.3 NEX Regulatory Reporting Products Portfolio

9.4.4 NEX Regulatory Reporting Financial Overview

9.4.5 NEX Regulatory Reporting News/Recent Developments

9.5 Lombard Risk

9.5.1 Lombard Risk Overview

9.5.2 Key Stakeholders/Person in Lombard Risk

9.5.3 Lombard Risk Products Portfolio

9.5.4 Lombard Risk Financial Overview

9.5.5 Lombard Risk News/Recent Developments

9.6 Ayasdi, Inc

9.6.1 Ayasdi, Inc Overview

9.6.2 Key Stakeholders/Person in Ayasdi, Inc

9.6.3 Ayasdi, Inc Products Portfolio

9.6.4 Ayasdi, Inc Financial Overview

9.6.5 Ayasdi, Inc News/Recent Developments

9.7 Featurespace Limited

9.7.1 Featurespace Limited Overview

9.7.2 Key Stakeholders/Person in Featurespace Limited

9.7.3 Featurespace Limited Products Portfolio

9.7.4 Featurespace Limited Financial Overview

9.7.5 Featurespace Limited News/Recent Developments

9.8 Abside Smart Financial Technologies

9.8.1 Abside Smart Financial Technologies Overview

9.8.2 Key Stakeholders/Person in Abside Smart Financial Technologies

9.8.3 Abside Smart Financial Technologies Products Portfolio

9.8.4 Abside Smart Financial Technologies Financial Overview

9.8.5 Abside Smart Financial Technologies News/Recent Developments

9.9 Fintellix Solutions

9.9.1 Fintellix Solutions Overview

9.9.2 Key Stakeholders/Person in Fintellix Solutions

9.9.3 Fintellix Solutions Products Portfolio

9.9.4 Fintellix Solutions Financial Overview

9.9.5 Fintellix Solutions News/Recent Developments

9.10 Promapp

9.10.1 Promapp Overview

9.10.2 Key Stakeholders/Person in Promapp

9.10.3 Promapp Products Portfolio

9.10.4 Promapp Financial Overview

9.10.5 Promapp News/Recent Developments