Smart Water Management is a way to collect, share, and analyze data from water equipment and water networks. It provides a more resilient and efficient water supply system, which reduces cost and improves sustainability. Smart water management is gaining popularity across the globe, owing to water scarcity and the increasing need for water conservation. Smart water management solution providers are offering smart water technologies to help users in managing the chronic shortage of water.

Smart water management has been primarily adopted by chemical and manufacturing industries to reduce water wastage and for the efficient use of their resources. Smart water management technology helps various organizations in identifying the network issues, enhancing customer engagement in water conservation, and most prominently, in reducing non-revenue water losses due to the damage to infrastructure.

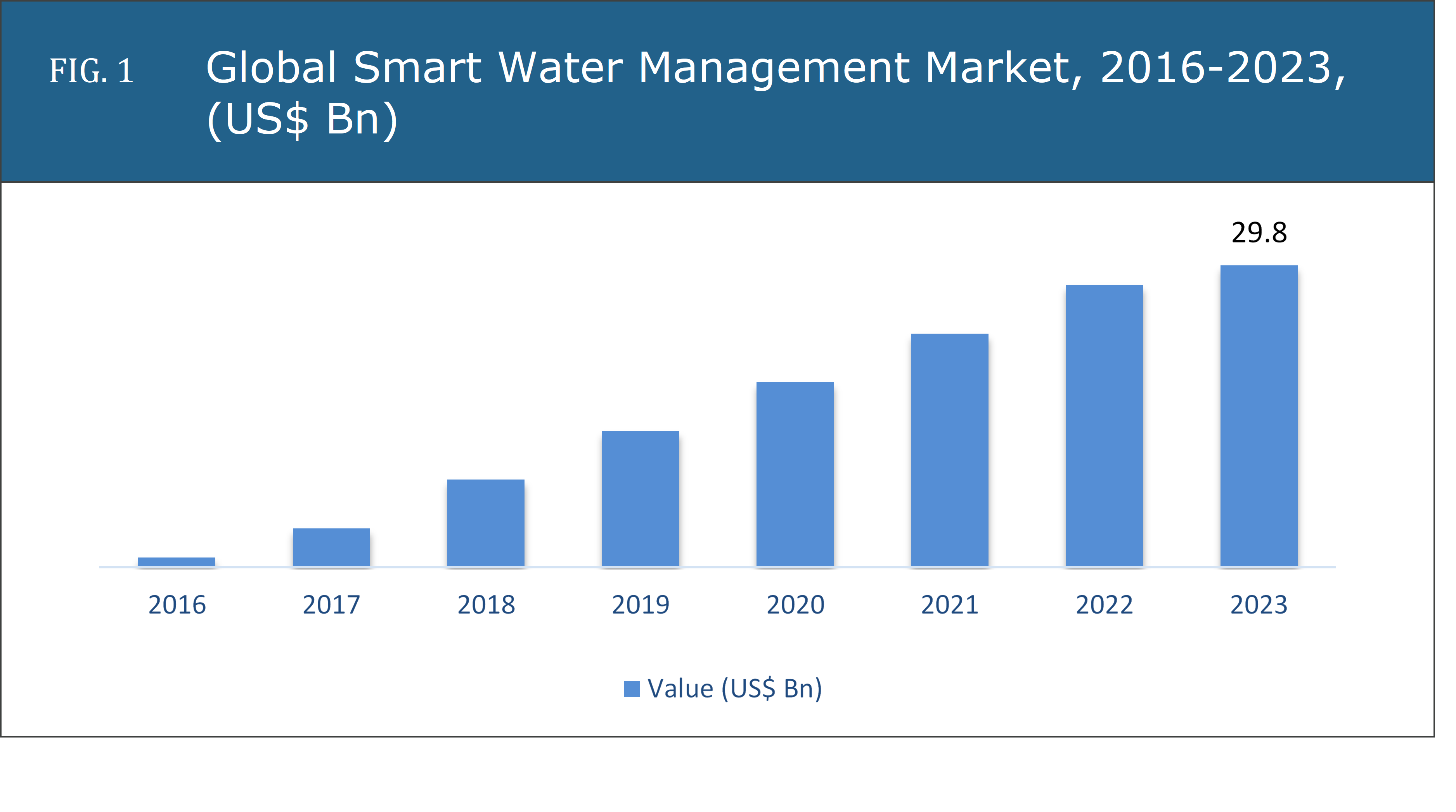

The global smart water management system market is expected to reach US$ 29.8 billion by 2023, growing with a high CAGR during the forecast period. The market is witnessing growth due to the growing scarcity of water, coupled with the increasing demand for water conservation across the globe. Various organizations and governments are taking initiatives to meet the rising demand for water globally. In addition to these, regulatory bodies are implementing smart water technologies for the efficient management of distribution channels, for updating water management solutions, decreasing maintenance cost, and for reducing non-revenue losses of water due to thefts and water leakage. Such factors are further expected to drive the smart water management market growth in the coming years.

This Smart Water Management market report covers an in-depth analysis of the market including statistical and subjective data points, along with the key market drivers and opportunities & restraints that have positive or negative effects on the overall global market. An exclusive coverage has been provided for market drivers and challenges & opportunities for a country-level market in the respective regional segments. The report comprises a competitive analysis of the key players functioning in the segments market and covers in-depth data related to the competitive landscape of the market and the recent strategies & products that will assist or affect the market in the near future.

The smart water management market has been segmented based on the product type into the cellular network, advanced water meters, and meter read technology. Advanced water meters are further divided into Advanced Metering Infrastructure (AMI) and Automated Metering Reading (AMR). Advanced Metering Infrastructure (AMI) is expected to dominate the market in the year 2018, due to the operational benefits it offers such as accuracy in meter reading, detection of energy theft, and response to power outages, along with security and financial advantages.

By Product Type

By Solutions

By Service

Reduction in operating costs is accelerating the penetration of SCADA in water industries

Water utilities are under pressure to provide good quality water, but are struggling with their outdated infrastructure. The SCADA solution helps in reducing energy costs in pumping water through the distribution network, streamlining water utility operations, and in enhancing asset management for water and wastewater utility infrastructure. The option of remote access in SCADA solutions enables utilities to access water usage data even from smartphones, laptops, and tablets.

North America is dominating the smart water management market

North America is dominating the smart water management market in 2018, owing to the growth of SWM solution in the U.S. and Canada. In addition to this, smart water management is dominating in the market due to its sustainable energy, technological advancements, and reducing aging infrastructure demands.

The Asia Pacific smart water management market is the fastest growing market during the forecast period, due to the rising government initiatives taken to raise awareness among people and development of smart cities. In 2011, the government of China launched its 12th Five-Year Plan that includes the guidelines for economic development during 2011-2015. In this plan, two of the key themes such as “Sustainable Development” and “Scientific Development” are related to smart water management.

Geographies covered:

North America

US

Canada

Mexico

Europe

UK

Germany

France

Italy

Spain

Rest of Europe

Asia Pacific

China

Japan

India

Indonesia

Thailand

Rest of APAC

Latin America

Brazil

Argentina

Rest of Latin America

Middle East & Africa

Southern Africa

Northern Africa

GCC

Rest of Middle East & Africa

The global smart water management market is a highly competitive market due to the presence of various international, regional, and local vendors. The demand for smart water management is expected to grow over the coming years due to rising investments in R&D by the key players, such as Evoqua Water Technologies, General Electric Co., and others. To expand the market, the majority of the vendors are adopting new technologies and product launches to gain competitive advantage in the global market. The smart water management market is being largely driven by new product launches and acquisitions.

The competition in the global smart water management market is intense as various international and regional vendors are providing the new technology to various end-use industries for the expansion of the market. Smart water management vendors are emphasizing on investing in R&D facilities to boost technology development. The key players and emerging vendors have improved manufacturing techniques and their products, in order to have a competitive edge over others. Furthermore, companies are involved in acquisitions and expansions to improve their product offerings and increase the production process. Industry players have developed partnerships and collaborations for addressing the demand and for strengthening their presence across the globe.

Key questions answered

Ask for free product review call with the author

Share your specific research requirements for a customized report

Request for due diligence and consumer centric studies

Request for study updates, segment specific and country level reports

Table of Content

Chapter 1 Preface

1.1 Report Description

1.1.1 Purpose of the Report

1.1.2 Target Audience

1.1.3 USP and Key Offerings

1.2 Research Scope

1.3 Research Methodology

1.3.1 Phase I – Secondary Research

1.3.2 Phase II – Primary Research

1.3.3 Phase III – Expert Panel Review

1.3.4 Approach Adopted

1.3.4.1 Top-Down Approach

1.3.4.2 Bottom-Up Approach

1.3.5 Assumptions

1.4 Market Segmentation Scope

Chapter 2 Executive Summary

2.1 Market Summary

2.1.1 Global Smart Water Management Market, 2016-2023, (US$ Bn)

2.1 Market Snapshot: Global Smart Water Management Market

2.2 Market Dynamics

2.3 Global Smart Water Management Market, by Segment, 2018

2.3.1 Global Smart Water Management Market, by Product Type, 2018, (US$ Bn)

2.3.2 Global Smart Water Management Market, by Solutions, 2018, (US$ Bn)

2.3.3 Global Smart Water Management Market, by Services, 2018 (US$ Bn)

2.3.4 Global Smart Water Management Market, by Region, 2018 (US$ Bn)

2.4 Premium Insights

2.4.1 Smart Water Management Market In Developed Vs. Developing Economies, 2018 vs 2023

2.4.2 Global Smart Water Management Market: Regional Life Cycle Analysis

Chapter 3 Market Dynamics

3.1 Market Overview

3.2 Market Drivers

3.2.1 Sustainable use of energy resources

3.2.2 Increasing need to reduce non-revenue water losses

3.2.3 Driver 3

3.3 Market Restraints

3.3.1 Lack of capital investments to install infrastructure

3.3.2 Restraint 2

3.4 Market Opportunities

3.4.1 Rising awareness level to protect natural resources

3.4.2 Opportunity 2

3.5 Industry Value Chain Analysis

3.5.1 Analyst’s Views

3.6 Industry SWOT Analysis

Chapter 4 Global Smart Water Management Market, by Product Type

4.1 Market Overview, by Product Type

4.1.1 Global Smart Water Management Market, by Product Type, 2016-2023 (US$ Bn)

4.1.2 Incremental Opportunity, by Product Type, From 2018-2023

4.2 Advanced Water Meters

4.2.1 Global Smart Water Management Market, by Advanced Water Meters, 2016-2023, (US$ Bn)

4.3 Meter Read Technology

4.3.1 Global Smart Water Management Market, by Meter Read Technology, 2016-2023, (US$ Bn)

4.4 Cellular Network

4.4.1 Global Smart Water Management Market, by Cellular Network, 2016-2023, (US$ Bn)

Chapter 5 Global Smart Water Management Market, by Solutions

5.1 Market Overview, by Solutions

5.1.1 Global Smart Water Management Market, by Solutions, 2016-2023 (US$ Bn)

5.1.2 Incremental Opportunity, by Solutions, From 2018-2023

5.2 Advanced Pressure Management

5.2.1 Global Smart Water Management Market, by Advanced Pressure Management, 2016-2023, (US$ Bn)

5.3 SCADA System

5.3.1 Global Smart Water Management Market, by SCADA System, 2016-2023, (US$ Bn)

5.4 Network Monitoring

5.4.1 Global Smart Water Management Market, by Network Monitoring, 2016-2023, (US$ Bn)

5.5 Residential Water Efficiency

5.5.1 Global Smart Water Management Market, by Residential Water Efficiency, 2016-2023, (US$ Bn)

5.6 Advanced Analytics

5.6.1 Global Smart Water Management Market, by Advanced Analytics, 2016-2023, (US$ Bn)

5.7 Others

5.7.1 Global Smart Water Management Market, by Others, 2016-2023, (US$ Bn)

Chapter 6 Global Smart Water Management Market, by Services

6.1 Market Overview, by Services

6.1.1 Global Smart Water Management Market, by Services, 2016-2023 (US$ Bn)

6.1.2 Incremental Opportunity, by Services, From 2018-2023

6.2 Professional Service

6.2.1 Global Smart Water Management Market, by Professional Service, 2016-2023, (US$ Bn)

6.3 Managed Service

6.3.1 Global Smart Water Management Market, by Managed Service, 2016-2023, (US$ Bn)

Chapter 7 Global Smart Water Management Market, by Region

7.1 Market Overview, by Region

7.1.1 Global Smart Water Management Market, by Region, 2016-2023, (US$ Bn)

7.2 Attractive Investment Opportunity, by Region, 2018

7.3 North America Smart Water Management Market

7.3.1 North America Smart Water Management Market, by Product Type, 2016-2023 (US$ Bn)

7.3.2 North America Smart Water Management Market, by Solutions, 2016-2023 (US$ Bn)

7.3.3 North America Smart Water Management Market, by Services, 2016-2023 (US$ Bn)

7.3.4 United States Country Profile

7.3.4.1 United States Smart Water Management Market, 2016-2023 (US$ Bn)

7.3.5 Canada Country Profile

7.3.5.1 Canada Smart Water Management Market, 2016-2023 (US$ Bn)

7.3.6 Mexico Country Profile

7.3.6.1 Mexico Smart Water Management Market, 2016-2023 (US$ Bn)

7.4 Europe Smart Water Management Market

7.4.1 Europe Smart Water Management Market, by Product Type, 2016-2023 (US$ Bn)

7.4.2 Europe Smart Water Management Market, by Solutions, 2016-2023 (US$ Bn)

7.4.3 Europe Smart Water Management Market, by Services, 2016-2023 (US$ Bn)

7.4.4 United Kingdom Country Profile

7.4.4.1 United Kingdom Smart Water Management Market, 2016-2023 (US$ Bn)

7.4.5 Germany Country Profile

7.4.5.1 Germany Smart Water Management Market, 2016-2023 (US$ Bn)

7.4.6 France Country Profile

7.4.6.1 France Smart Water Management Market, 2016-2023 (US$ Bn)

7.4.7 Italy Country Profile

7.4.7.1 Italy Smart Water Management Market, 2016-2023 (US$ Bn)

7.4.8 Spain Country Profile

7.4.8.1 Spain Smart Water Management Market, 2016-2023 (US$ Bn)

7.4.9 Rest of Europe

7.4.9.1 Rest of Europe Smart Water Management Market, 2016-2023 (US$ Bn)

7.5 Asia Pacific Smart Water Management Market

7.5.1 Asia Pacific Smart Water Management Market, by Product Type, 2016-2023 (US$ Bn)

7.5.2 Asia Pacific Smart Water Management Market, by Solutions, 2016-2023 (US$ Bn)

7.5.3 Asia Pacific Smart Water Management Market, by Services, 2016-2023 (US$ Bn)

7.5.4 China Country Profile

7.5.4.1 China Smart Water Management Market, 2016-2023 (US$ Bn)

7.5.5 Japan Country Profile

7.5.5.1 Japan Smart Water Management Market, 2016-2023 (US$ Bn)

7.5.6 India Country Profile

7.5.6.1 India Smart Water Management Market, 2016-2023 (US$ Bn)

7.5.7 Indonesia Country Profile

7.5.7.1 Indonesia Smart Water Management Market, 2016-2023 (US$ Bn)

7.5.8 Thailand Country Profile

7.5.8.1 Thailand Smart Water Management Market, 2016-2023 (US$ Bn)

7.5.9 Rest of Asia Pacific

7.5.9.1 Rest of Asia Pacific Smart Water Management Market, 2016-2023 (US$ Bn)

7.6 Latin America Smart Water Management Market

7.6.1 Latin America Smart Water Management Market, by Product Type, 2016-2023 (US$ Bn)

7.6.2 Latin America Smart Water Management Market, by Solutions, 2016-2023 (US$ Bn)

7.6.3 Latin America Smart Water Management Market, by Services, 2016-2023 (US$ Bn)

7.6.4 Brazil Country Profile

7.6.4.1 Brazil Smart Water Management Market, 2016-2023 (US$ Bn)

7.6.5 Argentina Country Profile

7.6.5.1 Argentina Smart Water Management Market, 2016-2023 (US$ Bn)

7.6.6 Rest of Latin America

7.6.6.1 Rest of Latin America Smart Water Management Market, 2016-2023 (US$ Bn)

7.7 Middle East & Africa Smart Water Management Market

7.7.1 Middle East & Africa Smart Water Management Market, by Product Type, 2016-2023 (US$ Bn)

7.7.2 Middle East & Africa Smart Water Management Market, by Solutions, 2016-2023 (US$ Bn)

7.7.3 Middle East & Africa Smart Water Management Market, by Services, 2016-2023 (US$ Bn)

7.7.4 Southern Africa

7.7.4.1 Southern Africa Smart Water Management Market, 2016-2023 (US$ Bn)

7.7.5 Northern Africa

7.7.5.1 Northern Africa Smart Water Management Market, 2016-2023 (US$ Bn)

7.7.6 GCC

7.7.6.1 GCC Smart Water Management Market, 2016-2023 (US$ Bn)

7.7.7 Rest of Middle East & Africa

7.7.7.1 Rest of Middle East & Africa Smart Water Management Market, 2016-2023 (US$ Bn)

Chapter 8 Competitive Intelligence

8.1 Introduction

8.2 Players Evaluated During the Study

8.3 Market Players Present in Market Life Cycle

8.4 Top 5 Players Comparison

8.5 Market Positioning of Key Players, 2018

8.6 Market Players Mapping

8.6.1 By Product Type

8.6.2 By Solutions

8.6.3 By Services

8.6.4 By Region

8.7 Strategies Adopted by Key Market Players

8.8 Recent Developments in the Market

8.8.1 Mergers & Acquisitions, Partnership, New Product Developments

8.9 Operational Efficiency Comparison by Key Players

Chapter 9 Company Profiles

9.1 IBM Corporation

9.1.1 IBM Corporation Overview

9.1.2 Key Stakeholders/Person in IBM Corporation

9.1.3 IBM Corporation Products Portfolio

9.1.4 IBM Corporation Financial Overview

9.1.5 IBM Corporation News/Recent Developments

9.2 ABB

9.2.1 ABB Overview

9.2.2 Key Stakeholders/Person in ABB

9.2.3 ABB Products Portfolio

9.2.4 ABB Financial Overview

9.2.5 ABB News/Recent Developments

9.3 Siemens AG

9.3.1 Siemens AG Overview

9.3.2 Key Stakeholders/Person in Siemens AG

9.3.3 Siemens AG Products Portfolio

9.3.4 Siemens AG Financial Overview

9.3.5 Siemens AG News/Recent Developments

9.4 Hitachi Ltd

9.4.1 Hitachi Ltd Overview

9.4.2 Key Stakeholders/Person in Hitachi Ltd

9.4.3 Hitachi Ltd Products Portfolio

9.4.4 Hitachi Ltd Financial Overview

9.4.5 Hitachi Ltd News/Recent Developments

9.5 Arad Group

9.5.1 Arad Group Overview

9.5.2 Key Stakeholders/Person in Arad Group

9.5.3 Arad Group Products Portfolio

9.5.4 Arad Group Financial Overview

9.5.5 Arad Group News/Recent Developments

9.6 Elster Group SE

9.6.1 Elster Group SE Overview

9.6.2 Key Stakeholders/Person in Elster Group SE

9.6.3 Elster Group SE Products Portfolio

9.6.4 Elster Group SE Financial Overview

9.6.5 Elster Group SE News/Recent Developments

9.7 Sensus

9.7.1 Sensus Overview

9.7.2 Key Stakeholders/Person in Sensus

9.7.3 Sensus Products Portfolio

9.7.4 Sensus Financial Overview

9.7.5 Sensus News/Recent Developments

9.8 Takadu

9.8.1 Takadu Overview

9.8.2 Key Stakeholders/Person in Takadu

9.8.3 Takadu Products Portfolio

9.8.4 Takadu Financial Overview

9.8.5 Takadu News/Recent Developments

9.9 I2O Water Ltd

9.9.1 I2O Water Ltd Overview

9.9.2 Key Stakeholders/Person in I2O Water Ltd

9.9.3 I2O Water Ltd Products Portfolio

9.9.4 I2O Water Ltd Financial Overview

9.9.5 I2O Water Ltd News/Recent Developments

9.10 Schneider Electric

9.10.1 Schneider Electric Overview

9.10.2 Key Stakeholders/Person in Schneider Electric

9.10.3 Schneider Electric Products Portfolio

9.10.4 Schneider Electric Financial Overview

9.10.5 Schneider Electric News/Recent Developments