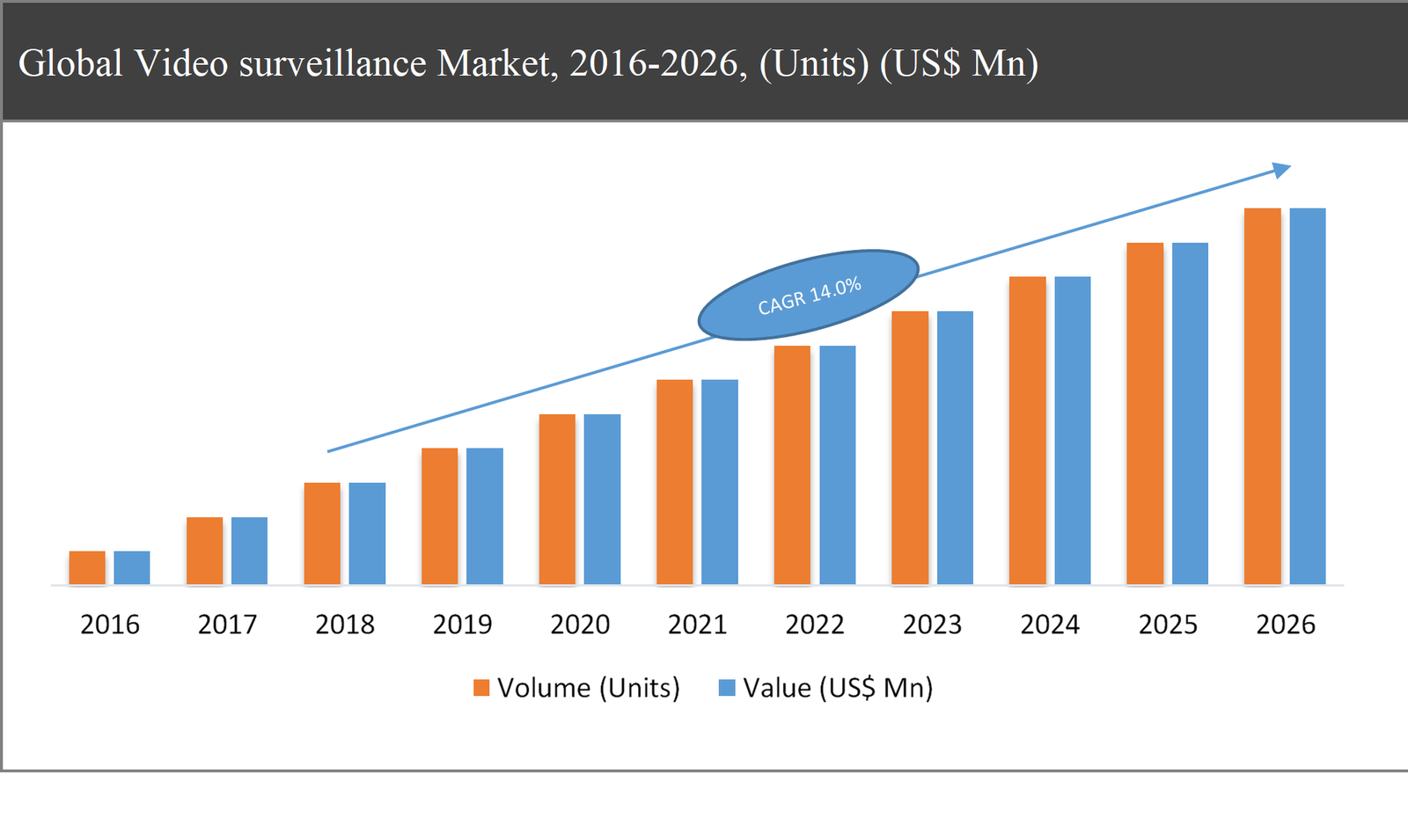

The global video surveillance market was valued at USD XX million in 2018 and is expected to reach USD XX million by 2026, growing at a CAGR of 14.0% during the forecast period.

Video surveillance, also known as closed-circuit television (CCTV) surveillance, is a system of one or more video cameras that capture video and audio information and transfer the signal to a specific place over a monitor, through the structured centralized network. These cameras can be used in almost any environment and across various applications, such as commercial, residential, military & defense, industrial, etc. The rise in demand for Video Surveillance as a Service (VSaaS) and Video Content Analytics (VCA), the increasing demand for intelligent transportation systems, and the integration of AI in video surveillance systems are some important factors that are driving the demand for video surveillance systems.

The incorporation of IoT in surveillance cameras is also a major factor that is expected to fuel the video surveillance market. The demand for video surveillance is mainly driven by the rising government focus on the implementation of surveillance cameras for the protection of public places and critical infrastructure. For instance, in 2018, the US government installed 250 surveillance cameras in the city of New Orleans and the New York Police Department installed 2,000 street-level cameras throughout the city’s public spaces.

Further, companies are developing modern cameras to meet the growing security and safety need, which is expected to drive the demand for video surveillance systems. For instance, Axis communication has announced a new generation PTZ camera named “AXIS Q60 PTZ Network Camera Series”. These high-performance cameras offer improved imaging, extended capabilities for analytics, enhanced security features, and significantly more well-organized video compression.

However, the market growth is expected to be hindered by a lack of expertise in handling IP cameras and the high costs associated with surveillance cameras.

Video Surveillance Market Segmentation |

|

| By Offering | 1. Hardware |

| 1. Camera | |

| 1. Fixed Cameras | |

| 2. Dome Cameras | |

| 3. Pan Tilt Zoom (PTZ) Cameras | |

| 4. Others (Panoramic and Thermal) | |

| 2. Monitors | |

| 3. Storage | |

| 4. Accessories | |

| 2. Software | |

| 3. Service | |

| By Technology | 1. Analog Video Surveillance Systems |

| 2. IP Video Surveillance Systems | |

| 3. Hybrid Surveillance Systems | |

| By Installation Type | 1. Outdoor |

| 2. Indoor | |

| By Application | 1. Commercial |

| 2. Residential | |

| 1. Military & Defense | |

| 2. Industrial | |

| 3. Public Facility | |

| 4. Others | |

| By Region | 1. North America (US and Canada) |

| 2. Europe (UK, Germany, France and Rest of Europe) | |

| 3. Asia Pacific (China, Japan, India and Rest of Asia Pacific) | |

| 4. Latin America (Brazil, Mexico and Rest of Latin America) | |

| 5. Middle East & Africa (GCC and Rest of Middle East & Africa) | |

Based on Offerings, the hardware segment is expected to have the highest market share during the forecast period.

Based on offerings, the video surveillance market has been segmented into hardware, software, and services. The hardware segment is expected to have the highest market share during the forecast period. The latest developments in hardware components and the replacement of analog surveillance systems are some of the key factors that are expected to boost the demand for this segment. Further, the growing use of cameras in several security-related applications is anticipated to drive the growth of this segment.

Based on Technology, the IP video surveillance systems segment is expected to hold the largest share in the market during the forecast period.

Based on technology, the market has been segmented into analog video surveillance systems, IP video surveillance systems, and hybrid surveillance systems. IP video surveillance systems are expected to hold the largest share in the market during the forecast period. Various benefits offered by IP surveillance cameras such as easy installation, avoidance of interference, and less bandwidth requirement in transmission are expected to boost the demand for IP video surveillance systems. Also, the growing adoption of PTZ camera for 360-degree security and visibility is expected to fuel the demand for IP cameras.

Based on Installation Type, the indoor segment is anticipated to have the highest share in the market during the forecast period.

Based on Installation Type, the market has been segmented into outdoor and indoor. The indoor segment is anticipated to have the highest market share during the forecast period. Indoor video surveillance cameras are necessary for home security management, as well as for business security systems. They help keep an eye on employees and customers and safeguard the business from lawsuits. Also, these cameras provide additional home security by automatically sending alerts to the user’s mobile phone. These factors are anticipated to drive the growth of this segment.

Based on Applications, the commercial segment is anticipated to have the highest share in the market during the forecasted period.

Based on applications, the market has been segmented into commercial, residential, military & defence, industrial, public facility, and others. The commercial segment is anticipated to have the highest market share during the forecast period. The growing use of video surveillance systems in applications such as malls, enterprises, datacentres, hospitality centres, warehouses, etc., is expected to fuel the demand for video surveillance systems. Rising security risks such as accidental loss, burglary, vandalism, theft, product diversion, vandalism, and inventory loss in business properties, are expected to boost the demand for video surveillance systems.

Based on regions, the Asia-Pacific region is anticipated to capture a significant portion of the global market during the forecast period.

The Asia-Pacific video surveillance market is anticipated to capture a significant portion of the global market during the forecast period. The growing adoption of technologically advanced security systems is expected to accelerate the growth of the video surveillance market in the region. Further, the strong possibility of terrorist attacks in emerging economies and the growing number of manufacturing bases deploying these security cameras for provincial security are anticipated to drive the growth of the market. Moreover, increased security concerns in countries such as India and China are also expected to boost the demand for video surveillance systems.

Company Profiles and Competitive Intelligence Covered in Video Surveillance Market Report are:

The major players operating in the global video surveillance market are, Axis Communications, Bosch Security Systems Incorporation, Dahua Technology, Hangzhou Hikvision Digital Technology Limited, Panasonic, PELCO, Infinova, Honeywell Security Group, Avigilon Corporation, and FLIR Systems Inc., among others.

Ask for free product review call with the author

Share your specific research requirements for a customized report

Request for due diligence and consumer centric studies

Request for study updates, segment specific and country level reports

Table of Content

Chapter 1 Preface

1.1 Report Description

1.1.1 Purpose of the Report

1.1.2 Target Audience

1.1.3 USP and Key Type

1.2 Research Scope

1.3 Research Methodology

1.3.1 Phase I – Secondary Research

1.3.2 Phase II – Primary Research

1.3.3 Phase III – Expert Panel Review

1.3.4 Approach Adopted

1.3.4.1 Top-Down Approach

1.3.4.2 Bottom-Up Approach

1.3.5 Assumptions

1.4 Market Segmentation Scope

Chapter 2 Executive Summary

2.1 Market Summary

2.1.1 Global Video Surveillance Market, 2016-2026, (Units) (US$ Mn)

2.1 Market Snapshot: Global Video Surveillance Market

2.2 Market Dynamics

2.3 Global Video Surveillance Market, by Segment, 2018

2.3.1 Global Video Surveillance Market, by Offering, 2018, (Units) (US$ Mn)

2.3.2 Global Video Surveillance Market, By Technology, 2018 (Units) (US$ Mn)

2.3.3 Global Video Surveillance Market, by Installation Type, 2018 (Units) (US$ Mn)

2.3.4 Global Video Surveillance Market, by Installation Type, 2018 (Units) (US$ Mn)

2.3.5 Global Video Surveillance Market, by Application, 2018 (Units) (US$ Mn)

2.3.6 Global Video Surveillance Market, by Region, 2018 (Units) (US$ Mn)

2.4 Market Insights

2.4.1 Video Surveillance Market In Developed vs. Developing Economies, 2018 vs 2026

2.4.2 Global Video Surveillance Market: Regional Life Cycle Analysis

Chapter 3 Market Dynamics

3.1 Market Overview

3.2 Market Drivers

3.2.1 Growing concerns for public safety and security

3.2.1 Driver 2

3.3 Market Restraints

3.3.1 High initial investment costs

3.4 Market Opportunities

3.4.1 Integration of IoT with video surveillance systems

3.5 Industry SWOT Analysis

Chapter 4 Global Video Surveillance Market, by Offering

4.1 Market Overview, by Offering

4.1.1 Global Video Surveillance Market, by Offering, 2016-2026 (Units) (US$ Mn)

4.1.2 Incremental Opportunity, by Offering, From 2018-2026

4.2 Hardware

4.2.1 Global Video Surveillance Market, by Hardware, 2016-2026, (Units) (US$ Mn)

4.3 Software

4.3.1 Global Video Surveillance Market, by Software, 2016-2026, (Units) (US$ Mn)

4.4 Service

4.4.1 Global Video Surveillance Market, by Service, 2016-2026, (Units) (US$ Mn)

Chapter 5 Global Video Surveillance Market, By Technology

5.1 Market Overview, By Technology

5.1.1 Global Video Surveillance Market, By Technology, 2016-2026 (Units) (US$ Mn)

5.1.2 Incremental Opportunity, By Technology, From 2018-2026

5.2 Analog Video Surveillance Systems

5.2.1 Global Video Surveillance Market, by Analog Video Surveillance Systems, 2016-2026, (Units) (US$ Mn)

5.3 IP Video Surveillance Systems

5.3.1 Global Video Surveillance Market, by IP Video Surveillance Systems, 2016-2026, (Units) (US$ Mn)

5.4 Hybrid Surveillance Systems

5.4.1 Global Video Surveillance Market, by Hybrid Surveillance Systems, 2016-2026, (Units) (US$ Mn)

Chapter 6 Global Video Surveillance Market, by Installation Type

6.1 Market Overview, by Installation Type

6.1.1 Global Video Surveillance Market, by Installation Type, 2016-2026 (Units) (US$ Mn)

6.1.2 Incremental Opportunity, by Installation Type, From 2018-2026

6.2 Outdoor

6.2.1 Global Video Surveillance Market, by Outdoor, 2016-2026, (Units) (US$ Mn)

6.3 Indoor

6.3.1 Global Video Surveillance Market, by Indoor, 2016-2026, (Units) (US$ Mn)

Chapter 7 Global Video Surveillance Market, by Application

7.1 Market Overview, by Application

7.1.1 Global Video Surveillance Market, by Application, 2016-2026 (Units) (US$ Mn)

7.1.2 Incremental Opportunity, by Application, From 2018-2026

7.2 Commercial

7.2.1 Global Video Surveillance Market, by Commercial, 2016-2026, (Units) (US$ Mn)

7.3 Residential

7.3.1 Global Video Surveillance Market, by Residential, 2016-2026, (Units) (US$ Mn)

7.4 Military & Defence

7.4.1 Global Video Surveillance Market, by Military & Defence, 2016-2026, (Units) (US$ Mn)

7.5 Industrial

7.5.1 Global Video Surveillance Market, by Industrial, 2016-2026, (Units) (US$ Mn)

7.6 Public Facility

7.6.1 Global Video Surveillance Market, by Public Facility, 2016-2026, (Units) (US$ Mn)

7.7 Others

7.7.1 Global Video Surveillance Market, by Others, 2016-2026, (Units) (US$ Mn)

Chapter 8 Global Video Surveillance Market, by Region

8.1 Market Overview, by Region

8.1.1 Global Video Surveillance Market, by Region, 2016-2026, (Units) (US$ Mn)

8.2 Attractive Investment Opportunity, by Region, 2018

8.3 North America Video Surveillance Market

8.3.1 North America Video Surveillance Market, by Offering, 2016-2026 (Units) (US$ Mn)

8.3.2 North America Video Surveillance Market, By Technology, 2016-2026 (Units) (US$ Mn)

8.3.3 North America Video Surveillance Market, by Installation Type, 2016-2026 (Units) (US$ Mn)

8.3.4 North America Video Surveillance Market, by Application, 2016-2026 (Units) (US$ Mn)

8.3.5 North America Video Surveillance Market, by Country, 2016-2026 (Units) (US$ Mn)

8.3.5.1 United States

8.3.5.1.1 United States Video Surveillance Market, 2016-2026 (Units) (US$ Mn)

8.3.5.2 Canada

8.3.5.2.1 Canada Video Surveillance Market, 2016-2026 (Units) (US$ Mn)

8.4 Europe Video Surveillance Market

8.4.1 Europe Video Surveillance Market, by Offering, 2016-2026 (Units) (US$ Mn)

8.4.2 Europe Video Surveillance Market, By Technology, 2016-2026 (Units) (US$ Mn)

8.4.3 Europe Video Surveillance Market, by Installation Type, 2016-2026 (Units) (US$ Mn)

8.4.4 Europe Video Surveillance Market, by Application, 2016-2026 (Units) (US$ Mn)

8.4.5 Europe Video Surveillance Market, by Country, 2016-2026 (Units) (US$ Mn)

8.4.5.1 United Kingdom

8.4.5.1.1 United Kingdom Video Surveillance Market, 2016-2026 (Units) (US$ Mn)

8.4.5.2 Germany

8.4.5.2.1 Germany Video Surveillance Market, 2016-2026 (Units) (US$ Mn)

8.4.5.3 France

8.4.5.3.1 France Video Surveillance Market, 2016-2026 (Units) (US$ Mn)

8.4.5.4 Rest of Europe

8.4.5.4.1 Rest of Europe Video Surveillance Market, 2016-2026 (Units) (US$ Mn)

8.5 Asia Pacific Video Surveillance Market

8.5.1 Asia Pacific Video Surveillance Market, by Offering, 2016-2026 (Units) (US$ Mn)

8.5.2 Asia Pacific Video Surveillance Market, By Technology, 2016-2026 (Units) (US$ Mn)

8.5.3 Asia Pacific Video Surveillance Market, by Installation Type, 2016-2026 (Units) (US$ Mn)

8.5.4 Asia Pacific Video Surveillance Market, by Application, 2016-2026 (Units) (US$ Mn)

8.5.5 Asia Pacific Video Surveillance Market, by Country, 2016-2026 (Units) (US$ Mn)

8.5.5.1 China

8.5.5.1.1 China Video Surveillance Market, 2016-2026 (Units) (US$ Mn)

8.5.5.2 Japan

8.5.5.2.1 Japan Video Surveillance Market, 2016-2026 (Units) (US$ Mn)

8.5.5.3 India

8.5.5.3.1 India Video Surveillance Market, 2016-2026 (Units) (US$ Mn)

8.5.5.4 Rest of Asia Pacific

8.5.5.4.1 Rest of Asia Pacific Video Surveillance Market, 2016-2026 (Units) (US$ Mn)

8.6 Latin America Video Surveillance Market

8.6.1 Latin America Video Surveillance Market, by Offering, 2016-2026 (Units) (US$ Mn)

8.6.2 Latin America Video Surveillance Market, By Technology, 2016-2026 (Units) (US$ Mn)

8.6.3 Latin America Video Surveillance Market, by Installation Type, 2016-2026 (Units) (US$ Mn)

8.6.4 Latin America Video Surveillance Market, by Application, 2016-2026 (Units) (US$ Mn)

8.6.5 Latin America Video Surveillance Market, by Country, 2016-2026 (Units) (US$ Mn)

8.6.5.1 Brazil

8.6.5.1.1 Brazil Video Surveillance Market, 2016-2026 (Units) (US$ Mn)

8.6.5.2 Mexico

8.6.5.2.1 Mexico Video Surveillance Market, 2016-2026 (Units) (US$ Mn)

8.6.5.3 Rest of Latin America

8.6.5.3.1 Rest of Latin America Video Surveillance Market, 2016-2026 (Units) (US$ Mn)

8.7 Middle East & Africa Video Surveillance Market

8.7.1 Middle East & Africa Video Surveillance Market, by Offering, 2016-2026 (Units) (US$ Mn)

8.7.2 Middle East & Africa Video Surveillance Market, By Technology, 2016-2026 (Units) (US$ Mn)

8.7.3 Middle East & Africa Video Surveillance Market, by Installation Type, 2016-2026 (Units) (US$ Mn)

8.7.4 Middle East & Africa Video Surveillance Market, by Application, 2016-2026 (Units) (US$ Mn)

8.7.5 Middle East & Africa Video Surveillance Market, by Country, 2016-2026 (Units) (US$ Mn)

8.7.5.1 GCC

8.7.5.1.1 GCC Video Surveillance Market, 2016-2026 (Units) (US$ Mn)

8.7.5.2 Rest of Middle East & Africa

8.7.5.2.1 Rest of Middle East & Africa Video Surveillance Market, 2016-2026 (Units) (US$ Mn)

Chapter 9 Competitive Intelligence

9.1 Market Players Present in Market Life Cycle

9.2 Top 5 Players Comparison

9.3 Market Positioning of Key Players, 2018

9.4 Market Players Mapping

9.4.1 By Platform

9.4.2 By Technology

9.4.3 By Installation Type

9.4.4 By Application

9.4.5 By Region

9.5 Strategies Adopted by Key Market Players

9.6 Recent Developments in the Market

9.6.1 Mergers & Acquisitions, Partnership, New Product Developments

Chapter 10 Company Profiles

10.1 Axis Communication

10.1.1 Axis Communication Overview

10.1.2 Axis Communication Products Portfolio

10.1.3 Axis Communication Financial Overview

10.1.4 Axis Communication News/Recent Developments

10.2 Bosch Security Systems Incorporation

10.2.1 Bosch Security Systems Incorporation Overview

10.2.2 Bosch Security Systems Incorporation Products Portfolio

10.2.3 Bosch Security Systems Incorporation Financial Overview

10.2.4 Bosch Security Systems Incorporation News/Recent Developments

10.3 Dahua Technology

10.3.1 Dahua Technology Overview

10.3.2 Dahua Technology Products Portfolio

10.3.3 Dahua Technology Financial Overview

10.3.4 Dahua Technology News/Recent Developments

10.4 Hangzhou Hikvision Digital Technology Limited

10.4.1 Hangzhou Hikvision Digital Technology Limited Overview

10.4.2 Hangzhou Hikvision Digital Technology Limited Products Portfolio

10.4.3 Hangzhou Hikvision Digital Technology Limited Financial Overview

10.4.4 Hangzhou Hikvision Digital Technology Limited News/Recent Developments

10.5 Panasonic

10.5.1 Panasonic Overview

10.5.2 Panasonic Products Portfolio

10.5.3 Panasonic Financial Overview

10.5.4 Panasonic News/Recent Developments

10.6 PELCO

10.6.1 PELCO Overview

10.6.2 PELCO Products Portfolio

10.6.3 PELCO Financial Overview

10.6.4 PELCO News/Recent Developments

10.7 Infinova

10.7.1 Infinova Overview

10.7.2 Infinova Products Portfolio

10.7.3 Infinova Financial Overview

10.7.4 Infinova News/Recent Developments

10.8 Honeywell Security Group

10.8.1 Honeywell Security Group Overview

10.8.2 Honeywell Security Group Products Portfolio

10.8.3 Honeywell Security Group Financial Overview

10.8.4 Honeywell Security Group News/Recent Developments

10.9 Avigilon Corporation

10.9.1 Avigilon Corporation Overview

10.9.2 Avigilon Corporation Products Portfolio

10.9.3 Avigilon Corporation Financial Overview

10.9.4 Avigilon Corporation News/Recent Developments

10.10 FLIR Systems Incorporation

10.10.1 FLIR Systems Incorporation Overview

10.10.2 FLIR Systems Incorporation Products Portfolio

10.10.3 FLIR Systems Incorporation Financial Overview

10.10.4 FLIR Systems Incorporation News/Recent Developments