Surface protection tapes are made up of plastic and have self-adhesive and self-adhering properties. It protects the surface from scratches during transit, handling, and post-installation and offers various properties including adjustable peel force, no adhesive residue, weather resistance, and UV resistance. These tapes are used on stainless steel, coated metals, aluminum, glass, and plastics.

Surface Protection Tapes Market Segmentation |

|

| By Type | 1. Polyethylene |

| 2. Polypropylene | |

| 3. Polyvinyl chloride | |

| 4. Other | |

| By Surface Material | 1. Polished Metals |

| 2. Glass | |

| 3. Plastic | |

| 4. Others | |

| By End Use | 1. Electronics & Appliances |

| 2. Building & Construction | |

| 3. Automotive | |

| 4. Others | |

| By Region | 1. North America (US and Canada) |

| 2. Europe (UK, Germany, France and Rest of Europe) | |

| 3. Asia Pacific (China, Japan, India and Rest of Asia Pacific) | |

| 4. Latin America (Brazil, Mexico and Rest of Latin America) | |

| 5. Middle East & Africa (GCC and Rest of Middle East & Africa) | |

The growth of the surface protection tapes market is primarily driven by the growing demand for surface protection tapes in various end-user industries, and increase in demand for surface protection tapes owing to their ease applicability, reduced weight, durability, customization, and smooth removal. Moreover, technological advancement in adhesive tapes and growing e-commerce industries are expected to create opportunities for the manufacturers in the global market over the forecast period. However, volatile prices of raw materials and difficulty in recycling polymer plastics are expected to hamper the growth of the global surface protection tapes market in the coming years.

The polyethylene segment expected to dominate the market throughout the forecast period

Based on the type, the global surface protection tapes market has been segmented into polyethylene, polypropylene, polyvinyl chloride, and others. The polyethylene of surface protection tapes accounted for approximately 27% of the share in the global surface protection tapes market in 2018.

While the polypropylene segment accounted highest CAGR of around 10.1% in the global surface protection tapes market during the forecast period. Polypropylene is widely adopted for packaging due to temporary protection purposes and offers a clean and smooth adhesive-free removal. Furthermore, it has enhanced barrier properties, better impact strength, improved clarity, and higher elasticity. These tapes are majorly used in transportation and electronics industries where resistance to high temperatures is required. Thus, inbuilt barrier properties and growing demand from end user industries further expected to increase demand for surface protection tapes during the forecast period.

Based on the surface material, the polished metals segment is expected to grow at a CAGR of around 9.5% throughout the forecast period

Based on the surface material, the market has been segmented into polished metals, glass, plastic, and others. The polished metals segment accounts of the largest share in the market and are expected to grow at a CAGR of around 9.5% during the forecast period.

The major factors that are driving the growth of this segment are the demand for Polished Metals tapes in various end-user industries such as building & construction. The manufacturers 3M, Toray Industries, Inc., and Berry Global Inc. are mainly investing in the development of polished metals, which expected the lead the market in the coming years.

Based on end-use industry, the electronics & appliances segment is expected to dominate during the forecast period

Based on end-use industry, the market has been segmented into electronics & appliances, building & construction, automotive, and others. The electronics & appliances segment accounts of the largest share in the market and held for more than 45% of the total market in 2018. The major factors that are driving the growth of this segment are the rising demand for ultra-low and very low types of adhesives and growth rates for the electronics industry developing countries such as India, China, and Indonesia.

Asia-Pacific to dominate the surface protection tapes market throughout the forecast period

Asia-Pacific accounted for nearly 40% share of the global surface protection tapes market in 2018 and is expected to dominate the market throughout the forecast period. The rapid growth in the urbanization and liberalization of foreign direct investment in the manufacturing sector are the major driving factor for the region in the global market. Moreover, rapid urbanization, high economic growth, intensive construction activities, and increasing standards of living increase its dominance in the global surface protection tapes market in future.

North America is expected to hold the highest CAGR in the global market during the forecast period. The manufacturers are investing in North American countries to meet the demand for end-user industries. Growth of industries such as consumer electronics and construction is expected to enhance the market growth in the global surface protection tapes market during the forecast.

Company Profiles and Competitive Intelligence:

Toray Industries, Inc. (Japan), 3M (US), DowDuPont (US), Compagnie de Saint-Gobain S.A. (France), Chevron Phillips Chemical Company (US), Berry Global Inc. (US), Nitto Denko Corporation (Japan), Avery Dennison (US), Tesa SE (Germany), and Intertape Polymer Group (Canada) among others are some of the major players operating in the global surface protection tapes market.

Ask for free product review call with the author

Share your specific research requirements for a customized report

Request for due diligence and consumer centric studies

Request for study updates, segment specific and country level reports

TABLE OF CONTENT

Chapter 1 Executive Summary

1.1. Market Summary

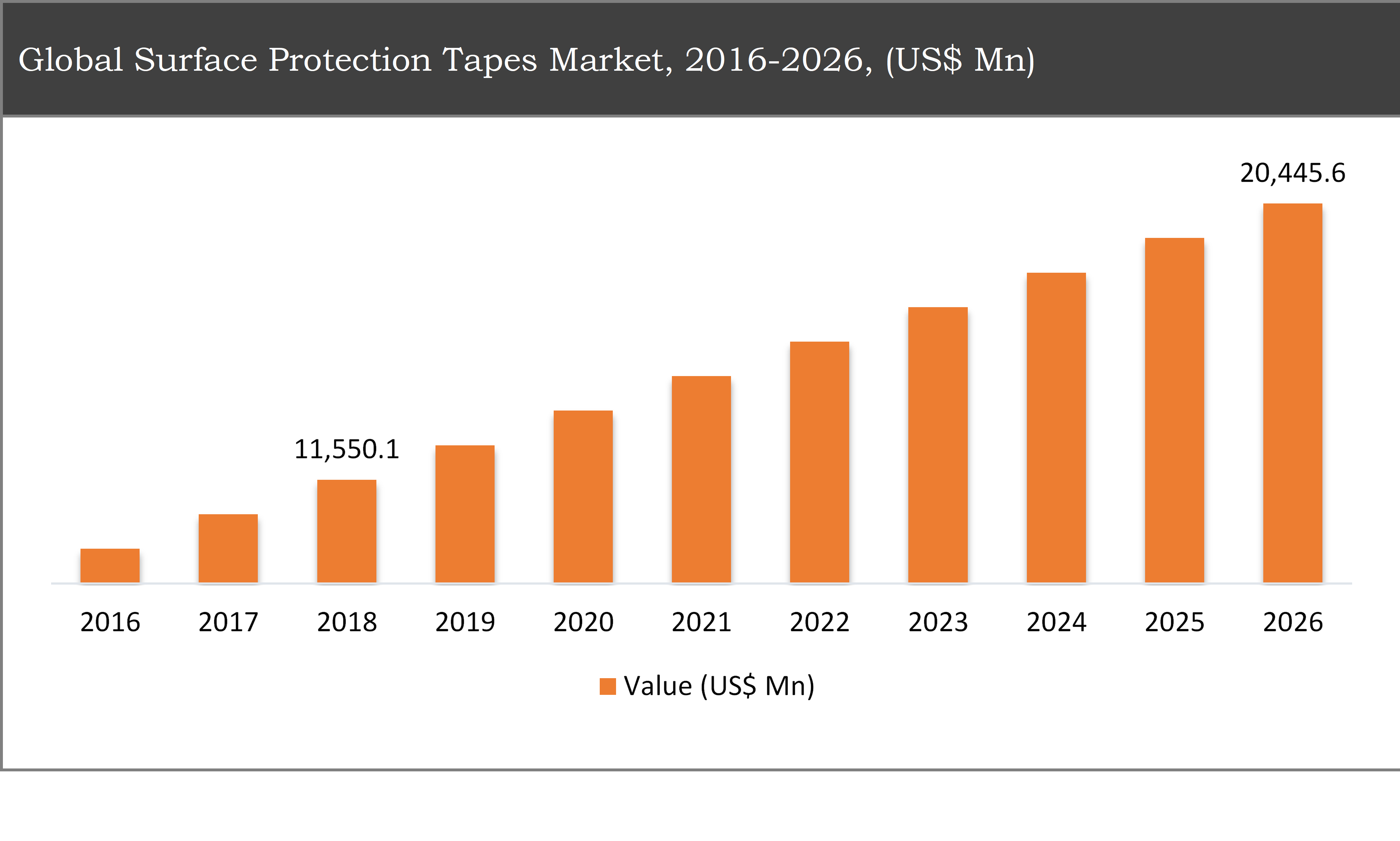

1.1.1. Global Surface Protection Tapes Market, 2016-2026, (USD Million)

1.2. Market Snapshot: Global Surface Protection Tapes Market

1.3. Market Dynamics

1.4. Global Surface Protection Tapes Market, by Segment, 2018

1.4.1. Global Surface Protection Tapes Market, by Type, 2018, (USD Million)

1.4.2. Global Surface Protection Tapes Market, by Surface Material, 2018, (USD Million)

1.4.3. Global Surface Protection Tapes Market, by End-Use Industry, 2018, (USD Million)

1.4.4. Global Surface Protection Tapes Market, by Region, 2018 (USD Million)

1.5. Premium Insights

1.5.1. Surface Protection Tapes Market In Developed Vs. Developing Economies, 2018 vs 2026

1.5.2. Global Surface Protection Tapes Market: Regional Life Cycle Analysis

Chapter 2 Market Dynamics

2.1. Market Overview

2.2. Market Drivers

2.2.1. Growing demand for surface protection tapes from various end user industries

2.2.2. Wide acceptance due to reduced weight, ease of application, and ease of removal

2.3. Market Restraints

2.3.1. Difficulty in recycling polymer plastics

2.3.2. Fluctuations in raw material prices

2.4. Market Opportunities

2.4.1. Technological advancement in adhesive tapes

2.4.2. Rise in building & construction activities

2.5. Industry Value Chain Analysis

2.6. Pricing Analysis

2.7. Porter’s Five Forces Analysis

Chapter 3 Global Surface Protection Tapes Market, by Type

3.1. Market Overview, by Type

3.1.1. Global Surface Protection Tapes Market, by Type, 2016-2026 (USD Million)

3.1.2. Incremental Opportunity, by Type, 2018

3.2. Polyethylene

3.2.1. Global Surface Protection Tapes Market, by Polyethylene, 2016-2026, (USD Million)

3.3. Polypropylene

3.3.1. Global Surface Protection Tapes Market, by Polypropylene, 2016-2026, (USD Million)

3.4. Polyvinyl Chloride

3.4.1. Global Surface Protection Tapes Market, by Polyvinyl Chloride, 2016-2026, (USD Million)

3.5. Others

3.5.1. Global Surface Protection Tapes Market, by Others, 2016-2026, (USD Million)

Chapter 4 Global Surface Protection Tapes Market, by Surface Material

4.1. Market Overview, by Surface Material

4.1.1. Global Surface Protection Tapes Market, by Surface Material, 2016-2026 (USD Million)

4.1.2. Incremental Opportunity, by Surface Material, 2018

4.2. Polished Metals

4.2.1. Global Surface Protection Tapes Market, by Polished Metals, 2016-2026, (USD Million)

4.3. Glass

4.3.1. Global Surface Protection Tapes Market, by Glass, 2016-2026, (USD Million)

4.4. Plastic

4.4.1. Global Surface Protection Tapes Market, by Plastic, 2016-2026, (USD Million)

4.5. Others

4.5.1. Global Surface Protection Tapes Market, by Others, 2016-2026, (USD Million)

Chapter 5 Global Surface Protection Tapes Market, by End-Use Industry

5.1. Market Overview, by End-Use Industry

5.1.1. Global Surface Protection Tapes Market, by End-Use Industry, 2016-2026 (USD Million)

5.1.2. Incremental Opportunity, by End-Use Industry, 2018

5.2. Electronics & Appliances

5.2.1. Global Surface Protection Tapes Market, by Electronics & Appliances, 2016-2026, (USD Million)

5.3. Building & Construction

5.3.1. Global Surface Protection Tapes Market, by Building & Construction, 2016-2026, (USD Million)

5.4. Automotive

5.4.1. Global Surface Protection Tapes Market, by Automotive, 2016-2026, (USD Million)

5.5. Others

5.5.1. Global Surface Protection Tapes Market, by Others, 2016-2026, (USD Million)

Chapter 6 Global Surface Protection Tapes Market, by Region

6.1. Market Overview, by Region

6.1.1. Global Surface Protection Tapes Market, by Region, 2016-2026, (USD Million)

6.2. Attractive Investment Opportunity, by Region, 2018

6.3. North America Surface Protection Tapes Market

6.3.1. North America Surface Protection Tapes Market, by Type, 2016-2026 (USD Million)

6.3.2. North America Surface Protection Tapes Market, by Surface Material, 2016-2026 (USD Million)

6.3.3. North America Surface Protection Tapes Market, by End-Use Industry, 2016-2026 (USD Million)

6.3.4. United States Surface Protection Tapes Market, 2016-2026 (USD Million)

6.3.5. Canada Surface Protection Tapes Market, 2016-2026 (USD Million)

6.4. Europe Surface Protection Tapes Market

6.4.1. Europe Surface Protection Tapes Market, by Type, 2016-2026 (USD Million)

6.4.2. Europe Surface Protection Tapes Market, by Surface Material, 2016-2026 (USD Million)

6.4.3. Europe Surface Protection Tapes Market, by End-Use Industry, 2016-2026 (USD Million)

6.4.4. United Kingdom Surface Protection Tapes Market, 2016-2026 (USD Million)

6.4.5. Germany Surface Protection Tapes Market, 2016-2026 (USD Million)

6.4.6. France Surface Protection Tapes Market, 2016-2026 (USD Million)

6.4.7. Rest of Europe Surface Protection Tapes Market, 2016-2026 (USD Million)

6.5. Asia Pacific Surface Protection Tapes Market

6.5.1. Asia Pacific Surface Protection Tapes Market, by Type, 2016-2026 (USD Million)

6.5.2. Asia Pacific Surface Protection Tapes Market, by Surface Material, 2016-2026 (USD Million)

6.5.3. Asia Pacific Surface Protection Tapes Market, by End-Use Industry, 2016-2026 (USD Million)

6.5.4. China Surface Protection Tapes Market, 2016-2026 (USD Million)

6.5.5. Japan Surface Protection Tapes Market, 2016-2026 (USD Million)

6.5.6. India Surface Protection Tapes Market, 2016-2026 (USD Million)

6.5.7. Rest of Asia Pacific Surface Protection Tapes Market, 2016-2026 (USD Million)

6.6. Latin America Surface Protection Tapes Market

6.6.1. Latin America Surface Protection Tapes Market, by Type, 2016-2026 (USD Million)

6.6.2. Latin America Surface Protection Tapes Market, by Surface Material, 2016-2026 (USD Million)

6.6.3. Latin America Surface Protection Tapes Market, by End-Use Industry, 2016-2026 (USD Million)

6.6.4. Brazil Surface Protection Tapes Market, 2016-2026 (USD Million)

6.6.5. Mexico Surface Protection Tapes Market, 2016-2026 (USD Million)

6.6.6. Rest of Latin America Surface Protection Tapes Market, 2016-2026 (USD Million)

6.7. Middle East & Africa Surface Protection Tapes Market

6.7.1. Middle East & Africa Surface Protection Tapes Market, by Type, 2016-2026 (USD Million)

6.7.2. Middle East & Africa Surface Protection Tapes Market, by Surface Material, 2016-2026 (USD Million)

6.7.3. Middle East & Africa Surface Protection Tapes Market, by End-Use Industry, 2016-2026 (USD Million)

6.7.4. GCC Surface Protection Tapes Market, 2016-2026 (USD Million)

6.7.5. Rest of Middle East & Africa Surface Protection Tapes Market, 2016-2026 (USD Million)

Chapter 7 Competitive Intelligence

7.1. Top 5 Players Comparison

7.2. Market Positioning of Key Players, 2018

7.3. Market Players Mapping

7.3.1. By Type

7.3.2. By Surface Material

7.3.3. By End-Use Industry

7.3.4. By Region

7.4. Strategies Adopted by Key Market Players

7.5. Recent Developments in the Market

7.5.1. Mergers & Acquisitions, Partnership, New Type Developments

Chapter 8 Company Profiles

8.1. 3M

8.1.1. 3M Overview

8.1.2. 3M Types Portfolio

8.1.3. 3M Financial Overview

8.1.4. 3M News/Recent Developments

8.2. DowDuPont

8.2.1. DowDuPont Overview

8.2.2. DowDuPont Types Portfolio

8.2.3. DowDuPont Financial Overview

8.2.4. DowDuPont News/Recent Developments

8.3. Compagnie De Saint-Gobain S.A.

8.3.1. Compagnie De Saint-Gobain S.A. Overview

8.3.2. Compagnie De Saint-Gobain S.A. Types Portfolio

8.3.3. Compagnie De Saint-Gobain S.A. Financial Overview

8.3.4. Compagnie De Saint-Gobain S.A. News/Recent Developments

8.4. Toray Industries, Inc.

8.4.1. Toray Industries, Inc. Overview

8.4.2. Toray Industries, Inc. Types Portfolio

8.4.3. Toray Industries, Inc. Financial Overview

8.4.4. Toray Industries, Inc. News/Recent Developments

8.5. Chevron Phillips Chemical Company

8.5.1. Chevron Phillips Chemical Company Overview

8.5.2. Chevron Phillips Chemical Company Types Portfolio

8.5.3. Chevron Phillips Chemical Company Financial Overview

8.5.4. Chevron Phillips Chemical Company News/Recent Developments

8.6. Berry Global Inc.

8.6.1. Berry Global Inc. Overview

8.6.2. Berry Global Inc. Types Portfolio

8.6.3. Berry Global Inc. Financial Overview

8.6.4. Berry Global Inc. News/Recent Developments

8.7. Nitto Denko Corporation

8.7.1. Nitto Denko Corporation Overview

8.7.2. Nitto Denko Corporation Types Portfolio

8.7.3. Nitto Denko Corporation Financial Overview

8.7.4. Nitto Denko Corporation News/Recent Developments

8.8. Avery Dennison

8.8.1. Avery Dennison Overview

8.8.2. Avery Dennison Types Portfolio

8.8.3. Avery Dennison Financial Overview

8.8.4. Avery Dennison News/Recent Developments

8.9. Tesa SE

8.9.1. Tesa SE Overview

8.9.2. Tesa SE Types Portfolio

8.9.3. Tesa SE Financial Overview

8.9.4. Tesa SE News/Recent Developments

8.10. Intertape Polymer Group Inc.

8.10.1. Intertape Polymer Group Inc. Overview

8.10.2. Intertape Polymer Group Inc. Types Portfolio

8.10.3. Intertape Polymer Group Inc. Financial Overview

8.10.4. Intertape Polymer Group Inc. News/Recent Developments

Chapter 9 Preface

9.1. Data Triangulation

9.2. Research Methodology

9.2.1. Phase I – Secondary Research

9.2.2. Phase II – Primary Research

9.2.3. Phase III – Expert Panel Review

9.2.4. Approach Adopted

9.2.4.1. Top-Down Approach

9.2.4.2. Bottom-Up Approach

9.2.5. Supply- Demand side

9.2.6. Breakup of the Primary Profiles