The U.S. Patient Lifts market was valued at US$ 71.8 Mn in 2018 and is expected to reach US$ XX Mn by 2026, growing at a 10.8% CAGR during the forecast period. In terms of volume, the U.S. Patient lifts market was valued at 39.8 thousand units in 2018 and is expected to reach XX thousand units by the year 2026.

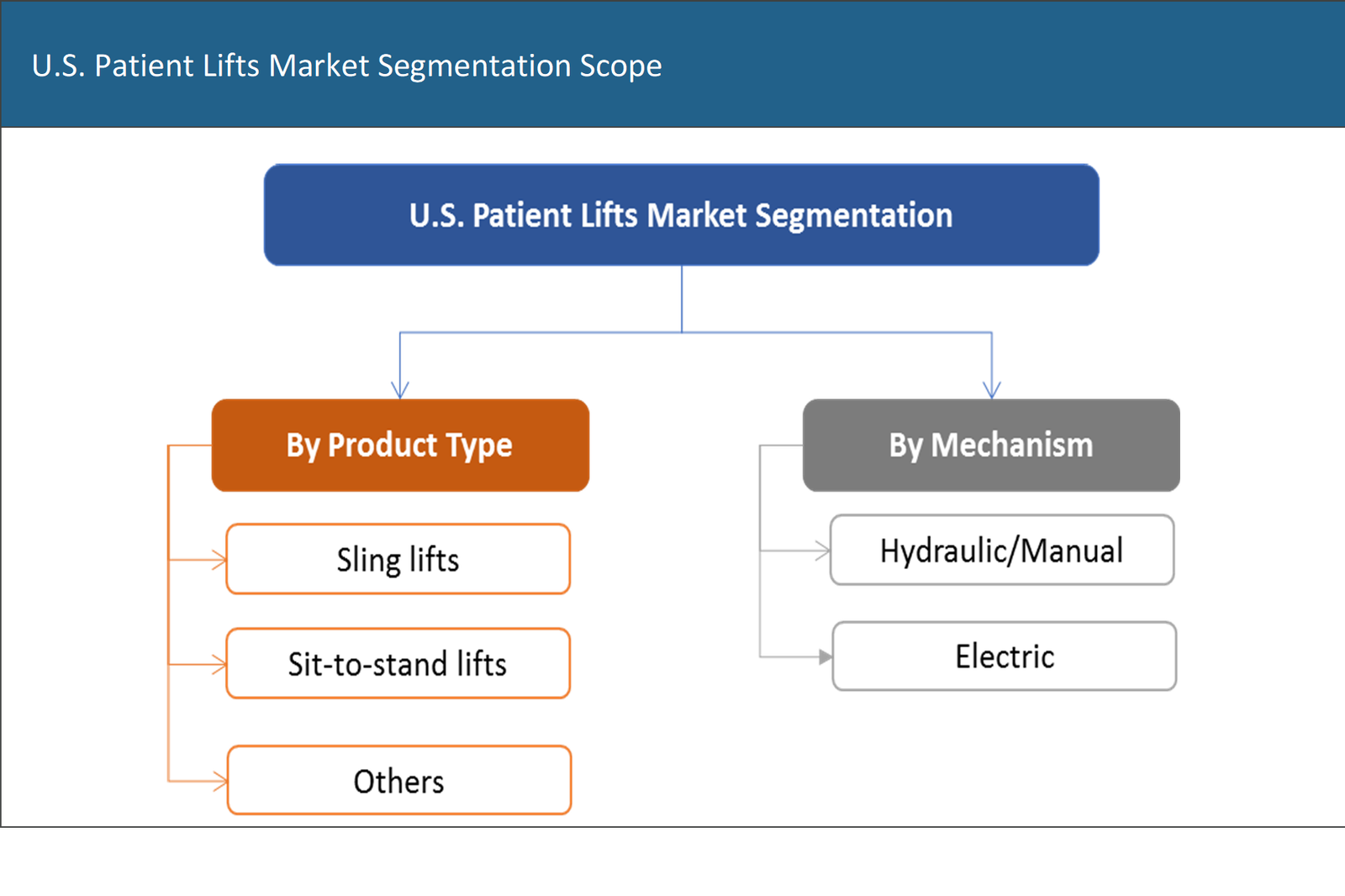

A patient lift is a device used for moving patients from one place to another with minimum stress to the caregiver. A wide variety of patient lifts are available for bedridden or dependent patients, such as sit-to-stand lifts, sling lifts and wheelchair lifts, bath lifts, and others. Patient lifts can be used in hospitals, homes, and other settings.

The major factor driving the growth of the U.S. patient lifts market is the rising geriatric and bariatric population. Apart from this, various rules implemented by government authorities to support safe patient handling measures and the growing investment for the development of innovative patient lifting devices are further expected to drive the growth of the U.S. patient lifts market.

The outbreak of COVID-19 has bought along with a global recession, which has impacted several industries. Along with this impact, COVID Pandemic has also generated a few new business opportunities for the U.S. Patient Lifts market ecosystem. The overall competitive landscape and market dynamics of the U.S. Patient Lifts have been disrupted due to this pandemic. All these disruptions and impacts have been analyzed quantifiably in this report, which is backed by market trends, events, and revenue shift analysis. COVID impact analysis also covers strategic adjustments for Tier 1, 2, and 3 players of the U.S. Patient Lifts market.

Key Questions Answered:

Ask for free product review call with the author

Share your specific research requirements for a customized report

Request for due diligence and consumer centric studies

Request for study updates, segment specific and country level reports

Chapter 1 Executive Summary

1.1 Market Summary

1.1.1 U.S. Patient Lifts Market, 2016-2026, (Units) (US$ Mn)

1.1 Market Snapshot: U.S. Patient Lifts Market

1.2 Market Dynamics

1.3 U.S. Patient Lifts Market, by Segment, 2018

1.3.1 U.S. Patient Lifts Market, by Product Type, 2018 (Units) (US$ Mn)

1.3.2 U.S. Patient Lifts Market, by Mechanism, 2018 (Units) (US$ Mn)

Chapter 2 Market Dynamics

2.1 Market Overview

2.2 Market Drivers

2.2.1 Rising geriatric and bariatric population

2.2.2 Rules and norms related to safe patient handling

2.3 Market Restraints

2.3.1 Restraint 1

2.3.2 Restraint 2

2.4 Market Opportunities

2.4.1 Opportunity 1

2.4.2 Opportunity 2

Chapter 3 U.S. Patient Lifts Market, by Product Type

3.1 Market Overview, by Product Type

3.1.1 U.S. Patient Lifts Market, by Product Type, 2016-2026 (Units) (US$ Mn)

3.1.2 Incremental Opportunity, by Product Type, From 2018-2026

3.2 Sling Lifts

3.2.1 U.S. Patient Lifts Market, by Sling Lifts, 2016-2026, (Units) (US$ Mn)

3.3 Sit-to-stand lifts

3.3.1 U.S. Patient Lifts Market, by Sit-to-stand lifts, 2016-2026, (Units) (US$ Mn)

3.4 Others

3.4.1 U.S. Patient Lifts Market, by Others, 2016-2026, (Units) (US$ Mn)

Chapter 4 U.S. Patient Lifts Market, by Mechanism

4.1 Market Overview, by Mechanism

4.1.1 U.S. Patient Lifts Market, by Mechanism, 2016-2026 (Units) (US$ Mn)

4.1.2 Incremental Opportunity, by Mechanism, From 2018-2026

4.2 Manual/Hydraulic lifts

4.2.1 U.S. Patient Lifts Market, by Manual/Hydraulic lifts, 2016-2026, (Units) (US$ Mn)

4.3 Electric lifts

4.3.1 U.S. Patient Lifts Market, by Electric lifts, 2016-2026, (Units) (US$ Mn)

Chapter 5 Competitive Intelligence

5.1 Market Positioning of Key Players, 2018

5.2 Market Players Mapping

5.2.1 By Product Type

5.2.2 By Mechanism

5.3 Strategies Adopted by Key Market Players

5.4 Recent Developments in the Market

5.4.1 Mergers & Acquisitions, Partnership, New Product Developments

Chapter 6 Company Profiles

6.1 Invacare Corporation

6.1.1 Invacare Corporation Overview

6.1.2 Key Stakeholders/Person in Invacare Corporation

6.1.3 Invacare Corporation Products Portfolio

6.1.4 Invacare Corporation Financial Overview

6.1.5 Invacare Corporation News/Recent Developments

6.2 Hill-Rom Inc.

6.2.1 Hill-Rom Inc. Overview

6.2.2 Key Stakeholders/Person in Hill-Rom Inc.

6.2.3 Hill-Rom Inc. Products Portfolio

6.2.4 Hill-Rom Inc. Financial Overview

6.2.5 Hill-Rom Inc. News/Recent Developments

6.3 Arjo (a part of Getinge Group)

6.3.1 Arjo (a part of Getinge Group) Overview

6.3.2 Key Stakeholders/Person in Arjo (a part of Getinge Group)

6.3.3 Arjo (a part of Getinge Group) Products Portfolio

6.3.4 Arjo (a part of Getinge Group) Financial Overview

6.3.5 Arjo (a part of Getinge Group) News/Recent Developments

6.4 Drive Medical

6.4.1 Drive Medical Overview

6.4.2 Key Stakeholders/Person in Drive Medical

6.4.3 Drive Medical Products Portfolio

6.4.4 Drive Medical Financial Overview

6.4.5 Drive Medical News/Recent Developments

6.5 Joerns Healthcare LLC

6.5.1 Joerns Healthcare LLC Overview

6.5.2 Key Stakeholders/Person in Joerns Healthcare LLC

6.5.3 Joerns Healthcare LLC Products Portfolio

6.5.4 Joerns Healthcare LLC Financial Overview

6.5.5 Joerns Healthcare LLC News/Recent Developments

Chapter 7 Research Methodology

7.3 Research Methodology

7.3.1 Phase I – Secondary Research

7.3.2 Phase II – Primary Research

7.3.3 Phase III – Expert Panel Review

7.3.4 Approach Adopted

7.3.4.1 Top-Down Approach

7.3.4.2 Bottom-Up Approach

7.3.5 Assumptions

List of Figures

FIG. 1 U.S. Patient Lifts Market, 2016-2026, (Units) (US$ Mn)

FIG. 2 Key Drivers, Restraints and Opportunities

FIG. 3 U.S. Patient Lifts Market, by Product Type, 2018 (Units) (US$ Mn)

FIG. 4 U.S. Patient Lifts Market, by Mechanism, 2018 (Units) (US$ Mn)

FIG. 5 Incremental Opportunity, by Product Type, From 2018-2026

FIG. 6 U.S. Patient Lifts Market, by Sling Lifts, 2016-2026, (Units) (US$ Mn)

FIG. 7 U.S. Patient Lifts Market, by Sit-to-stand lifts, 2016-2026, (Units) (US$ Mn)

FIG. 8 U.S. Patient Lifts Market, by Others, 2016-2026, (Units) (US$ Mn)

FIG. 9 Incremental Opportunity, by Mechanism, From 2018-2026

FIG. 10 U.S. Patient Lifts Market, by Manual/Hydraulic lifts, 2016-2026, (Units) (US$ Mn)

FIG. 11 U.S. Patient Lifts Market, by Electric lifts, 2016-2026, (Units) (US$ Mn)

FIG. 12 Market Positioning of Key Players, 2018

FIG. 13 Invacare Corporation Financial Overview

FIG. 14 Hill-Rom Inc. Financial Overview

FIG. 15 Arjo (a part of Getinge Group) Financial Overview

FIG. 16 Drive Medical Financial Overview

FIG. 17 Joerns Healthcare LLC Financial Overview

FIG. 18 U.S. Patient Lifts Market: Research Methodology