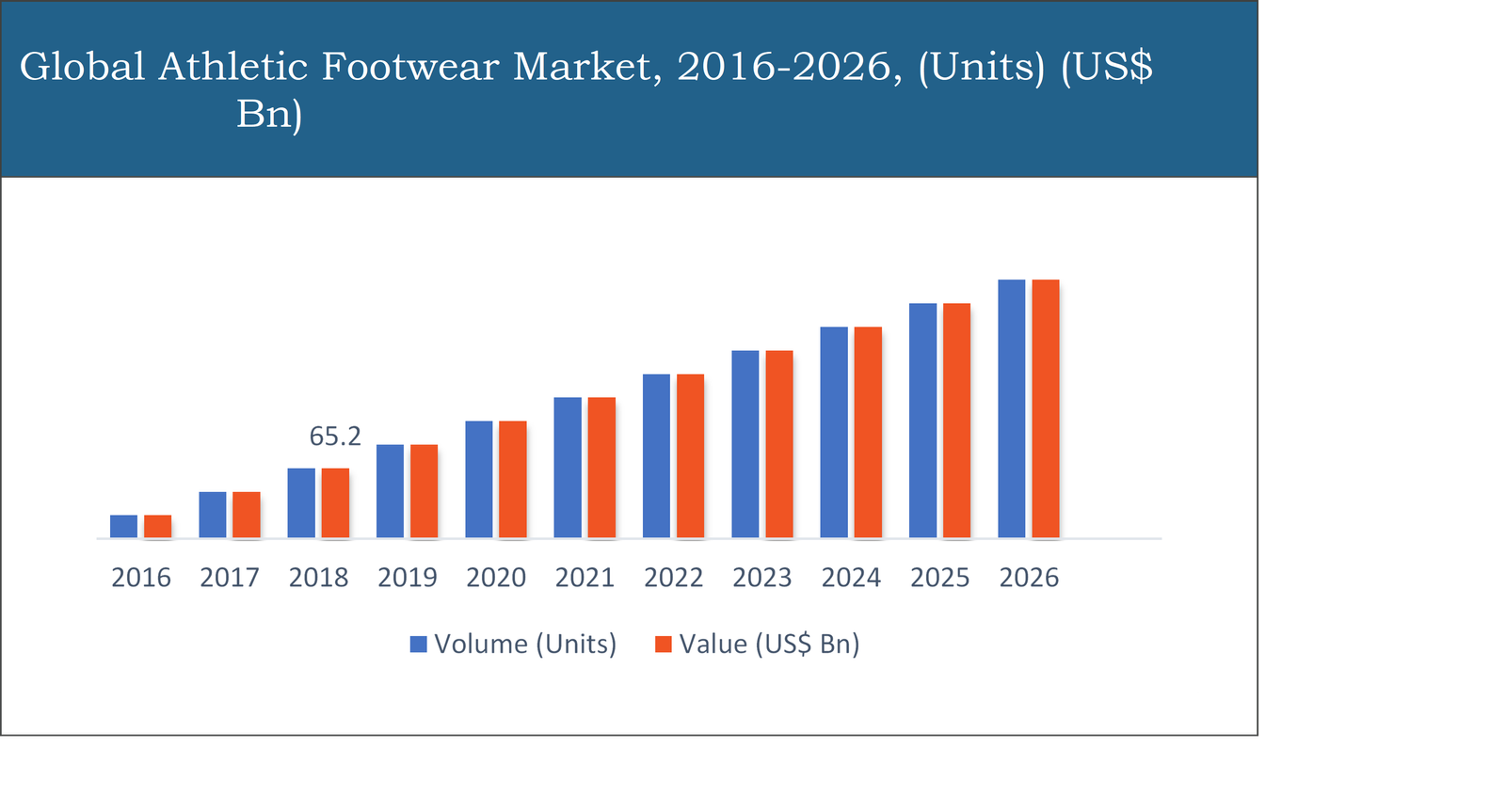

The athletic footwear market report provides an analysis for the period from 2016 to 2026, where 2019 to 2026 is the forecast period with 2018 as the base year.

Growing awareness about the health benefits derived from sporting activities is resulting in the rise in demand for athletic footwear over the years. In addition to this, the expansion of e-commerce platforms and increasing disposable income of people are some of the major factors that are triggering the market growth.

This report on athletic footwear covers an in-depth analysis of the market including statistical and subjective data points, along with the key market drivers and opportunities & restraints that have positive or negative effects on the overall global market. An exclusive coverage has been provided for market drivers and challenges & opportunities for a country-level market in the respective regional segments. The report comprises a competitive analysis of the key players functioning in the market and covers in-depth data related to the competitive landscape of the market and the recent strategies & products that will assist or affect the market in the coming years.

The global athletic footwear market has been segmented on the basis different product types, distribution channels, and end-use. On the basis of different product types, the market has been segmented into sports shoes, running/walking shoes, hiking shoes, and others. By distribution channels, the market has been segmented into online channel and offline channel. The offline channel has been further segregated into hypermarkets, specialty stores, and others. The market has been further segregated on the basis of end-use such as men, women and kids.

Sports shoes segment dominated the market in 2018 and is expected to display a similar trend in the coming years

In terms of different product types, sports shoes dominated the market in 2018. The sports shoes segment has been further segmented on the basis of prominent sports in each region. For instance, the sports shoe market in the U.S. consists of basketball, baseball, American football, tennis, ice hockey, and golf.

Running/walking shoes are expected to witness the fastest growth during the forecast period. The availability of these shoes in a wide range of prices is a major to trigger the growth of this segment during the forecast period.

The hiking/trekking shoes segment is expected to witness a significant growth rate, owing to advancements in technology that ensure more flexibility and comfort for hikers. For instance, W.L. Gore & Associates Inc. partnered with Salewa and introduced the first version of surround technology. The technology features GORE-TEX laminates that are assimilated in shoe upper of hiking and trekking shoes that surround the foot completely and expel the heat and sweat out of the shoes through the side ventilation.

Online channel is expected to witness the fastest growth during the forecast period

In terms of different distribution channels, the offline channel segment dominated the market in 2018. However, the online channel is gaining significant traction over the years. The online channel is largely preferred in developed economies such as U.K, U.S, and Germany for purchasing footwear and other consumer durable goods. Significant growth exhibited by online platforms in emerging economies such as China and India is compelling companies to re-orient their distribution strategies for these countries.

The women segment is expected to witness a significant growth rate during the forecast period

In terms of different end-use, the men segment dominated the market in 2018. However, women’s segment is expected to witness a significant growth rate during the forecast period. Rising awareness about fitness among women is a major factor that is triggering the overall market growth.

By Product Type

By Distribution Channel

By End-Use

North America

Europe

Asia Pacific

LATAM

Middle East Africa

The Asia Pacific is expected to witness the fastest growth during the forecast period

In terms of different regions, North America dominated the market in 2018 and is expected to display a similar trend in the coming years. High enthusiasm among both men and women towards sporting and physical activities is a major factor resulting in the rise in demand for athletic footwear.

The Asia Pacific is expected to witness significant growth rate during the forecast period. India and China are leading economies in the Asia Pacific region with the rising penetration of e-commerce websites, increasing per capita income, and significant investments undertaken by top industry players, seeing the potential growth opportunities in the region.

The market players have stepped up new product innovation and new product launches in order to gain more attention from customers. Moreover, the market growth is attributed to strategic mergers & acquisitions, geographical expansions, joint ventures & partnerships, which help to ensure long-term sustenance in the market.

Key Questions Answered in the Report:

Ask for free product review call with the author

Share your specific research requirements for a customized report

Request for due diligence and consumer centric studies

Request for study updates, segment specific and country level reports

Table of Content

Chapter 1 Preface

1.1 Report Description

1.1.1 Purpose of the Report

1.1.2 Target Audience

1.1.3 USP and Key Offerings

1.2 Research Scope

1.3 Research Methodology

1.3.1 Phase I – Secondary Research

1.3.2 Phase II – Primary Research

1.3.3 Phase III – Expert Panel Review

1.3.4 Approach Adopted

1.3.4.1 Top-Down Approach

1.3.4.2 Bottom-Up Approach

1.3.5 Assumptions

1.4 Market Segmentation Scope

Chapter 2 Executive Summary

2.1 Market Summary

2.1.1 Global Athletic Footwear Market, 2016-2026, (US$ Bn)

2.1 Market Snapshot: Global Athletic Footwear Market

2.2 Market Dynamics

2.3 Global Athletic Footwear Market, by Segment, 2018

2.3.1 Global Athletic Footwear Market, by Product Type, 2018, (Units) (US$ Bn)

2.3.2 Global Athletic Footwear Market, by Distribution Channel, 2018 (Units) (US$ Bn)

2.3.3 Global Athletic Footwear Market, by End-use, 2018 (Units) (US$ Bn)

2.3.4 Global Athletic Footwear Market, by Region, 2018 (Units) (US$ Bn)

2.4 Premium Insights

2.4.1 Athletic Footwear Market In Developed Vs. Developing Economies, 2018 vs 2026

2.4.2 Global Athletic Footwear Market: Regional Life Cycle Analysis

Chapter 3 Market Dynamics

3.1 Market Overview

3.2 Market Drivers

3.2.1 Inclination towards fitness activities is resulting to the rise in the demand for Athletic Footwear

3.2.2 Driver 2

3.2.3 Driver 3

3.3 Market Restraints

3.3.1 Counterfeit products is a restraining the overall Athletic Footwear market

3.3.2 Restraint 2

3.4 Market Opportunities

3.4.1 Product innovations is generating opportunity to the market during the forecast period

3.4.2 Opportunity 2

3.5 Industry Value Chain Analysis

3.5.1 Analyst’s Views

3.6 Industry SWOT Analysis

Chapter 4 Global Athletic Footwear Market, by Product Type

4.1 Market Overview, by Product Type

4.1.1 Global Athletic Footwear Market, by Product Type, 2016-2026 (Units) (US$ Bn)

4.1.2 Incremental Opportunity, by Product Type, From 2018-2026

4.2 Sports Shoes

4.2.1 Global Athletic Footwear Market, by Sports Shoes, 2016-2026, (Units) (US$ Bn)

4.3 Running/Walking Shoes

4.3.1 Global Athletic Footwear Market, by Running/Walking Shoes, 2016-2026, (Units) (US$ Bn)

4.4 Hiking Shoes

4.4.1 Global Athletic Footwear Market, by Hiking Shoes, 2016-2026, (Units) (US$ Bn)

4.5 Others

4.5.1 Global Athletic Footwear Market, by Others, 2016-2026, (Units) (US$ Bn)

Chapter 5 Global Athletic Footwear Market, by Distribution Channel

5.1 Market Overview, by Distribution Channel

5.1.1 Global Athletic Footwear Market, by Distribution Channel, 2016-2026 (Units) (US$ Bn)

5.1.2 Incremental Opportunity, by Distribution Channel, From 2018-2026

5.2 Online Channel

5.2.1 Global Athletic Footwear Market, by Online Channel, 2016-2026, (Units) (US$ Bn)

5.3 Offline Channel

5.3.1 Global Athletic Footwear Market, by Offline Channel, 2016-2026 (Units) (US$ Bn)

5.3.1.1 Hypermarkets

5.3.1.1.1 Global Athletic Footwear Market, by Hypermarkets, 2016-2026, (Units) (US$ Bn)

5.3.1.2 Specialty Stores

5.3.1.2.1 Global Athletic Footwear Market, by Specialty Stores, 2016-2026, (Units) (US$ Bn)

5.3.1.3 Others

5.3.1.3.1 Global Athletic Footwear Market, by Others, 2016-2026, (Units) (US$ Bn)

Chapter 6 Global Athletic Footwear Market, by End-use

6.1 Market Overview, by End-use

6.1.1 Global Athletic Footwear Market, by End-use, 2016-2026 (Units) (US$ Bn)

6.1.2 Incremental Opportunity, by End-use, From 2018-2026

6.2 Men

6.2.1 Global Athletic Footwear Market, by Men, 2016-2026, (Units) (US$ Bn)

6.3 Women

6.3.1 Global Athletic Footwear Market, by Women, 2016-2026, (Units) (US$ Bn)

6.4 Kids

6.4.1 Global Athletic Footwear Market, by Kids, 2016-2026, (Units) (US$ Bn)

Chapter 7 Global Athletic Footwear Market, by Region

7.1 Market Overview, by Region

7.1.1 Global Athletic Footwear Market, by Region, 2016-2026, (Units) (US$ Bn)

7.2 Attractive Investment Opportunity, by Region, 2018

7.3 North America Athletic Footwear Market

7.3.1 North America Athletic Footwear Market, by Product Type, 2016-2026 (Units) (US$ Bn)

7.3.2 North America Athletic Footwear Market, by Distribution Channel, 2016-2026 (Units) (US$ Bn)

7.3.2.1 North America Athletic Footwear Market, by Offline Channel, 2016-2026 (Units) (US$ Bn)

7.3.3 North America Athletic Footwear Market, by End-use, 2016-2026 (Units) (US$ Bn)

7.3.4 United States Country Profile

7.3.4.1 United States Athletic Footwear Market, 2016-2026 (Units) (US$ Bn)

7.3.5 Canada Country Profile

7.3.5.1 Canada Athletic Footwear Market, 2016-2026 (Units) (US$ Bn)

7.3.6 Mexico Country Profile

7.3.6.1 Mexico Athletic Footwear Market, 2016-2026 (Units) (US$ Bn)

7.4 Europe Athletic Footwear Market

7.4.1 Europe Athletic Footwear Market, by Product Type, 2016-2026 (Units) (US$ Bn)

7.4.2 Europe Athletic Footwear Market, by Distribution Channel, 2016-2026 (Units) (US$ Bn)

7.4.2.1 Europe Athletic Footwear Market, by Offline Channel, 2016-2026 (Units) (US$ Bn)

7.4.3 Europe Athletic Footwear Market, by End-use, 2016-2026 (Units) (US$ Bn)

7.4.4 United Kingdom Country Profile

7.4.4.1 United Kingdom Athletic Footwear Market, 2016-2026 (Units) (US$ Bn)

7.4.5 Germany Country Profile

7.4.5.1 Germany Athletic Footwear Market, 2016-2026 (Units) (US$ Bn)

7.4.6 France Country Profile

7.4.6.1 France Athletic Footwear Market, 2016-2026 (Units) (US$ Bn)

7.4.7 Italy Country Profile

7.4.7.1 Italy Athletic Footwear Market, 2016-2026 (Units) (US$ Bn)

7.4.8 Spain Country Profile

7.4.8.1 Spain Athletic Footwear Market, 2016-2026 (Units) (US$ Bn)

7.4.9 Rest of Europe

7.4.9.1 Rest of Europe Athletic Footwear Market, 2016-2026 (Units) (US$ Bn)

7.5 Asia Pacific Athletic Footwear Market

7.5.1 Asia Pacific Athletic Footwear Market, by Product Type, 2016-2026 (Units) (US$ Bn)

7.5.2 Asia Pacific Athletic Footwear Market, by Distribution Channel, 2016-2026 (Units) (US$ Bn)

7.5.2.1 Asia Pacific Athletic Footwear Market, by Offline Channel, 2016-2026 (Units) (US$ Bn)

7.5.3 Asia Pacific Athletic Footwear Market, by End-use, 2016-2026 (Units) (US$ Bn)

7.5.4 China Country Profile

7.5.4.1 China Athletic Footwear Market, 2016-2026 (Units) (US$ Bn)

7.5.5 Japan Country Profile

7.5.5.1 Japan Athletic Footwear Market, 2016-2026 (Units) (US$ Bn)

7.5.6 India Country Profile

7.5.6.1 India Athletic Footwear Market, 2016-2026 (Units) (US$ Bn)

7.5.7 Indonesia Country Profile

7.5.7.1 Indonesia Athletic Footwear Market, 2016-2026 (Units) (US$ Bn)

7.5.8 Thailand Country Profile

7.5.8.1 Thailand Athletic Footwear Market, 2016-2026 (Units) (US$ Bn)

7.5.9 Rest of Asia Pacific

7.5.9.1 Rest of Asia Pacific Athletic Footwear Market, 2016-2026 (Units) (US$ Bn)

7.6 Latin America Athletic Footwear Market

7.6.1 Latin America Athletic Footwear Market, by Product Type, 2016-2026 (Units) (US$ Bn)

7.6.2 Latin America Athletic Footwear Market, by Distribution Channel, 2016-2026 (Units) (US$ Bn)

7.6.2.1 Latin America Athletic Footwear Market, by Offline Channel, 2016-2026 (Units) (US$ Bn)

7.6.3 Latin America Athletic Footwear Market, by End-use, 2016-2026 (Units) (US$ Bn)

7.6.4 Brazil Country Profile

7.6.4.1 Brazil Athletic Footwear Market, 2016-2026 (Units) (US$ Bn)

7.6.5 Argentina Country Profile

7.6.5.1 Argentina Athletic Footwear Market, 2016-2026 (Units) (US$ Bn)

7.6.6 Rest of Latin America

7.6.6.1 Rest of Latin America Athletic Footwear Market, 2016-2026 (Units) (US$ Bn)

7.7 Middle East & Africa Athletic Footwear Market

7.7.1 Middle East & Africa Athletic Footwear Market, by Product Type, 2016-2026 (Units) (US$ Bn)

7.7.2 Middle East & Africa Athletic Footwear Market, by Distribution Channel, 2016-2026 (Units) (US$ Bn)

7.7.3 Middle East & Africa Athletic Footwear Market, by End-use, 2016-2026 (Units) (US$ Bn)

7.7.4 Southern Africa

7.7.4.1 Southern Africa Athletic Footwear Market, 2016-2026 (Units) (US$ Bn)

7.7.5 Northern Africa

7.7.5.1 Northern Africa Athletic Footwear Market, 2016-2026 (Units) (US$ Bn)

7.7.6 GCC

7.7.6.1 GCC Athletic Footwear Market, 2016-2026 (Units) (US$ Bn)

7.7.7 Rest of Middle East & Africa

7.7.7.1 Rest of Middle East & Africa Athletic Footwear Market, 2016-2026 (Units) (US$ Bn)

Chapter 8 Competitive Intelligence

8.1 Introduction

8.2 Players Evaluated During the Study

8.3 Market Players Present in Market Life Cycle

8.4 Top 5 Players Comparison

8.5 Market Positioning of Key Players, 2018

8.6 Market Players Mapping

8.6.1 By Product Type

8.6.2 By Distribution Channel

8.6.3 By End-use

8.6.4 By Region

8.7 Strategies Adopted by Key Market Players

8.8 Recent Developments in the Market

8.8.1 Mergers & Acquisitions, Partnership, New Product Developments

8.9 Operational Efficiency Comparison by Key Players

Chapter 9 Company Profiles

9.1 Adidas AG

9.1.1 Adidas AG Overview

9.1.2 Key Stakeholders/Person in Adidas AG

9.1.3 Adidas AG Products Portfolio

9.1.4 Adidas AG Financial Overview

9.1.5 Adidas AG News/Recent Developments

9.2 Nike Inc.

9.2.1 Nike Inc. Overview

9.2.2 Key Stakeholders/Person in Nike Inc.

9.2.3 Nike Inc. Products Portfolio

9.2.4 Nike Inc. Financial Overview

9.2.5 Nike Inc. News/Recent Developments

9.3 Skechers USA

9.3.1 Skechers USA Overview

9.3.2 Key Stakeholders/Person in Skechers USA

9.3.3 Skechers USA Products Portfolio

9.3.4 Skechers USA Financial Overview

9.3.5 Skechers USA News/Recent Developments

9.4 Puma SE

9.4.1 Puma SE Overview

9.4.2 Key Stakeholders/Person in Puma SE

9.4.3 Puma SE Products Portfolio

9.4.4 Puma SE Financial Overview

9.4.5 Puma SE News/Recent Developments

9.5 GeoX

9.5.1 GeoX Overview

9.5.2 Key Stakeholders/Person in GeoX

9.5.3 GeoX Products Portfolio

9.5.4 GeoX Financial Overview

9.5.5 GeoX News/Recent Developments

9.6 Under Armour Inc.

9.6.1 Under Armour Inc. Overview

9.6.2 Key Stakeholders/Person in Under Armour Inc.

9.6.3 Under Armour Inc. Products Portfolio

9.6.4 Under Armour Inc. Financial Overview

9.6.5 Under Armour Inc. News/Recent Developments

9.7 ECCO Sko A/S

9.7.1 ECCO Sko A/S Overview

9.7.2 Key Stakeholders/Person in ECCO Sko A/S

9.7.3 ECCO Sko A/S Products Portfolio

9.7.4 ECCO Sko A/S Financial Overview

9.7.5 ECCO Sko A/S News/Recent Developments

9.8 Timberland

9.8.1 Timberland Overview

9.8.2 Key Stakeholders/Person in Timberland

9.8.3 Timberland Products Portfolio

9.8.4 Timberland Financial Overview

9.8.5 Timberland News/Recent Developments

9.9 New Balance

9.9.1 New Balance Overview

9.9.2 Key Stakeholders/Person in New Balance

9.9.3 New Balance Products Portfolio

9.9.4 New Balance Financial Overview

9.9.5 New Balance News/Recent Developments

9.10 Deichmann SE

9.10.1 Deichmann SE Overview

9.10.2 Key Stakeholders/Person in Deichmann SE

9.10.3 Deichmann SE Products Portfolio

9.10.4 Deichmann SE Financial Overview

9.10.5 Deichmann SE News/Recent Developments