Fraud Detection & Prevention (FDP) systems are software that provides analytical solutions for the detection and prevention of frauds. It primarily analyzes the patterns and abnormalities in transactions from various data sources. Growing technological advancements such as data mining, machine learning, and statistical modeling have replaced the traditional methods of Fraud Detection & Prevention, thereby increasing the market for the new improved Fraud Detection & Prevention. The common frauds experienced by most of the enterprises are information theft, supplier and procurement frauds, asset theft, and internal financial theft.

The adoption of fraud detection at the initial stage is very important to prevent further harm to the business. The Fraud Detection & Prevention system identifies the probable risk and reports doubtful transactions and situations to the respective organization. The Blockchain technology has decentralized ledger that stores and shares information which is being used by the companies to detect frauds, as it enables transparency in transactions.

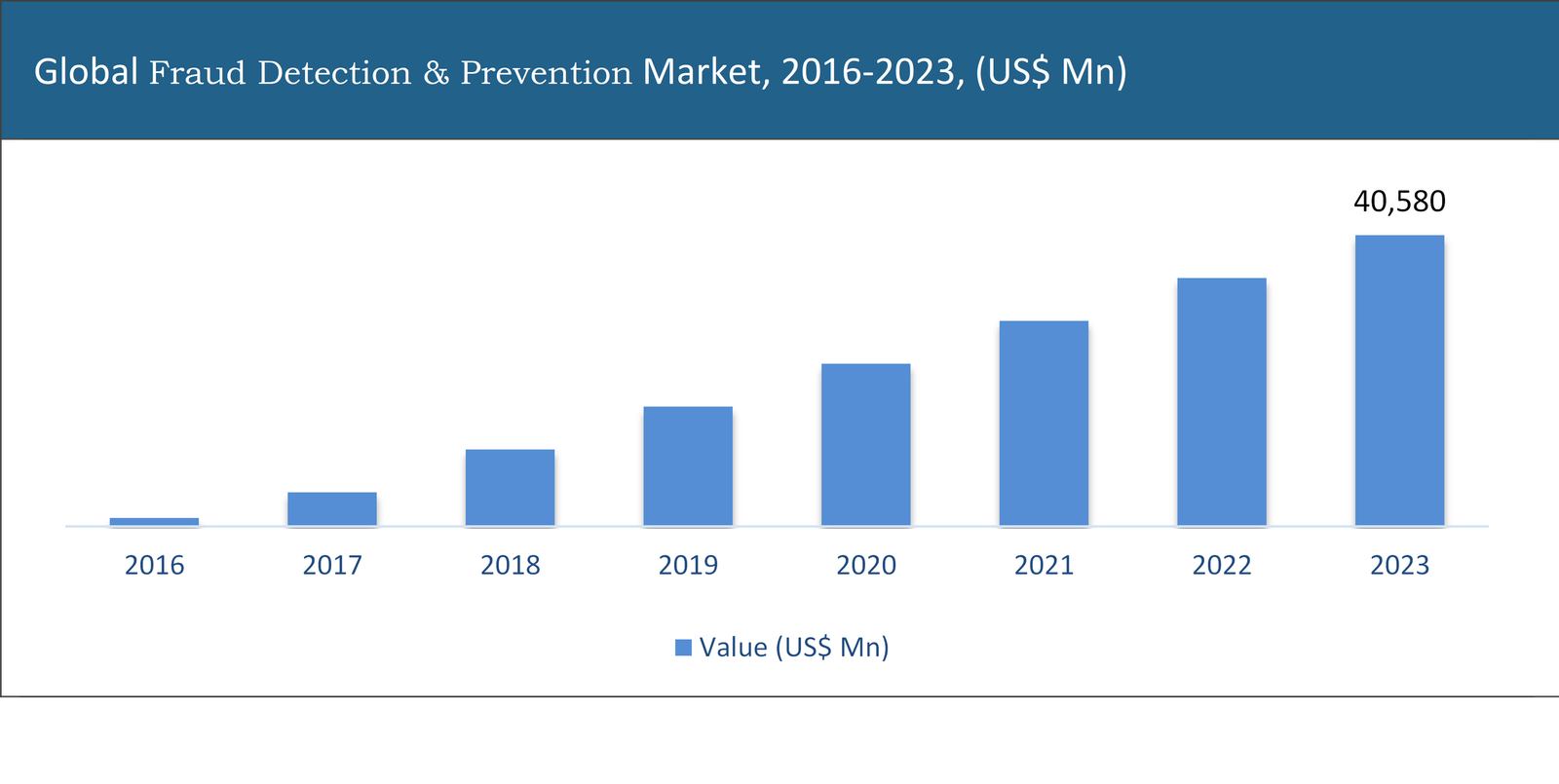

The global fraud detection & prevention (FDP) market is expected to reach US$ 40,580 million by 2023, growing at a high CAGR during the forecast period. Fraud detection & prevention systems are software applications and are being used in providing analytical solutions against fraudulent incidents. It also helps in identifying or preventing future occurrences.

With the emergence of big data analytics and cloud computing, the market is expected to experience accelerated growth during the forecast period. The cloud infrastructure allows various organizations to meet cloud security compliance need for encryption and access control of protected data. Moreover, the growth in the generation of enterprise data and its complexity, high industry-specific requirements, and an increase in the incidence of frauds will further augment the growth of the fraud detection & prevention market.

This Fraud Detection & Prevention market report covers an in-depth analysis of the market including statistical and subjective data points, along with the key market drivers and opportunities & restraints that have positive or negative effects on the overall global market. Exclusive coverage has been provided for market drivers and challenges & opportunities for a country-level market in the respective regional segments. The report comprises a competitive analysis of the key players functioning in the market and covers in-depth data related to the competitive landscape of the market and the recent strategies & products that will assist or affect the market soon.

The fraud detection and prevention market are segmented based on component type, application, deployment mode, organization size, end-use industry, and by geography. The end-use industry includes BFSI, healthcare, retail, government sector, and others. Among these, the adoption of Fraud Detection & Prevention in the BFSI sector is expected to grow significantly, owing to the acceptance of cashless payment modes and digitization, and the growing demand for technological advancement. In addition to these, the healthcare segment is expected to increase its market share in Fraud Detection & Prevention due to increasing health concerns and online availability of health records of patients.

By Component Type

By Deployment Mode

By Organization Size

By Application,

By End-Use Industry

Identity theft segment to grow at the highest CAGR during the forecast period

The fraud detection & prevention (FDP) solutions primarily help organizations to operate efficiently by saving cost, which help accelerate the growth of the Fraud Detection & Prevention market. Based on the application, the Fraud Detection & Prevention market has been segmented as identity theft, payment fraud, money laundering, and others. The identity theft segment was witnessing significant growth in the year 2018 and is expected to grow with the highest CAGR during the forecast period. Identity theft is misusing a person’s identity or credentials for fraudulent transactions or criminal activities. The stolen identity is primarily used by cyber criminals for making fraudulent purchases or transactions for their personal gains.

North America to dominate the global FDP market in 2018

North America is dominating the Fraud Detection & Prevention market, followed by Asia-Pacific, Europe, Middle East and Africa and Latin America. There is an increasing adoption of e-commerce and internet-based services in North America that raises the need for retailers to adopt Fraud Detection & Prevention measures to reduce financial losses. APAC is the fastest growing region with the increasing awareness of FDP across SMEs and growing incidents of frauds, which in turn, accelerate the market growth. In addition to these, Europe Fraud Detection & Prevention market is witnessing growth due to the growing manufacturing industry that increases the chances of frauds, thereby raising the demand for Fraud Detection & Prevention. For instance, in 2015 BMW, a car manufacturing company in Germany was defrauded by the attacker for $ 7.7 million that made manufacturers to opt for fraud prevention.

North America

Europe

Asia Pacific

Latin America

Middle East & Africa

The key players operating in the market include IBM, FICO, SAS Institute, BAE Systems, DXC Technology, SAP, ACI Worldwide, Fiserv, NICE Systems, and others. The global fraud detection & prevention market is a highly competitive market due to the presence of various international, regional, and local vendors. The demand for fraud detection & prevention is expected to propel over the coming years due to rising investments in R&D by key players, such as IBM, SAP, and others. To expand the market, majority of the vendors are adopting new technologies and product launches to gain competitive advantage in the global market. The InsurTech market is largely driven by the new product launches and acquisition.

The competition in the global fraud detection & prevention market is intense as various international and regional vendors are providing the new technology to various end-use industries for the expansion of the market. The fraud detection & prevention vendors are emphasizing on investing in R&D facilities to increase technology development. The key players and emerging vendors have improved their products to have a competitive edge over others. Furthermore, companies are involved in acquisitions and expansion to improve their product offerings and increase the production process. Industry players have developed partnerships and collaborations with the leading technology providers for addressing the demand and strengthen their presence across the globe.

Key questions answered

Ask for free product review call with the author

Share your specific research requirements for a customized report

Request for due diligence and consumer centric studies

Request for study updates, segment specific and country level reports

Table of Content

Chapter 1 Preface

1.1 Report Description

1.1.1 Purpose of the Report

1.1.2 Target Audience

1.1.3 USP and Key Offerings

1.2 Research Scope

1.3 Research Methodology

1.3.1 Phase I – Secondary Research

1.3.2 Phase II – Primary Research

1.3.3 Phase III – Expert Panel Review

1.3.4 Approach Adopted

1.3.4.1 Top-Down Approach

1.3.4.2 Bottom-Up Approach

1.3.5 Assumptions

1.4 Market Segmentation Scope

Chapter 2 Executive Summary

2.1 Market Summary

2.1.1 Global Fraud Detection & Prevention Market, 2016-2023, (US$ Mn)

2.1 Market Snapshot: Global Fraud Detection & Prevention Market

2.2 Market Dynamics

2.3 Global Fraud Detection & Prevention Market, by Segment, 2018

2.3.1 Global Fraud Detection & Prevention Market, by Component, 2018, (US$ Mn)

2.3.2 Global Fraud Detection & Prevention Market, by Deployment, 2018,(US$ Mn)

2.3.3 Global Fraud Detection & Prevention Market, by Organization Size, 2018 (US$ Mn)

2.3.4 Global Fraud Detection & Prevention Market, by End-use Industry, 2018 (US$ Mn)

2.3.5 Global Fraud Detection & Prevention Market, by Region, 2018 (US$ Mn)

2.4 Premium Insights

2.4.1 Fraud Detection & Prevention Market In Developed Vs. Developing Economies, 2018 vs 2023

2.4.2 Global Fraud Detection & Prevention Market: Regional Life Cycle Analysis

Chapter 3 Market Dynamics

3.1 Market Overview

3.2 Market Drivers

3.2.1 Increasing requirement of regulatory compliance and security

3.2.2 Rising need for remote monitoring solutions

3.2.3 Driver 3

3.3 Market Restraints

3.3.1 Lack of awareness

3.3.2 Restraint 2

3.4 Market Opportunities

3.4.1 Growing investments in cyber security

3.4.2 Opportunity 2

3.5 Industry Value Chain Analysis

3.5.1 Analyst’s Views

3.6 Industry SWOT Analysis

Chapter 4 Global Fraud Detection & Prevention Market, by Component

4.1 Market Overview, by Component

4.1.1 Global Fraud Detection & Prevention Market, by Component, 2016-2023 (US$ Mn)

4.1.2 Incremental Opportunity, by Component, From 2018-2023

4.2 Solutions

4.2.1 Global Fraud Detection & Prevention Market, by Solutions , 2016-2023, (US$ Mn)

4.3 Services

4.3.1 Global Fraud Detection & Prevention Market, by Services, 2016-2023, (US$ Mn)

Chapter 5 Global Fraud Detection & Prevention Market, by Deployment

5.1 Market Overview, by Deployment

5.1.1 Global Fraud Detection & Prevention Market, by Deployment , 2016-2023 (US$ Mn)

5.1.2 Incremental Opportunity, by Deployment , From 2018-2023

5.2 Cloud Based

5.2.1 Global Fraud Detection & Prevention Market, by Cloud Based, 2016-2023, (US$ Mn)

5.3 On-Premises

5.3.1 Global Fraud Detection & Prevention Market, by On-Premises, 2016-2023, (US$ Mn)

Chapter 6 Global Fraud Detection & Prevention Market, by Organization Size

6.1 Market Overview, by Organization Size

6.1.1 Global Fraud Detection & Prevention Market, by Organization Size, 2016-2023 (US$ Mn)

6.1.2 Incremental Opportunity, by Organization Size, From 2018-2023

6.2 SMEs

6.2.1 Global Fraud Detection & Prevention Market, by SMEs, 2016-2023, (US$ Mn)

6.3 Large Enterprises

6.3.1 Global Fraud Detection & Prevention Market, by Large Enterprises, 2016-2023, (US$ Mn)

Chapter 7 Global Fraud Detection & Prevention Market, by Application

7.1 Market Overview, by Application

7.1.1 Global Fraud Detection & Prevention Market, by Application, 2016-2023 (US$ Mn)

7.1.2 Incremental Opportunity, by Application, From 2018-2023

7.2 Identity Theft

7.2.1 Global Fraud Detection & Prevention Market, by Identity Theft, 2016-2023, (US$ Mn)

7.3 Payment Fraud

7.3.1 Global Fraud Detection & Prevention Market, by Payment Fraud, 2016-2023, (US$ Mn)

7.4 Money laundering

7.4.1 Global Fraud Detection & Prevention Market, by Money laundering, 2016-2023, (US$ Mn)

7.5 Others

7.5.1 Global Fraud Detection & Prevention Market, by Others, 2016-2023, (US$ Mn)

Chapter 8 Global Fraud Detection & Prevention Market, by End-use Industry

8.1 Market Overview, by End-use Industry

8.1.1 Global Fraud Detection & Prevention Market, by End-use Industry, 2016-2023 (US$ Mn)

8.1.2 Incremental Opportunity, by End-use Industry, From 2018-2023

8.2 BFSI

8.2.1 Global Fraud Detection & Prevention Market, by BFSI, 2016-2023, (US$ Mn)

8.3 Retail

8.3.1 Global Fraud Detection & Prevention Market, by Retail, 2016-2023, (US$ Mn)

8.4 IT & Telecommunication

8.4.1 Global Fraud Detection & Prevention Market, by IT & Telecommunication, 2016-2023, (US$ Mn)

8.5 Government

8.5.1 Global Fraud Detection & Prevention Market, by Government, 2016-2023, (US$ Mn)

8.6 Healthcare

8.6.1 Global Fraud Detection & Prevention Market, by Healthcare, 2016-2023, (US$ Mn)

8.7 Others

8.7.1 Global Fraud Detection & Prevention Market, by Others, 2016-2023, (US$ Mn)

Chapter 9 Global Fraud Detection & Prevention Market, by Region

9.1 Market Overview, by Region

9.1.1 Global Fraud Detection & Prevention Market, by Region, 2016-2023, (US$ Mn)

9.2 Attractive Investment Opportunity, by Region, 2018

9.3 North America Fraud Detection & Prevention Market

9.3.1 North America Fraud Detection & Prevention Market, by Component, 2016-2023 (US$ Mn)

9.3.2 North America Fraud Detection & Prevention Market, by Deployment , 2016-2023 (US$ Mn)

9.3.3 North America Fraud Detection & Prevention Market, by Organization Size, 2016-2023 (US$ Mn)

9.3.1 North America Fraud Detection & Prevention Market, by Application, 2016-2023 (US$ Mn)

9.3.2 North America Fraud Detection & Prevention Market, by End-use Industry, 2016-2023 (US$ Mn)

9.3.3 United States Country Profile

9.3.3.1 United States Fraud Detection & Prevention Market, 2016-2023 (US$ Mn)

9.3.4 Canada Country Profile

9.3.4.1 Canada Fraud Detection & Prevention Market, 2016-2023 (US$ Mn)

9.3.5 Mexico Country Profile

9.3.5.1 Mexico Fraud Detection & Prevention Market, 2016-2023 (US$ Mn)

9.4 Europe Fraud Detection & Prevention Market

9.4.1 Europe Fraud Detection & Prevention Market, by Component, 2016-2023 (US$ Mn)

9.4.2 Europe Fraud Detection & Prevention Market, by Deployment , 2016-2023 (US$ Mn)

9.4.3 Europe Fraud Detection & Prevention Market, by Organization Size, 2016-2023 (US$ Mn)

9.4.4 Europe Fraud Detection & Prevention Market, by Application, 2016-2023 (US$ Mn)

9.4.5 Europe Fraud Detection & Prevention Market, by End-use Industry, 2016-2023 (US$ Mn)

9.4.6 United Kingdom Country Profile

9.4.6.1 United Kingdom Fraud Detection & Prevention Market, 2016-2023 (US$ Mn)

9.4.7 Germany Country Profile

9.4.7.1 Germany Fraud Detection & Prevention Market, 2016-2023 (US$ Mn)

9.4.8 France Country Profile

9.4.8.1 France Fraud Detection & Prevention Market, 2016-2023 (US$ Mn)

9.4.9 Italy Country Profile

9.4.9.1 Italy Fraud Detection & Prevention Market, 2016-2023 (US$ Mn)

9.4.10 Spain Country Profile

9.4.10.1 Spain Fraud Detection & Prevention Market, 2016-2023 (US$ Mn)

9.4.11 Rest of Europe

9.4.11.1 Rest of Europe Fraud Detection & Prevention Market, 2016-2023 (US$ Mn)

9.5 Asia Pacific Fraud Detection & Prevention Market

9.5.1 Asia Pacific Fraud Detection & Prevention Market, by Component, 2016-2023 (US$ Mn)

9.5.2 Asia Pacific Fraud Detection & Prevention Market, by Deployment , 2016-2023 (US$ Mn)

9.5.3 Asia Pacific Fraud Detection & Prevention Market, by Organization Size, 2016-2023 (US$ Mn)

9.5.4 Asia Pacific Fraud Detection & Prevention Market, by Application, 2016-2023 (US$ Mn)

9.5.5 Asia Pacific Fraud Detection & Prevention Market, by End-use Industry, 2016-2023 (US$ Mn)

9.5.6 China Country Profile

9.5.6.1 China Fraud Detection & Prevention Market, 2016-2023 (US$ Mn)

9.5.7 Japan Country Profile

9.5.7.1 Japan Fraud Detection & Prevention Market, 2016-2023 (US$ Mn)

9.5.8 India Country Profile

9.5.8.1 India Fraud Detection & Prevention Market, 2016-2023 (US$ Mn)

9.5.9 South Korea Country Profile

9.5.9.1 South Korea Fraud Detection & Prevention Market, 2016-2023 (US$ Mn)

9.5.10 Southeast Asia Country Profile

9.5.10.1 Southeast Asia Fraud Detection & Prevention Market, 2016-2023 (US$ Mn)

9.5.11 Rest of Asia Pacific

9.5.11.1 Rest of Asia Pacific Fraud Detection & Prevention Market, 2016-2023 (US$ Mn)

9.6 Latin America Fraud Detection & Prevention Market

9.6.1 Latin America Fraud Detection & Prevention Market, by Component, 2016-2023 (US$ Mn)

9.6.2 Latin America Fraud Detection & Prevention Market, by Deployment , 2016-2023 (US$ Mn)

9.6.3 Latin America Fraud Detection & Prevention Market, by Organization Size, 2016-2023 (US$ Mn)

9.6.4 Latin America Fraud Detection & Prevention Market, by Application, 2016-2023 (US$ Mn)

9.6.5 Latin America Fraud Detection & Prevention Market, by End-use Industry, 2016-2023 (US$ Mn)

9.6.6 Brazil Country Profile

9.6.6.1 Brazil Fraud Detection & Prevention Market, 2016-2023 (US$ Mn)

9.6.7 Argentina Country Profile

9.6.7.1 Argentina Fraud Detection & Prevention Market, 2016-2023 (US$ Mn)

9.6.8 Rest of Latin America

9.6.8.1 Rest of Latin America Fraud Detection & Prevention Market, 2016-2023 (US$ Mn)

9.7 Middle East & Africa Fraud Detection & Prevention Market

9.7.1 Middle East & Africa Fraud Detection & Prevention Market, by Component, 2016-2023 (US$ Mn)

9.7.2 Middle East & Africa Fraud Detection & Prevention Market, by Deployment , 2016-2023 (US$ Mn)

9.7.3 Middle East & Africa Fraud Detection & Prevention Market, by Organization Size, 2016-2023 (US$ Mn)

9.7.4 Middle East & Africa Fraud Detection & Prevention Market, by Application, 2016-2023 (US$ Mn)

9.7.5 Middle East & Africa Fraud Detection & Prevention Market, by End-use Industry, 2016-2023 (US$ Mn)

9.7.6 Southern Africa

9.7.6.1 Southern Africa Fraud Detection & Prevention Market, 2016-2023 (US$ Mn)

9.7.7 Northern Africa

9.7.7.1 Northern Africa Fraud Detection & Prevention Market, 2016-2023 (US$ Mn)

9.7.8 GCC

9.7.8.1 GCC Fraud Detection & Prevention Market, 2016-2023 (US$ Mn)

9.7.9 Rest of Middle East & Africa

9.7.9.1 Rest of Middle East & Africa Fraud Detection & Prevention Market, 2016-2023 (US$ Mn)

Chapter 10 Competitive Intelligence

10.1 Market Players Present in Market Life Cycle

10.2 Top 5 Players Comparison

10.3 Market Positioning of Key Players, 2018

10.4 Market Players Mapping

10.4.1 By Component

10.4.2 By Deployment

10.4.3 By Organization Size

10.4.1 By End-use Industry

10.4.2 By Region

10.5 Strategies Adopted by Key Market Players

10.6 Recent Developments in the Market

10.6.1 Mergers & Acquisitions, Partnership, New Product Developments

10.7 Operational Efficiency Comparison by Key Players

Chapter 11 Company Profiles

11.1 SAP SE

11.1.1 SAP SE Overview

11.1.2 Key Stakeholders/Person in Microsoft

11.1.3 SAP SE Co. Products Portfolio

11.1.4 SAP SE Financial Overview

11.1.5 SAP SE Co. News/Recent Developments

11.2 IBM Corporation

11.2.1 IBM Corporation Overview

11.2.2 Key Stakeholders/Person in IBM Corporation

11.2.3 IBM Corporation Products Portfolio

11.2.4 IBM Corporation Financial Overview

11.2.5 IBM Corporation News/Recent Developments

11.3 Microsoft

11.3.1 Microsoft Overview

11.3.2 Key Stakeholders/Person in Microsoft

11.3.3 Microsoft Products Portfolio

11.3.4 Microsoft Financial Overview

11.3.5 Microsoft News/Recent Developments

11.4 SAS Institute

11.4.1 SAS Institute Overview

11.4.2 Key Stakeholders/Person in SAS Institute

11.4.3 SAS Institute Products Portfolio

11.4.4 SAS Institute Financial Overview

11.4.5 SAS Institute News/Recent Developments

11.5 ACI Worldwide Inc.

11.5.1 ACI Worldwide Inc. Overview

11.5.2 Key Stakeholders/Person in ACI Worldwide Inc.

11.5.3 ACI Worldwide Inc. Products Portfolio

11.5.4 ACI Worldwide Inc. Financial Overview

11.5.5 ACI Worldwide Inc. News/Recent Developments

11.6 CyberSource Corporation

11.6.1 CyberSource Corporation Overview

11.6.2 Key Stakeholders/Person in CyberSource Corporation

11.6.3 CyberSource Corporation Products Portfolio

11.6.4 CyberSource Corporation Financial Overview

11.6.5 CyberSource Corporation News/Recent Developments

11.7 Global Payments Inc.

11.7.1 Global Payments Inc. Overview

11.7.2 Key Stakeholders/Person in Global Payments Inc.

11.7.3 Global Payments Inc. Products Portfolio

11.7.4 Global Payments Inc. Financial Overview

11.7.5 Global Payments Inc. News/Recent Developments

11.8 Feedzai Inc.

11.8.1 Feedzai Inc. Overview

11.8.2 Key Stakeholders/Person in Feedzai Inc.

11.8.3 Feedzai Inc. Products Portfolio

11.8.4 Feedzai Inc. Financial Overview

11.8.5 Feedzai Inc. News/Recent Developments

11.9 Fair Isaac Corporation

11.9.1 Fair Isaac Corporation Overview

11.9.2 Key Stakeholders/Person in Fair Isaac Corporation

11.9.3 Fair Isaac Corporation Products Portfolio

11.9.4 Fair Isaac Corporation Financial Overview

11.9.5 Fair Isaac Corporation News/Recent Developments

11.10 LexisNexis Group Inc.

11.10.1 LexisNexis Group Inc. Overview

11.10.2 Key Stakeholders/Person in LexisNexis Group Inc.

11.10.3 LexisNexis Group Inc. Products Portfolio

11.10.4 LexisNexis Group Inc. Financial Overview

11.10.5 LexisNexis Group Inc. News/Recent Developments