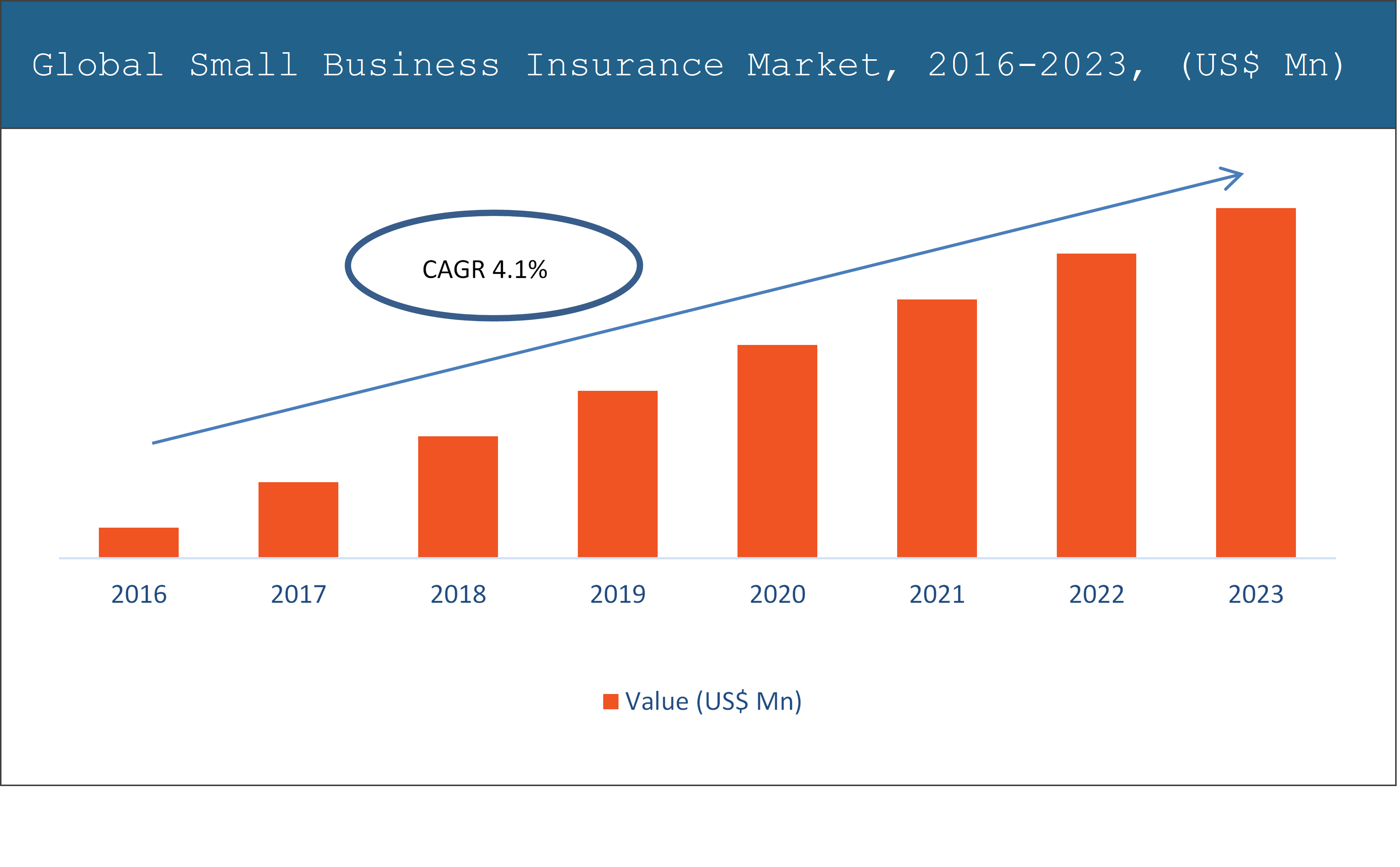

The Global Small Business Insurance Market was valued at US$ xx million in the year 2018 and is expected to reach US$ xx million by the year 2023, growing at a CAGR of approximately 4.1%. A small business insurance helps a company to protect its assets against damage claims. A business insurance can be advantageous for a business’s continuous success or failure. Many businesses are not covered by insurance. According to the Next Insurance’s database, more than 40% of small business proprietors never opted for insurance though they have completed more than one year of operations. By choosing the right kind of business insurance, a business owner can safeguard their assets, i.e., assets of the company against legal claims and damages.

The insurance packages differ according to the size of the business, the industry, and the location. Business owners want all insurance products under one umbrella. They don’t want to be distracted from their core business concerns and so, along with simplicity, they need maximum transparency to have trust in these policies.

The various types of small business insurance market include property insurance, general liability insurance, worker’s compensation insurance, and others. A worker’s compensation insurance includes coverage against work-related injuries or illnesses.

The increasing number of small businesses will propel the growth of the small business insurance market. However, improper knowledge about business owners, coupled with the uncertainties involved in running a business, is expected to impede the growth of the market. The rising footprints of insurance companies will create opportunities for the Small Business Insurance market in the future.

By Type of Insurance

By Organization Type

Geographies covered:

North America

US

Canada

Mexico

Europe

UK

Germany

France

Italy

Spain

Rest of Europe

Asia Pacific

China

Japan

India

Indonesia

Thailand

Rest of APAC

Rest of The World

Latin America

Middle East & Africa

Key Players of Small Business Insurance market are

Allianz (Germany)

Liberty Mutual (USA)

USAA (USA)

AIG (USA)

Allstate (USA)

Westfield (USA)

Marsh USA Inc. (USA)

AXA (France)

Liberty Mutual (USA)

CPIC (China)

Ask for free product review call with the author

Share your specific research requirements for a customized report

Request for due diligence and consumer centric studies

Request for study updates, segment specific and country level reports

Table of Content

Chapter 1 Preface

1.1 Report Description

1.1.1 Purpose of the Report

1.1.2 Target Audience

1.1.3 USP and Key Offerings

1.2 Research Scope

1.3 Research Methodology

1.3.1 Phase I – Secondary Research

1.3.2 Phase II – Primary Research

1.3.3 Phase III – Expert Panel Review

1.3.4 Approach Adopted

1.3.4.1 Top-Down Approach

1.3.4.2 Bottom-Up Approach

1.3.5 Assumptions

1.4 Market Segmentation Scope

Chapter 2 Executive Summary

2.1 Market Summary

2.1.1 Global Small Business Insurance Market, 2016-2023, (US$ Mn)

2.1 Market Snapshot: Global Small Business Insurance Market

2.2 Market Dynamics

2.3 Global Small Business Insurance Market, by Segment, 2018

2.3.1 Global Small Business Insurance Market, by Type of Insurance, 2018, (US$ Mn)

2.3.2 Global Small Business Insurance Market, by Organization Size, 2018, (US$ Mn)

2.3.3 Global Small Business Insurance Market, by Region, 2018 (US$ Mn)

2.4 Premium Insights

2.4.1 Small Business Insurance Market In Developed Vs. Developing Economies, 2018 vs 2023

2.4.2 Global Small Business Insurance Market: Regional Life Cycle Analysis

Chapter 3 Market Dynamics

3.1 Market Overview

3.2 Market Drivers

3.2.1 The increasing number of small businesses

3.2.2 Driver 2

3.3 Market Restraints

3.3.1 Improper knowledge about business owners

3.3.2 Restraint 2

3.4 Market Opportunities

3.4.1 The rising footprints of insurance companies

3.4.2 Opportunity 2

3.5 Industry Value Chain Analysis

3.5.1 Analyst’s Views

3.6 Industry SWOT Analysis

Chapter 4 Global Small Business Insurance Market, by Type of Insurance

4.1 Market Overview, by Type of Insurance

4.1.1 Global Small Business Insurance Market, by Type of Insurance, 2016-2023 (US$ Mn)

4.1.2 Incremental Opportunity, by Type of Insurance, From 2018-2023

4.2 General Liability Insurance

4.2.1 Global Small Business Insurance Market, by General Liability Insurance, 2016-2023, (US$ Mn)

4.3 Property Insurance

4.3.1 Global Small Business Insurance Market, by Property Insurance, 2016-2023, (US$ Mn)

4.4 Worker’s Compensation Insurance

4.4.1 Global Small Business Insurance Market, by Worker’s Compensation Insurance, 2016-2023, (US$ Mn)

4.5 Others

4.5.1 Global Small Business Insurance Market, by Others, 2016-2023, (US$ Mn)

Chapter 5 Global Small Business Insurance Market, by Organization Size

5.1 Market Overview, by Organization Size

5.1.1 Global Small Business Insurance Market, by Organization Size, 2016-2023 (US$ Mn)

5.1.2 Incremental Opportunity, by Organization Size, From 2018-2023

5.2 Small Sized Enterprises

5.2.1 Global Small Business Insurance Market, by Small Sized Enterprises, 2016-2023, (US$ Mn)

5.3 Medium Sized Enterprises

5.3.1 Global Small Enterprises Insurance Market, by Medium Sized Enterprises, 2016-2023, (US$ Mn)

5.4 Medium Sized Enterprises

5.4.1 Global Small Business Insurance Market, by Medium Sized Enterprises, 2016-2023, (US$ Mn)

Chapter 6 Global Small Business Insurance Market, by Region

6.1 Market Overview, by Region

6.1.1 Global Small Business Insurance Market, by Region, 2016-2023, (US$ Mn)

6.2 Attractive Investment Opportunity, by Region, 2018

6.3 North America Small Business Insurance Market

6.3.1 North America Small Business Insurance Market, by Type of Insurance, 2016-2023 (US$ Mn)

6.3.2 North America Small Business Insurance Market, by Organization Size, 2016-2023 (US$ Mn)

6.3.3 United States Country Profile

6.3.3.1 United States Small Business Insurance Market, 2016-2023 (US$ Mn)

6.3.4 Canada Country Profile

6.3.4.1 Canada Small Business Insurance Market, 2016-2023 (US$ Mn)

6.3.5 Mexico Country Profile

6.3.5.1 Mexico Small Business Insurance Market, 2016-2023 (US$ Mn)

6.4 Europe Small Business Insurance Market

6.4.1 Europe Small Business Insurance Market, by Type of Insurance, 2016-2023 (US$ Mn)

6.4.2 Europe Small Business Insurance Market, by Organization Size, 2016-2023 (US$ Mn)

6.4.3 United Kingdom Country Profile

6.4.3.1 United Kingdom Small Business Insurance Market, 2016-2023 (US$ Mn)

6.4.4 Germany Country Profile

6.4.4.1 Germany Small Business Insurance Market, 2016-2023 (US$ Mn)

6.4.5 France Country Profile

6.4.5.1 France Small Business Insurance Market, 2016-2023 (US$ Mn)

6.4.6 Italy Country Profile

6.4.6.1 Italy Small Business Insurance Market, 2016-2023 (US$ Mn)

6.4.7 Spain Country Profile

6.4.7.1 Spain Small Business Insurance Market, 2016-2023 (US$ Mn)

6.4.8 Rest of Europe

6.4.8.1 Rest of Europe Small Business Insurance Market, 2016-2023 (US$ Mn)

6.5 Asia Pacific Small Business Insurance Market

6.5.1 Asia Pacific Small Business Insurance Market, by Type of Insurance, 2016-2023 (US$ Mn)

6.5.2 Asia Pacific Small Business Insurance Market, by Organization Size, 2016-2023 (US$ Mn)

6.5.3 China Country Profile

6.5.3.1 China Small Business Insurance Market, 2016-2023 (US$ Mn)

6.5.4 Japan Country Profile

6.5.4.1 Japan Small Business Insurance Market, 2016-2023 (US$ Mn)

6.5.5 India Country Profile

6.5.5.1 India Small Business Insurance Market, 2016-2023 (US$ Mn)

6.5.6 South Korea Country Profile

6.5.6.1 South Korea Small Business Insurance Market, 2016-2023 (US$ Mn)

6.5.7 Southeast Asia

6.5.7.1 Southeast Asia Small Business Insurance Market, 2016-2023 (US$ Mn)

6.5.8 Rest of Asia Pacific

6.5.8.1 Rest of Asia Pacific Small Business Insurance Market, 2016-2023 (US$ Mn)

6.6 Rest of The World Small Business Insurance Market

6.6.1 Rest of The World Small Business Insurance Market, by Type of Insurance, 2016-2023 (US$ Mn)

6.6.2 Rest of The World Small Business Insurance Market, by Organization Size, 2016-2023 (US$ Mn)

6.6.2.1 Latin America Small Business Insurance Market, 2016-2023 (US$ Mn)

6.6.2.2 Middle East & Africa Small Business Insurance Market, 2016-2023 (US$ Mn)

Chapter 7 Competitive Intelligence

7.1 Introduction

7.2 Players Evaluated During the Study

7.3 Market Players Present in Market Life Cycle

7.4 Top 5 Players Comparison

7.5 Market Positioning of Key Players, 2018

7.6 Market Players Mapping

7.6.1 By Type of Insurance

7.6.2 By Organization Size

7.6.3 By Region

7.7 Strategies Adopted by Key Market Players

7.8 Recent Developments in the Market

7.8.1 Mergers & Acquisitions, Partnership, New Product Developments

7.9 Operational Efficiency Comparison by Key Players

Chapter 8 Company Profiles

8.1 Allianz

8.1.1 Allianz Overview

8.1.2 Key Stakeholders/Person in Allianz

8.1.3 Allianz Products Portfolio

8.1.4 Allianz Financial Overview

8.1.5 Allianz News/Recent Developments

8.2 Liberty Mutual

8.2.1 Liberty Mutual Overview

8.2.2 Key Stakeholders/Person in Liberty Mutual

8.2.3 Liberty Mutual Products Portfolio

8.2.4 Liberty Mutual Financial Overview

8.2.5 Liberty Mutual News/Recent Developments

8.3 USAA

8.3.1 USAA Overview

8.3.2 Key Stakeholders/Person in USAA

8.3.3 USAA Products Portfolio

8.3.4 USAA Financial Overview

8.3.5 USAA News/Recent Developments

8.4 AIG

8.4.1 AIG Overview

8.4.2 Key Stakeholders/Person in AIG

8.4.3 AIG Products Portfolio

8.4.4 AIG Financial Overview

8.4.5 AIG News/Recent Developments

8.5 Allstate

8.5.1 Allstate Overview

8.5.2 Key Stakeholders/Person in Allstate

8.5.3 Allstate Products Portfolio

8.5.4 Allstate Financial Overview

8.5.5 Allstate News/Recent Developments

8.6 Westfield

8.6.1 Westfield Overview

8.6.2 Key Stakeholders/Person in Westfield

8.6.3 Westfield Products Portfolio

8.6.4 Westfield Financial Overview

8.6.5 Westfield News/Recent Developments

8.7 Marsh USA Inc.

8.7.1 Marsh USA Inc. Overview

8.7.2 Key Stakeholders/Person in Marsh USA Inc.

8.7.3 Marsh USA Inc. Products Portfolio

8.7.4 Marsh USA Inc. Financial Overview

8.7.5 Marsh USA Inc. News/Recent Developments

8.8 AXA

8.8.1 AXA Overview

8.8.2 Key Stakeholders/Person in AXA

8.8.3 AXA Products Portfolio

8.8.4 AXA Financial Overview

8.8.5 AXA News/Recent Developments

8.9 Liberty Mutual

8.9.1 Liberty Mutual Overview

8.9.2 Key Stakeholders/Person in Liberty Mutual

8.9.3 Liberty Mutual Products Portfolio

8.9.4 Liberty Mutual Financial Overview

8.9.5 Liberty Mutual News/Recent Developments

8.10 CPIC

8.10.1 CPIC Overview

8.10.2 Key Stakeholders/Person in CPIC

8.10.3 CPIC Products Portfolio

8.10.4 CPIC Financial Overview

8.10.5 CPIC News/Recent Developments