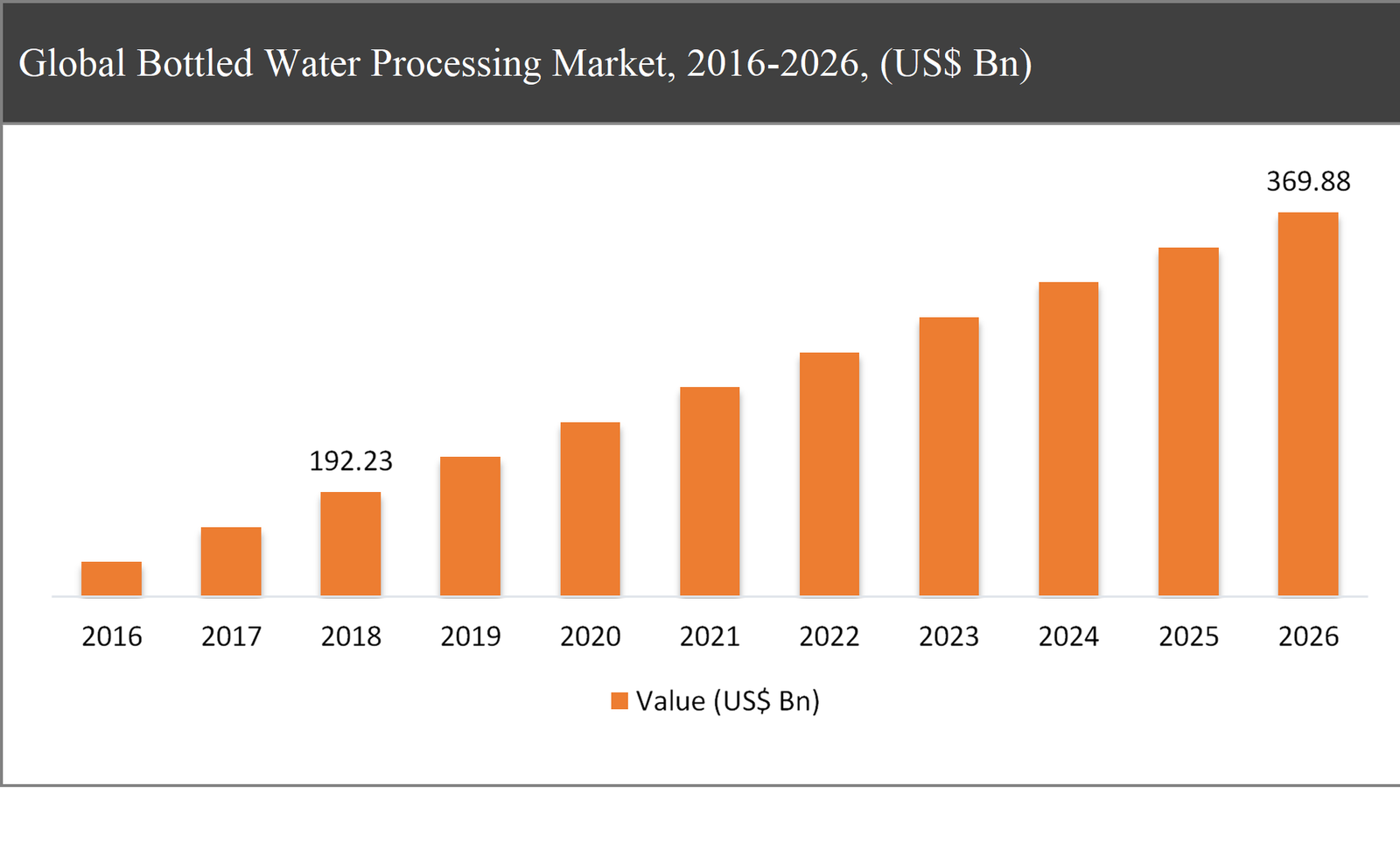

The global bottled water processing market was valued at USD 192.23 billion in 2018 and is expected to reach USD 369.88 billion in 2026, growing at a CAGR of 8.7% during the forecast period.

Bottled water is processed drinking water, packaged in plastic or glass bottle in the purpose of retail. By removing unwanted microorganisms manufacturer are purifying the water for consumption. Water purification is performed through multi-barrier sources, including source protection, source tracking, reverse osmosis, ultraviolet light, distillation, micron filtration, and ozonation.

|

By Product Type |

|

|

By Packaging Material |

|

|

By Equipment |

|

|

By Technology |

1. Ion exchange and demineralization 2. Filtration 3. Disinfection 4. Packaging |

|

By Region |

|

The growth of the bottled water processing market is primarily driven by increasing awareness about health-conscious and growing of diseases caused by contaminated water. Moreover, strict environmental rules and regulations of Govt. and using advance technology in bottled water equipment also drive the growth of the global bottled water processing market. On the other hand, the operational cost for bottled water processing industry is increasing owing to the scarcity of energy and it is creating a major hindrance for its market growth. However, the requirement of after-sales services to improve operational services is expected to create major growth opportunities during the forecast period.

Based on the product, the still water segment is expected to lead during the forecast period

Based on the product, the market has been segmented into still water and sparkling water. The still water segment expected to registered for the highest market share in the global market in 2018 and further predicted to grow in the coming years owing to an increase in concern for freshwater among millennial.

Based on the packaging material, the plastic segment is expected to lead during the forecast period

Based on the packaging material, the market has been segmented into plastic, glass, and others. The plastic-type packaging material is highly adopted in the global market with the highest market share of 76% in terms of value, which expected decrease in the coming years owing to growth in environmental concern and limited supply of plastic for daily-use household substances.

The filter segment expected to grow at the fastest rate of CAGR during the forecast period

Based on the equipment, the global bottled water processing market has been segmented into filters, blow molders, bottle washers, shrink wrappers and others. The filter segment accounted for the largest share in the market in 2018 and further estimated to grow at the highest CAGR of 11.2% in the forecast period. Filters are used primarily to remove visible particles and microorganisms from drinking water. The filtration process is one of the most widely used processes to purify and desalinate the drinking water. Microfiltration (MF), ultrafiltration (UF) and Nano filtration (NF) are the main membrane filtration methods used to process bottled water. Due to the aforementioned factors, the filter segment is expected to grow at the fastest rate throughout the forecast period.

Based on technology, the ion exchange and demineralization segment is expected to lead during the forecast period

Based on the technology, the market has been segmented into ion exchange and demineralization, filtration, disinfection, and packaging. Ion exchange softening is efficient in both carbonate and non-carbonate hardness removal and is often used in elevated non-carbonate hardness waters. To reduce water hardness, water softeners use salt and ion-exchange resins. The resins remove calcium and magnesium salts from the water; the resins are covered in a sodium solution, and as hard water comes into contact with the resin surfaces, the calcium and magnesium ions migrate from the solution to the resin's active sites and are substituted by sodium ions in the solution.so as per the market scenario, it is anticipated that ion exchange and demineralization segment will lead the global market during the forecast period.

Asia-Pacific to dominate the global bottled water processing market throughout the forecast period

Asia-Pacific accounted for the largest market share with almost 40% of the global bottled water processing market in 2018 and is expected to dominate the market throughout the forecast period followed by North America. Rapid economic growth in the Asia-Pacific region is one of the key factors driving the consumption of bottled water in this region. Moreover, the availability of raw materials, land, skilled laborer and low cost of equipment attract investors to set up their business in this region. Furthermore, the increase in favourable government schemes and its continuous support also experienced rapid growth in manufacturing activities of bottled water processing in the region. Due to the aforementioned factors, the Asia-Pacific region will dominate the global market during the forecast period.

Company Profiles and Competitive Intelligence:

The major players operating in the global bottled water processing market are DowDuPont (US), GEA (Germany), Lenntech B.V. (South Holland), Suez (US), Pall Corporation (US), Nestlé (Switzerland), PepsiCo (US), Coca-Cola Corporation (US), Danone (France), and Tata Global Beverages (India) among others.

Ask for free product review call with the author

Share your specific research requirements for a customized report

Request for due diligence and consumer centric studies

Request for study updates, segment specific and country level reports

Chapter 1 Executive Summary

1.1. Market Summary

1.1.1. Global Bottled Water Processing Market, 2016-2026, (USD Million)

1.2. Market Snapshot: Global Bottled Water Processing Market

1.3. Market Dynamics

1.4. Global Bottled Water Processing Market, by Segment, 2018

1.4.1. Global Bottled Water Processing Market, by Product Type, 2018, (USD Million)

1.4.2. Global Bottled Water Processing Market, by Packaging material, 2018, (USD Million)

1.4.3. Global Bottled Water Processing Market, by Equipment, 2018, (USD Million)

1.4.4. Global Bottled Water Processing Market, by Technology, 2018, (USD Million)

1.4.5. Global Bottled Water Processing Market, by Region, 2018 (USD Million)

1.5. Premium Insights

1.5.1. Bottled Water Processing Market In Developed Vs. Developing Economies, 2018 vs 2026

1.5.2. Global Bottled Water Processing Market: Regional Life Cycle Analysis

Chapter 2 Market Dynamics

2.1. Market Overview

2.2. Market Drivers

2.2.1. Increasing health consciousness among people

2.2.2. Using of advance technology in bottled water equipment

2.3. Market Restraints

2.3.1. Rapid growth in energy scarcity

2.4. Market Opportunities

2.4.1. Bottled water processors require after-sales services to improve operational efficiency

2.5. Industry Value Chain Analysis

2.6. Pricing Analysis

2.7. Porter’s Five Forces Analysis

Chapter 3 Global Bottled Water Processing Market, by Product Type

3.1. Market Overview, by Product Type

3.1.1. Global Bottled Water Processing Market, by Country, 2016-2026 (USD Million)

3.1.2. Incremental Opportunity, by Product Type, 2018

3.2. Still Water

3.2.1. Global Bottled Water Processing Market, by Still Water, 2016-2026, (USD Million)

3.3. Sparkling Water

3.3.1. Global Bottled Water Processing Market, by Sparkling Water, 2016-2026, (USD Million)

Chapter 4 Global Bottled Water Processing Market, by Packaging material

4.1. Market Overview, by Packaging material

4.1.1. Global Bottled Water Processing Market, by Packaging material, 2016-2026 (USD Million)

4.1.2. Incremental Opportunity, by Packaging material, 2018

4.2. Plastic

4.2.1. Global Bottled Water Processing Market, by Plastic, 2016-2026, (USD Million)

4.3. Glass

4.3.1. Global Bottled Water Processing Market, by Glass, 2016-2026, (USD Million)

4.4. Others

4.4.1. Global Bottled Water Processing Market, by Others, 2016-2026, (USD Million)

Chapter 5 Global Bottled Water Processing Market, by Equipment

5.1. Market Overview, by Equipment

5.1.1. Global Bottled Water Processing Market, by Equipment, 2016-2026 (USD Million)

5.1.2. Incremental Opportunity, by Equipment, 2018

5.2. Filters

5.2.1. Global Bottled Water Processing Market, by Filters, 2016-2026, (USD Million)

5.3. Blow Molders

5.3.1. Global Bottled Water Processing Market, by Blow Molders, 2016-2026, (USD Million)

5.4. Bottle Washers

5.4.1. Global Bottled Water Processing Market, by Bottle Washers, 2016-2026, (USD Million)

5.5. Shrink Wrappers

5.5.1. Global Bottled Water Processing Market, by Shrink Wrappers, 2016-2026, (USD Million)

5.6. Others

5.6.1. Global Bottled Water Processing Market, by Others, 2016-2026, (USD Million)

Chapter 6 Global Bottled Water Processing Market, by Technology

6.1. Market Overview, by Technology

6.1.1. Global Bottled Water Processing Market, by Technology, 2016-2026 (USD Million)

6.1.2. Incremental Opportunity, by Technology, 2018

6.2. Ion exchange and demineralization

6.2.1. Global Bottled Water Processing Market, by Ion exchange and demineralization, 2016-2026, (USD Million)

6.3. Filtration

6.3.1. Global Bottled Water Processing Market, by Filtration, 2016-2026, (USD Million)

6.4. Disinfection

6.4.1. Global Bottled Water Processing Market, by Disinfection, 2016-2026, (USD Million)

6.5. Packaging

6.5.1. Global Bottled Water Processing Market, by Packaging, 2016-2026, (USD Million)

Chapter 7 Global Bottled Water Processing Market, by Region

7.1. Market Overview, by Region

7.1.1. Global Bottled Water Processing Market, by Region, 2016-2026, (USD Million)

7.2. Attractive Investment Opportunity, by Region, 2018

7.3. North America Bottled Water Processing Market

7.3.1. North America Bottled Water Processing Market, by Product Type, 2016-2026 (USD Million)

7.3.2. North America Bottled Water Processing Market, by Packaging material, 2016-2026 (USD Million)

7.3.3. North America Bottled Water Processing Market, by Equipment, 2016-2026 (USD Million)

7.3.4. North America Bottled Water Processing Market, by Technology, 2016-2026 (USD Million)

7.3.5. United States Bottled Water Processing Market, 2016-2026 (USD Million)

7.3.6. Canada Bottled Water Processing Market, 2016-2026 (USD Million)

7.4. Europe Bottled Water Processing Market

7.4.1. Europe Bottled Water Processing Market, by Product Type, 2016-2026 (USD Million)

7.4.2. Europe Bottled Water Processing Market, by Packaging material, 2016-2026 (USD Million)

7.4.3. Europe Bottled Water Processing Market, by Equipment, 2016-2026 (USD Million)

7.4.4. Europe Bottled Water Processing Market, by Technology, 2016-2026 (USD Million)

7.4.5. United Kingdom Bottled Water Processing Market, 2016-2026 (USD Million)

7.4.6. Germany Bottled Water Processing Market, 2016-2026 (USD Million)

7.4.7. France Bottled Water Processing Market, 2016-2026 (USD Million)

7.4.8. Rest of Europe Bottled Water Processing Market, 2016-2026 (USD Million)

7.5. Asia Pacific Bottled Water Processing Market

7.5.1. Asia Pacific Bottled Water Processing Market, by Product Type, 2016-2026 (USD Million)

7.5.2. Asia Pacific Bottled Water Processing Market, by Packaging material, 2016-2026 (USD Million)

7.5.3. Asia Pacific Bottled Water Processing Market, by Equipment, 2016-2026 (USD Million)

7.5.4. Asia Pacific Bottled Water Processing Market, by Technology, 2016-2026 (USD Million)

7.5.5. China Bottled Water Processing Market, 2016-2026 (USD Million)

7.5.6. Japan Bottled Water Processing Market, 2016-2026 (USD Million)

7.5.7. India Bottled Water Processing Market, 2016-2026 (USD Million)

7.5.8. Rest of Asia Pacific Bottled Water Processing Market, 2016-2026 (USD Million)

7.6. Latin America Bottled Water Processing Market

7.6.1. Latin America Bottled Water Processing Market, by Product Type, 2016-2026 (USD Million)

7.6.2. Latin America Bottled Water Processing Market, by Packaging material, 2016-2026 (USD Million)

7.6.3. Latin America Bottled Water Processing Market, by Equipment, 2016-2026 (USD Million)

7.6.4. Latin America Bottled Water Processing Market, by Technology, 2016-2026 (USD Million)

7.6.5. Brazil Bottled Water Processing Market, 2016-2026 (USD Million)

7.6.6. Mexico Bottled Water Processing Market, 2016-2026 (USD Million)

7.6.7. Rest of Latin America Bottled Water Processing Market, 2016-2026 (USD Million)

7.7. Middle East & Africa Bottled Water Processing Market

7.7.1. Middle East & Africa Bottled Water Processing Market, by Product Type, 2016-2026 (USD Million)

7.7.2. Middle East & Africa Bottled Water Processing Market, by Packaging material, 2016-2026 (USD Million)

7.7.3. Middle East & Africa Bottled Water Processing Market, by Equipment, 2016-2026 (USD Million)

7.7.4. Middle East & Africa Bottled Water Processing Market, by Technology, 2016-2026 (USD Million)

7.7.5. GCC Bottled Water Processing Market, 2016-2026 (USD Million)

7.7.6. Rest of Middle East & Africa Bottled Water Processing Market, 2016-2026 (USD Million)

Chapter 8 Competitive Intelligence

8.1. Top 5 Players Comparison

8.2. Market Positioning of Key Players, 2018

8.3. Market Players Mapping

8.3.1. By Product Type

8.3.2. By Packaging material

8.3.3. By Equipment

8.3.4. By Technology

8.3.5. By Region

8.4. Strategies Adopted by Key Market Players

8.5. Recent Developments in the Market

8.5.1. Mergers & Acquisitions, Partnership, New Product Developments

Chapter 9 Company Profiles

9.1. DowDuPont

9.1.1. DowDuPont Overview

9.1.2. DowDuPont Products Portfolio

9.1.3. DowDuPont Financial Overview

9.1.4. DowDuPont News/Recent Developments

9.2. GEA

9.2.1. GEA Overview

9.2.2. GEA Products Portfolio

9.2.3. GEA Financial Overview

9.2.4. GEA News/Recent Developments

9.3. DANONE

9.3.1. DANONE Overview

9.3.2. DANONE Products Portfolio

9.3.3. DANONE Financial Overview

9.3.4. DANONE News/Recent Developments

9.4. Tata Global Beverages

9.4.1. Tata Global Beverages Overview

9.4.2. Tata Global Beverages Products Portfolio

9.4.3. Tata Global Beverages Financial Overview

9.4.4. Tata Global Beverages News/Recent Developments

9.5. Lenntech B.V.

9.5.1. Lenntech B.V. Overview

9.5.2. Lenntech B.V. Products Portfolio

9.5.3. Lenntech B.V. Financial Overview

9.5.4. Lenntech B.V. News/Recent Developments

9.6. Suez

9.6.1. Suez Overview

9.6.2. Suez Products Portfolio

9.6.3. Suez Financial Overview

9.6.4. Suez News/Recent Developments

9.7. Pall Corporation

9.7.1. Pall Corporation Overview

9.7.2. Pall Corporation Products Portfolio

9.7.3. Pall Corporation Financial Overview

9.7.4. Pall Corporation News/Recent Developments

9.8. Nestlé

9.8.1. Nestlé Overview

9.8.2. Nestlé Products Portfolio

9.8.3. Nestlé Financial Overview

9.8.4. Nestlé News/Recent Developments

9.9. PepsiCo

9.9.1. PepsiCo Overview

9.9.2. PepsiCo Products Portfolio

9.9.3. PepsiCo Financial Overview

9.9.4. PepsiCo News/Recent Developments

9.10. Coca-Cola

9.10.1. Coca-Cola Overview

9.10.2. Coca-Cola Products Portfolio

9.10.3. Coca-Cola Financial Overview

9.10.4. Coca-Cola News/Recent Developments

Chapter 10 Preface

10.1. Data Triangulation

10.2. Research Methodology

10.2.1. Phase I – Secondary Research

10.2.2. Phase II – Primary Research

10.2.3. Phase III – Expert Panel Review

10.2.4. Approach Adopted

10.2.4.1. Top-Down Approach

10.2.4.2. Bottom-Up Approach

10.2.5. Supply- Demand side

10.2.6. Breakup of the Primary Profiles