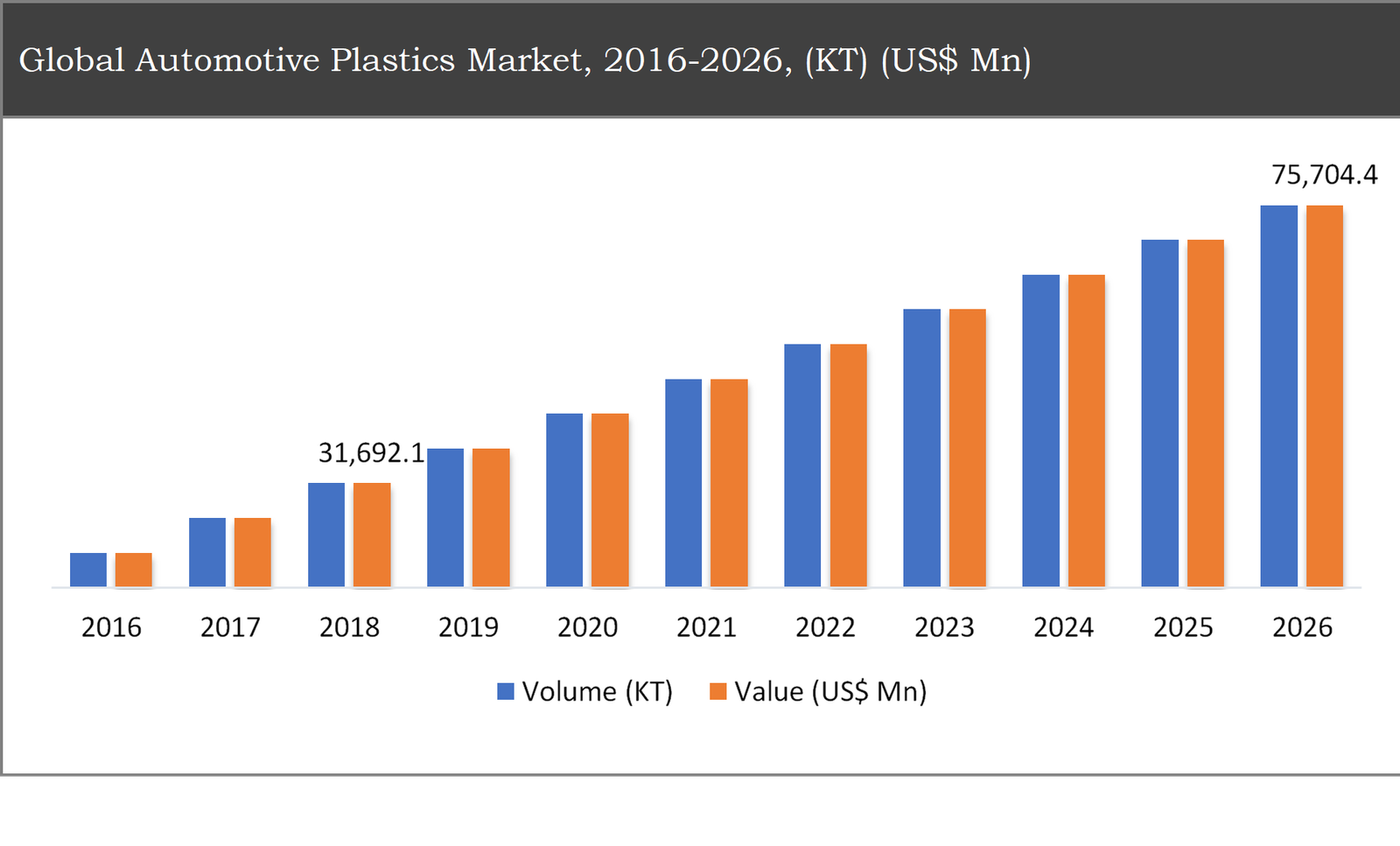

The global automotive plastics market was valued at USD 31,692.1 million in 2018 and is expected to reach USD 75,704.4 million in 2026, growing at a CAGR of 11.5% from 2019 to 2026.

Automotive plastics are the synthetic material which is recyclable, durable, strong, scratch resistance, resistance to abrasion, improve vibration and noise control and allows design, molding, and integration of components in automobiles. Automotive plastics are used in various applications including dashboard, fuel systems, bumpers seats, liquid reservoirs, body panels, under-bonnet components, interior trim, electrical components, exterior trim, lighting, upholstery.

Automotive Plastics Market Segmentation |

|

| By Product Type | 1. Polypropylene |

| 2. Polyurethane | |

| 3. Polyvinyl Chloride | |

| 4. Acrylonitrile-Butadiene-Styrene (ABS) | |

| 5. Polyamide | |

| 6. High-Density Polyethylene (HDPE) | |

| 7. Polycarbonate | |

| 8. Polybutylene Terephthalate (PBT) | |

| 9. Others | |

| By Application | 1. Interior |

| 2. Exterior | |

| 3. Under-the-hood | |

| 4. Electrical components | |

| By Region | 1. North America (US and Canada) |

| 2. Europe (UK, Germany, France and Rest of Europe) | |

| 3. Asia Pacific (China, Japan, India and Rest of Asia Pacific) | |

| 4. Latin America (Brazil, Mexico and Rest of Latin America) | |

| 5. Middle East & Africa (GCC and Rest of Middle East & Africa) | |

The growth of the automotive plastics market is primarily driven by the rising demand for overall weight reduction in vehicles, increase in application areas of automotive plastics, and improved vehicle design capabilities. Moreover, stringent government regulations regarding vehicle emissions less price availability of vehicles, major automotive OEMs prefer automotive plastics in their designs, thus driving the growth of the automotive plastics. The development in the plastics such as blended thermoplastic materials, lightweight material with perfect heat resistance and mechanical properties polymethyl methacrylate (PMMA), reinforced composites such as “GB 266 WG”, biodegradable plastics are expected to create opportunities for the manufacturers in the global market throughout the forecast period. However, volatile prices of raw metals and the availability of substitute products such as carbon fibers are expected to hamper the growth of the global automotive plastics market during the forecast period.

The polypropylene dominated the market throughout the forecast period

Based on product type, the automotive plastics market has been segmented into polypropylene, polyurethane, polyvinyl chloride, acrylonitrile-butadiene-styrene (ABS), polyamide, high-density polyethylene (HDPE), polycarbonate, polybutylene terephthalate (PBT), and others. The polypropylene segment accounted for approximately 31% of the share in the global automotive plastics market in 2018.

While the polyamide segment accounted highest CAGR of around 10.12% in the global automotive plastics market during the forecast period. Unique optical properties, major usage in automotive components due to its excellent mechanical properties and flexibility are some of the factors expected to increase the demand for polyamide. Growing applications of polyamide in automotive and combination with other thermoplastics, such as polyphenylene ether (PPE) to enhance the heat resistant properties is expected to further boost their demand in the next few years.

Based on application, the interior segment is expected to grow at a CAGR of around 12% during the forecast period

Based on application, the market has been segmented into the interior, exterior, under-the-hood, electrical components, and others. The interior segment accounts of the largest share in the market and expected to grow at a CAGR of around 13.5% during the forecast period.

While the under bonnet segment expected to hold the CAGR of approximately 11% during the forecast period. The increase in the replacement of conventional materials used under bonnet components with plastics and composites are expected to increase the market share of under bonnet in terms of value in the global automotive plastics market during the forecast period.

Asia-Pacific to dominate the automotive plastics market throughout the forecast period

Asia-Pacific accounted for nearly 40% share of the global automotive plastics market in 2018 and is expected to dominate the market throughout the forecast period. The rapid growth in the automotive industry in this region is the major driving factor for the global market. Moreover, increasing demand for plastic materials for passenger vehicles from various countries of the region, such as China, India, and Thailand, growing manufacturing facilities due to low manufacturing costs and supportive government incentives, and expanding manufacturing base further dominate the global automotive plastics market during the forecast period.

Europe is expected to hold the highest CAGR in the global market during the forecast period. Manufacturers are investing in the development of plastics to meet the growing demand for automotive plastics. Stringent government regulations regarding vehicle emission are expected to enhance the market growth in the global automotive plastics market during the forecast period.

Company Profiles and Competitive Intelligence:

The major players operating in the global automotive plastics market are BASF SE (Germany), Magna International Inc. (Canada), Adient PLC (Ireland), Borealis AG (Austria), Saudi Basic Industries Corporation (Saudi Arabia), Lear Corporation (US), The DOW Chemical Company (US), Grupo Antolin-Irausa S.A. (Spain), Evonik Industries AG (Germany), and Covestro AG (Germany) among others.

Ask for free product review call with the author

Share your specific research requirements for a customized report

Request for due diligence and consumer centric studies

Request for study updates, segment specific and country level reports

Table of Contents

Chapter 1 Executive Summary

1.1. Market Summary

1.1.1. Global Automotive Plastics Market, 2016-2026, (KT) (USD Million)

1.2. Market Snapshot: Global Automotive Plastics Market

1.3. Market Dynamics

1.4. Global Automotive Plastics Market, by Segment, 2018

1.4.1. Global Automotive Plastics Market, by Product Type, 2018, (KT) (USD Million)

1.4.2. Global Automotive Plastics Market, by Application, 2018, (KT) (USD Million)

1.4.3. Global Automotive Plastics Market, by Region, 2018 (KT) (USD Million)

1.5. Premium Insights

1.5.1. Automotive Plastics Market In Developed Vs. Developing Economies, 2018 vs 2026

1.5.2. Global Automotive Plastics Market: Regional Life Cycle Analysis

Chapter 2 Market Dynamics

2.1. Market Overview

2.2. Market Drivers

2.2.1. Increase in application areas of automotive plastics

2.2.2. Rising demand for overall weight reduction in vehicles

2.2.3. Improved vehicle design capabilities

2.3. Market Restraints

2.3.1. Volatile prices of raw metals

2.3.2. The availability of substitute products

2.4. Market Opportunities

2.4.1. Stringent government regulations regarding vehicle emissions

2.5. Industry Value Chain Analysis

2.6. Pricing Analysis

2.7. Porter’s Five Forces Analysis

Chapter 3 Global Automotive Plastics Market, by Product Type

3.1. Market Overview, by Product Type

3.1.1. Global Automotive Plastics Market, by Product Type, 2016-2026 (KT) (USD Million)

3.1.2. Incremental Opportunity, by Product Type, 2018

3.2. Polypropylene

3.2.1. Global Automotive Plastics Market, by Polypropylene, 2016-2026, (KT) (USD Million)

3.3. Polyurethane

3.3.1. Global Automotive Plastics Market, by Polyurethane, 2016-2026, (KT) (USD Million)

3.4. Polyvinyl Chloride

3.4.1. Global Automotive Plastics Market, by Polyvinyl Chloride, 2016-2026, (KT) (USD Million)

3.5. Acrylonitrile-Butadiene-Styrene (ABS)

3.5.1. Global Automotive Plastics Market, by Acrylonitrile-Butadiene-Styrene (ABS), 2016-2026, (KT) (USD Million)

3.6. Polyamide

3.6.1. Global Automotive Plastics Market, by Polyamide, 2016-2026, (KT) (USD Million)

3.7. High-Density Polyethylene (HDPE)

3.7.1. Global Automotive Plastics Market, by High-Density Polyethylene (HDPE), 2016-2026, (KT) (USD Million)

3.8. Polycarbonate

3.8.1. Global Automotive Plastics Market, by Polycarbonate, 2016-2026, (KT) (USD Million)

3.9. Polybutylene Terephthalate (PBT)

3.9.1. Global Automotive Plastics Market, by Polybutylene Terephthalate (PBT), 2016-2026, (KT) (USD Million)

3.10. Others

3.10.1. Global Automotive Plastics Market, by Others, 2016-2026, (KT) (USD Million)

Chapter 4 Global Automotive Plastics Market, by Application

4.1. Market Overview, by Application

4.1.1. Global Automotive Plastics Market, by Application, 2016-2026 (KT) (USD Million)

4.1.2. Incremental Opportunity, by Application, 2018

4.2. Interior

4.2.1. Global Automotive Plastics Market, by Interior, 2016-2026, (KT) (USD Million)

4.3. Exterior

4.3.1. Global Automotive Plastics Market, by Exterior, 2016-2026, (KT) (USD Million)

4.4. Under-the-hood

4.4.1. Global Automotive Plastics Market, by Under-the-hood, 2016-2026, (KT) (USD Million)

4.5. Electrical components

4.5.1. Global Automotive Plastics Market, by Electrical components, 2016-2026, (KT) (USD Million)

4.6. Others

4.6.1. Global Automotive Plastics Market, by Others, 2016-2026, (KT) (USD Million)

Chapter 5 Global Automotive Plastics Market, by Region

5.1. Market Overview, by Region

5.1.1. Global Automotive Plastics Market, by Region, 2016-2026, (KT) (USD Million)

5.2. Attractive Investment Opportunity, by Region, 2018

5.3. North America Automotive Plastics Market

5.3.1. North America Automotive Plastics Market, by Product Type, 2016-2026 (KT) (USD Million)

5.3.2. North America Automotive Plastics Market, by Application, 2016-2026 (KT) (USD Million)

5.3.3. United States Automotive Plastics Market, 2016-2026 (KT) (USD Million)

5.3.4. Canada Automotive Plastics Market, 2016-2026 (KT) (USD Million)

5.4. Europe Automotive Plastics Market

5.4.1. Europe Automotive Plastics Market, by Product Type, 2016-2026 (KT) (USD Million)

5.4.2. Europe Automotive Plastics Market, by Application, 2016-2026 (KT) (USD Million)

5.4.3. United Kingdom Automotive Plastics Market, 2016-2026 (KT) (USD Million)

5.4.4. Germany Automotive Plastics Market, 2016-2026 (KT) (USD Million)

5.4.5. France Automotive Plastics Market, 2016-2026 (KT) (USD Million)

5.4.6. Rest of Europe Automotive Plastics Market, 2016-2026 (KT) (USD Million)

5.5. Asia Pacific Automotive Plastics Market

5.5.1. Asia Pacific Automotive Plastics Market, by Product Type, 2016-2026 (KT) (USD Million)

5.5.2. Asia Pacific Automotive Plastics Market, by Application, 2016-2026 (KT) (USD Million)

5.5.3. China Automotive Plastics Market, 2016-2026 (KT) (USD Million)

5.5.4. Japan Automotive Plastics Market, 2016-2026 (KT) (USD Million)

5.5.5. India Automotive Plastics Market, 2016-2026 (KT) (USD Million)

5.5.6. Rest of Asia Pacific Automotive Plastics Market, 2016-2026 (KT) (USD Million)

5.6. Latin America Automotive Plastics Market

5.6.1. Latin America Automotive Plastics Market, by Product Type, 2016-2026 (KT) (USD Million)

5.6.2. Latin America Automotive Plastics Market, by Application, 2016-2026 (KT) (USD Million)

5.6.3. Brazil Automotive Plastics Market, 2016-2026 (KT) (USD Million)

5.6.4. Mexico Automotive Plastics Market, 2016-2026 (KT) (USD Million)

5.6.5. Rest of Latin America Automotive Plastics Market, 2016-2026 (KT) (USD Million)

5.7. Middle East & Africa Automotive Plastics Market

5.7.1. Middle East & Africa Automotive Plastics Market, by Product Type, 2016-2026 (KT) (USD Million)

5.7.2. Middle East & Africa Automotive Plastics Market, by Application, 2016-2026 (KT) (USD Million)

5.7.3. GCC Automotive Plastics Market, 2016-2026 (KT) (USD Million)

5.7.4. Rest of Middle East & Africa Automotive Plastics Market, 2016-2026 (KT) (USD Million)

Chapter 6 Competitive Intelligence

6.1. Top 5 Players Comparison

6.2. Market Positioning of Key Players, 2018

6.3. Market Players Mapping

6.3.1. By Product Type

6.3.2. By Application

6.3.3. By Region

6.4. Strategies Adopted by Key Market Players

6.5. Recent Developments in the Market

6.5.1. Mergers & Acquisitions, Partnership, New Product Developments

Chapter 7 Company Profiles

7.1. BASF SE

7.1.1. BASF SE Overview

7.1.2. BASF SE Products Portfolio

7.1.3. BASF SE Financial Overview

7.1.4. BASF SE News/Recent Developments

7.2. Magna International Inc.

7.2.1. Magna International Inc. Overview

7.2.2. Magna International Inc. Products Portfolio

7.2.3. Magna International Inc. Financial Overview

7.2.4. Magna International Inc. News/Recent Developments

7.3. Adient PLC

7.3.1. Adient PLC Overview

7.3.2. Adient PLC Products Portfolio

7.3.3. Adient PLC Financial Overview

7.3.4. Adient PLC News/Recent Developments

7.4. Borealis AG

7.4.1. Borealis AG Overview

7.4.2. Borealis AG Products Portfolio

7.4.3. Borealis AG Financial Overview

7.4.4. Borealis AG News/Recent Developments

7.5. Saudi Basic Industries Corporation

7.5.1. Saudi Basic Industries Corporation Overview

7.5.2. Saudi Basic Industries Corporation Products Portfolio

7.5.3. Saudi Basic Industries Corporation Financial Overview

7.5.4. Saudi Basic Industries Corporation News/Recent Developments

7.6. Lear Corporation

7.6.1. Lear Corporation Overview

7.6.2. Lear Corporation Products Portfolio

7.6.3. Lear Corporation Financial Overview

7.6.4. Lear Corporation News/Recent Developments

7.7. The DOW Chemical Company

7.7.1. The DOW Chemical Company Overview

7.7.2. The DOW Chemical Company Products Portfolio

7.7.3. The DOW Chemical Company Financial Overview

7.7.4. The DOW Chemical Company News/Recent Developments

7.8. Grupo Antolin-Irausa S.A.

7.8.1. Grupo Antolin-Irausa S.A. Overview

7.8.2. Grupo Antolin-Irausa S.A. Products Portfolio

7.8.3. Grupo Antolin-Irausa S.A. Financial Overview

7.8.4. Grupo Antolin-Irausa S.A. News/Recent Developments

7.9. Evonik Industries AG

7.9.1. Evonik Industries AG Overview

7.9.2. Evonik Industries AG Products Portfolio

7.9.3. Evonik Industries AG Financial Overview

7.9.4. Evonik Industries AG News/Recent Developments

7.10. Covestro AG

7.10.1. Covestro AG Overview

7.10.2. Covestro AG Products Portfolio

7.10.3. Covestro AG Financial Overview

7.10.4. Covestro AG News/Recent Developments

Chapter 8 Preface

8.1. Data Triangulation

8.2. Research Methodology

8.2.1. Phase I – Secondary Research

8.2.2. Phase II – Primary Research

8.2.3. Phase III – Expert Panel Review

8.2.4. Approach Adopted

8.2.4.1. Top-Down Approach

8.2.4.2. Bottom-Up Approach

8.2.5. Supply- Demand side

8.2.6. Breakup of the Primary Profiles