Diabetic footwear refers to the specifically designed footwear that provides protection to the feet of diabetic patients and reduces the risk of skin breakdown that can be caused by neuropathy, poor blood circulation, and foot deformities.

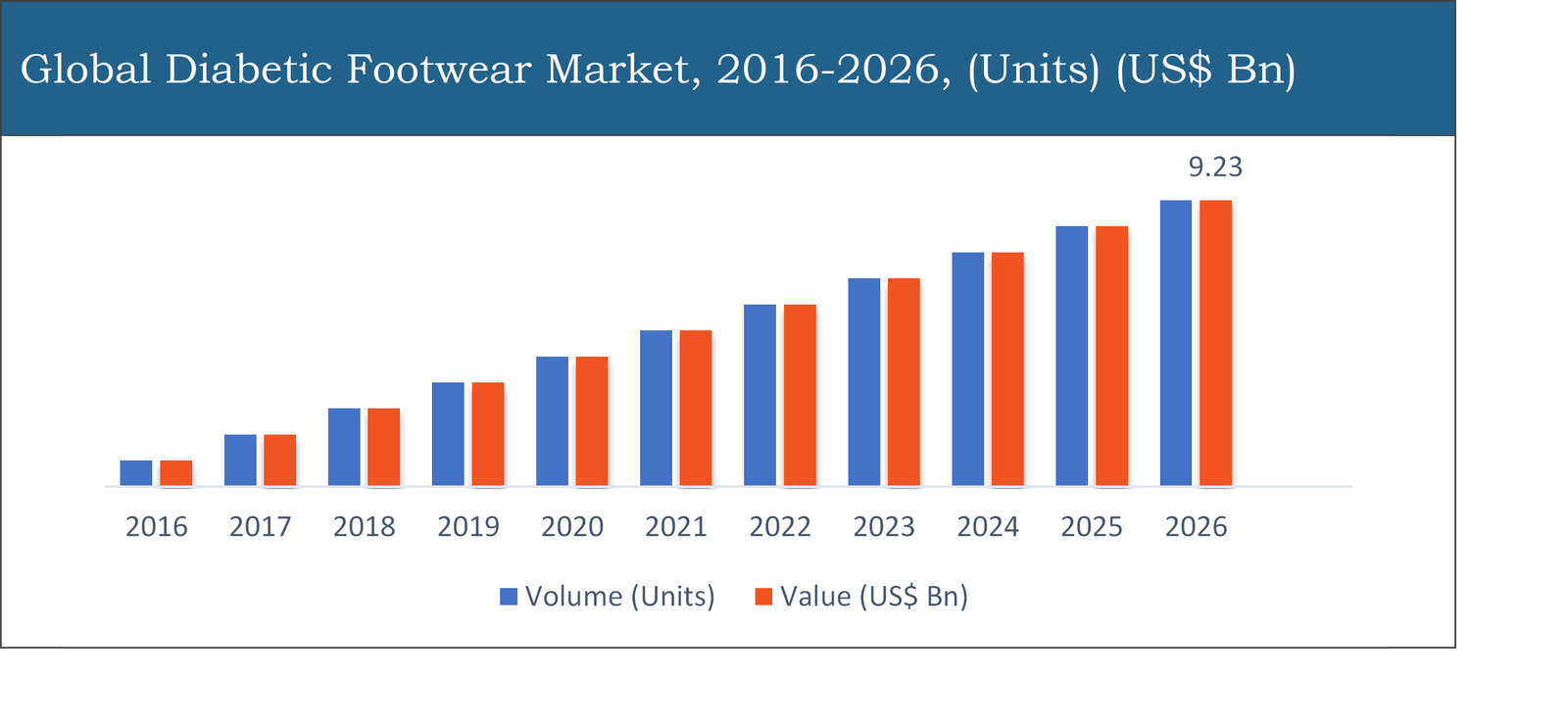

This diabetic footwear market report provides an analysis for the period from 2016 to 2026, where 2019 to 2026 is the forecast period with 2018 as the base year. This report on diabetic footwear covers an in-depth analysis of the market including statistical and subjective data points, along with the key market drivers and opportunities & restraints that have positive or negative effects on the overall global market. Exclusive coverage has been provided for market drivers and challenges & opportunities for a country-level market in the respective regional segments. The report comprises a competitive analysis of the key players functioning in the market and covers in-depth data related to the competitive landscape of the market and the recent strategies & products that will assist or affect the market in the coming years.

The global diabetic footwear market has been segmented on the basis of different product type, distribution channels, and end-use. On the basis of different product types, the market has been segmented as slipper/sandals and shoes. By different distribution channels, the market has been segmented into online channels and offline channels. By different end-use, the market has been segmented into men and women.

The women end-user segment dominated the market in 2018 and is expected to display a similar trend in the coming years

In terms of different end-users, the women segment dominated the market in 2018. The rising number of diabetic women has resulted in an increase in demand for diabetic footwear over the years. In addition to this, growing awareness about proper foot care and rapid penetration of online are some of the major factors that are boosting the demand for diabetic footwear.

The shoe segment dominated the market in 2018 and is expected to display a similar trend in the coming years

In terms of product type, the shoe segment dominated the market in 2018. This is attributed to a high preference for shoes among the male and female population. Shoes are much preferable for office-going people since formal attire includes shoes. The increasing number of working women populations over the years is also a major factor resulting in an increase in demand for diabetic shoes. Further, features such as the option to wear shoes on different occasions or places, and added protection offered by diabetic shoes are also boosting the overall market growth.

The online distribution channel is expected to witness the fastest growth during the forecast period

In terms of distribution channels, the online channel is expected to witness the fastest growth during the forecast period. The rapid penetration of online retail and options of several brands in online platforms are increasing the demand for diabetic footwear. Manufacturers are focussing on displaying their products on online platforms with detailed product information, in order to grab the attention of a greater number of customers.

Product Type

Slippers/ Sandles

Shoes

By Distribution Channels

Online channels

Offline channels

By End User

Men

Women

Region

North America

U.S.

Canada

Mexico

Europe

U.K.

Germany

France

Spain

Italy

Rest of Europe

Asia Pacific

China

Japan

India

Thailand

Indonesia

Rest of APAC

LATAM

Brazil

Argentina

Rest of LATAM

Middle East Africa

South Africa

GCC

Rest of MEA

Asia Pacific dominated the market in 2018 and is expected to display a similar trend in the coming years

Asia Pacific dominated the market in 2018 and is expected to display a similar trend in the coming years. The region is also expected to witness the fastest growth during the forecast period. The increasing number of type 2 diabetic patients over the years is a major factor to boost the overall marker growth of diabetic footwear. Moreover, the rising number of geriatric patients is also a major factor that is resulting in a rise in demand for diabetic footwear over the years.

North America accounted for a significant market share in 2018, owing to the rising awareness among diabetic patients regarding the benefits of diabetic footwear. Moreover, substantial investments undertaken in health and wellness by governments are also a major factor in boosting the overall market growth in the North America region.

Major manufacturers operating in the market are Aetrex Worldwide, Inc., Darco International, Inc., Orthofeet, Inc., Dr. Comfort, llc., Podartis Srl., Dr. Zen Products, Inc., Hanger, Inc., Etonic Worldwide llc., Drew Shoe Corp., Hush Puppies, Propet Usa, Inc., and New Balance, Inc. The players have stepped up new product innovations and new product launches in order to gain more attention from customers. Moreover, the market growth is attributed to strategic mergers & acquisitions, geographical expansions, and joint ventures & partnerships which helps in ensuring long-term sustenance in the market.

Key Questions Answered in the Report:

• What is the market value and volume of the overall diabetic footwear market?

• What are the different segments and sub-segments in the market?

• What are the key drivers, restraints, opportunities, and challenges in the market and how are they expected to impact the market?

• What are the attractive segments and geographies to invest in?

• What is the market value and volume at the regional and country level?

• Who are the key market players and their key competitors?

• What are the different strategies that are adopted by the key players in the market?

• How does a particular company rank against its competitors with respect to revenue, profit comparison, operational efficiency, cost competitiveness, and market capitalization?

• How financially strong are the key players in the market (on the basis of revenue and profit margin, market capitalization, expenditure analysis, investment analysis)?

• What are the recent trends in the market? (M&A, partnerships, new product developments, expansions)

Ask for free product review call with the author

Share your specific research requirements for a customized report

Request for due diligence and consumer centric studies

Request for study updates, segment specific and country level reports

Table of Content

Chapter 1 Preface

1.1 Report Description

1.1.1 Purpose of the Report

1.1.2 Target Audience

1.1.3 USP and Key Offerings

1.2 Research Scope

1.3 Research Methodology

1.3.1 Phase I – Secondary Research

1.3.2 Phase II – Primary Research

1.3.3 Phase III – Expert Panel Review

1.3.4 Approach Adopted

1.3.4.1 Top-Down Approach

1.3.4.2 Bottom-Up Approach

1.3.5 Assumptions

1.4 Market Segmentation Scope

Chapter 2 Executive Summary

2.1 Market Summary

2.1.1 Global Diabetic Footwear Market, 2016-2026, (US$ Bn)

2.1 Market Snapshot: Global Diabetic Footwear Market

2.2 Market Dynamics

2.3 Global Diabetic Footwear Market, by Segment, 2018

2.3.1 Global Diabetic Footwear Market, by Product Type, 2018, (Units) (US$ Bn)

2.3.2 Global Diabetic Footwear Market, by Distribution Channel, 2018 (Units) (US$ Bn)

2.3.3 Global Diabetic Footwear Market, by End-use, 2018 (Units) (US$ Bn)

2.3.4 Global Diabetic Footwear Market, by Region, 2018 (Units) (US$ Bn)

2.4 Premium Insights

2.4.1 Diabetic Footwear Market In Developed Vs. Developing Economies, 2018 vs 2026

2.4.2 Global Diabetic Footwear Market: Regional Life Cycle Analysis

Chapter 3 Market Dynamics

3.1 Market Overview

3.2 Market Drivers

3.2.1 Increasing number of diabetic patients over the years is driving the demand for diabetic footwear

3.2.2 Driver 2

3.2.3 Driver 3

3.3 Market Restraints

3.3.1 Lack of awareness regarding the benefits of diabetic footwear is restraining the market

3.3.2 Restraint 2

3.4 Market Opportunities

3.4.1 Product innovations is generating opportunity to the market during the forecast period

3.4.2 Opportunity 2

3.5 Industry Value Chain Analysis

3.5.1 Analyst’s Views

3.6 Industry SWOT Analysis

Chapter 4 Global Diabetic Footwear Market, by Product Type

4.1 Market Overview, by Product Type

4.1.1 Global Diabetic Footwear Market, by Product Type, 2016-2026 (Units) (US$ Bn)

4.1.2 Incremental Opportunity, by Product Type, From 2018-2026

4.2 Slippers/Sandals

4.2.1 Global Diabetic Footwear Market, by Slippers/Sandals, 2016-2026, (Units) (US$ Bn)

4.3 Shoes

4.3.1 Global Diabetic Footwear Market, by Shoes, 2016-2026, (Units) (US$ Bn)

Chapter 5 Global Diabetic Footwear Market, by Distribution Channel

5.1 Market Overview, by Distribution Channel

5.1.1 Global Diabetic Footwear Market, by Distribution Channel, 2016-2026 (Units) (US$ Bn)

5.1.2 Incremental Opportunity, by Distribution Channel, From 2018-2026

5.2 Online Channel

5.2.1 Global Diabetic Footwear Market, by Online Channel, 2016-2026, (Units) (US$ Bn)

5.3 Offline Channel

5.3.1 Global Diabetic Footwear Market, by Hypermarkets, 2016-2026, (Units) (US$ Bn)

Chapter 6 Global Diabetic Footwear Market, by End-use

6.1 Market Overview, by End-use

6.1.1 Global Diabetic Footwear Market, by End-use, 2016-2026 (Units) (US$ Bn)

6.1.2 Incremental Opportunity, by End-use, From 2018-2026

6.2 Men

6.2.1 Global Diabetic Footwear Market, by Men, 2016-2026, (Units) (US$ Bn)

6.3 Women

6.3.1 Global Diabetic Footwear Market, by Women, 2016-2026, (Units) (US$ Bn)

Chapter 7 Global Diabetic Footwear Market, by Region

7.1 Market Overview, by Region

7.1.1 Global Diabetic Footwear Market, by Region, 2016-2026, (Units) (US$ Bn)

7.2 Attractive Investment Opportunity, by Region, 2018

7.3 North America Diabetic Footwear Market

7.3.1 North America Diabetic Footwear Market, by Product Type, 2016-2026 (Units) (US$ Bn)

7.3.2 North America Diabetic Footwear Market, by Distribution Channel, 2016-2026 (Units) (US$ Bn)

7.3.3 North America Diabetic Footwear Market, by End-use, 2016-2026 (Units) (US$ Bn)

7.3.4 United States Country Profile

7.3.4.1 United States Diabetic Footwear Market, 2016-2026 (Units) (US$ Bn)

7.3.5 Canada Country Profile

7.3.5.1 Canada Diabetic Footwear Market, 2016-2026 (Units) (US$ Bn)

7.3.6 Mexico Country Profile

7.3.6.1 Mexico Diabetic Footwear Market, 2016-2026 (Units) (US$ Bn)

7.4 Europe Diabetic Footwear Market

7.4.1 Europe Diabetic Footwear Market, by Product Type, 2016-2026 (Units) (US$ Bn)

7.4.2 Europe Diabetic Footwear Market, by Distribution Channel, 2016-2026 (Units) (US$ Bn)

7.4.3 Europe Diabetic Footwear Market, by End-use, 2016-2026 (Units) (US$ Bn)

7.4.4 United Kingdom Country Profile

7.4.4.1 United Kingdom Diabetic Footwear Market, 2016-2026 (Units) (US$ Bn)

7.4.5 Germany Country Profile

7.4.5.1 Germany Diabetic Footwear Market, 2016-2026 (Units) (US$ Bn)

7.4.6 France Country Profile

7.4.6.1 France Diabetic Footwear Market, 2016-2026 (Units) (US$ Bn)

7.4.7 Italy Country Profile

7.4.7.1 Italy Diabetic Footwear Market, 2016-2026 (Units) (US$ Bn)

7.4.8 Spain Country Profile

7.4.8.1 Spain Diabetic Footwear Market, 2016-2026 (Units) (US$ Bn)

7.4.9 Rest of Europe

7.4.9.1 Rest of Europe Diabetic Footwear Market, 2016-2026 (Units) (US$ Bn)

7.5 Asia Pacific Diabetic Footwear Market

7.5.1 Asia Pacific Diabetic Footwear Market, by Product Type, 2016-2026 (Units) (US$ Bn)

7.5.2 Asia Pacific Diabetic Footwear Market, by Distribution Channel, 2016-2026 (Units) (US$ Bn)

7.5.3 Asia Pacific Diabetic Footwear Market, by End-use, 2016-2026 (Units) (US$ Bn)

7.5.4 China Country Profile

7.5.4.1 China Diabetic Footwear Market, 2016-2026 (Units) (US$ Bn)

7.5.5 Japan Country Profile

7.5.5.1 Japan Diabetic Footwear Market, 2016-2026 (Units) (US$ Bn)

7.5.6 India Country Profile

7.5.6.1 India Diabetic Footwear Market, 2016-2026 (Units) (US$ Bn)

7.5.7 Indonesia Country Profile

7.5.7.1 Indonesia Diabetic Footwear Market, 2016-2026 (Units) (US$ Bn)

7.5.8 Thailand Country Profile

7.5.8.1 Thailand Diabetic Footwear Market, 2016-2026 (Units) (US$ Bn)

7.5.9 Rest of Asia Pacific

7.5.9.1 Rest of Asia Pacific Diabetic Footwear Market, 2016-2026 (Units) (US$ Bn)

7.6 Latin America Diabetic Footwear Market

7.6.1 Latin America Diabetic Footwear Market, by Product Type, 2016-2026 (Units) (US$ Bn)

7.6.2 Latin America Diabetic Footwear Market, by Distribution Channel, 2016-2026 (Units) (US$ Bn)

7.6.3 Latin America Diabetic Footwear Market, by End-use, 2016-2026 (Units) (US$ Bn)

7.6.4 Brazil Country Profile

7.6.4.1 Brazil Diabetic Footwear Market, 2016-2026 (Units) (US$ Bn)

7.6.5 Argentina Country Profile

7.6.5.1 Argentina Diabetic Footwear Market, 2016-2026 (Units) (US$ Bn)

7.6.6 Rest of Latin America

7.6.6.1 Rest of Latin America Diabetic Footwear Market, 2016-2026 (Units) (US$ Bn)

7.7 Middle East & Africa Diabetic Footwear Market

7.7.1 Middle East & Africa Diabetic Footwear Market, by Product Type, 2016-2026 (Units) (US$ Bn)

7.7.2 Middle East & Africa Diabetic Footwear Market, by Distribution Channel, 2016-2026 (Units) (US$ Bn)

7.7.3 Middle East & Africa Diabetic Footwear Market, by End-use, 2016-2026 (Units) (US$ Bn)

7.7.4 Southern Africa

7.7.4.1 Southern Africa Diabetic Footwear Market, 2016-2026 (Units) (US$ Bn)

7.7.5 Northern Africa

7.7.5.1 Northern Africa Diabetic Footwear Market, 2016-2026 (Units) (US$ Bn)

7.7.6 GCC

7.7.6.1 GCC Diabetic Footwear Market, 2016-2026 (Units) (US$ Bn)

7.7.7 Rest of Middle East & Africa

7.7.7.1 Rest of Middle East & Africa Diabetic Footwear Market, 2016-2026 (Units) (US$ Bn)

Chapter 8 Competitive Intelligence

8.1 Introduction

8.2 Players Evaluated During the Study

8.3 Market Players Present in Market Life Cycle

8.4 Top 5 Players Comparison

8.5 Market Positioning of Key Players, 2018

8.6 Market Players Mapping

8.6.1 By Product Type

8.6.2 By Distribution Channel

8.6.3 By End-use

8.6.4 By Region

8.7 Strategies Adopted by Key Market Players

8.8 Recent Developments in the Market

8.8.1 Mergers & Acquisitions, Partnership, New Product Developments

8.9 Operational Efficiency Comparison by Key Players

Chapter 9 Company Profiles

9.1 Aetrex Worldwide, Inc.

9.1.1 Aetrex Worldwide, Inc. Overview

9.1.2 Key Stakeholders/Person in Aetrex Worldwide, Inc.

9.1.3 Aetrex Worldwide, Inc. Products Portfolio

9.1.4 Aetrex Worldwide, Inc. Financial Overview

9.1.5 Aetrex Worldwide, Inc. News/Recent Developments

9.2 Darco International, Inc.

9.2.1 Darco International, Inc. Overview

9.2.2 Key Stakeholders/Person in Darco International, Inc.

9.2.3 Darco International, Inc. Products Portfolio

9.2.4 Darco International, Inc. Financial Overview

9.2.5 Darco International, Inc. News/Recent Developments

9.3 Orthofeet, Inc.

9.3.1 Orthofeet, Inc. Overview

9.3.2 Key Stakeholders/Person in Orthofeet, Inc.

9.3.3 Orthofeet, Inc. Products Portfolio

9.3.4 Orthofeet, Inc. Financial Overview

9.3.5 Orthofeet, Inc. News/Recent Developments

9.4 Dr. Comfort, llc.

9.4.1 Dr. Comfort, llc. Overview

9.4.2 Key Stakeholders/Person in Dr. Comfort, llc.

9.4.3 Dr. Comfort, llc. Products Portfolio

9.4.4 Dr. Comfort, llc. Financial Overview

9.4.5 Dr. Comfort, llc. News/Recent Developments

9.5 Podartis Srl.

9.5.1 Podartis Srl. Overview

9.5.2 Key Stakeholders/Person in Podartis Srl.

9.5.3 Podartis Srl. Products Portfolio

9.5.4 Podartis Srl. Financial Overview

9.5.5 Podartis Srl. News/Recent Developments

9.6 Dr. Zen Products, Inc.

9.6.1 Dr. Zen Products, Inc. Overview

9.6.2 Key Stakeholders/Person in Dr. Zen Products, Inc.

9.6.3 Dr. Zen Products, Inc. Products Portfolio

9.6.4 Dr. Zen Products, Inc. Financial Overview

9.6.5 Dr. Zen Products, Inc. News/Recent Developments

9.7 Hanger, Inc.

9.7.1 Hanger, Inc. Overview

9.7.2 Key Stakeholders/Person in Hanger, Inc.

9.7.3 Hanger, Inc. Products Portfolio

9.7.4 Hanger, Inc. Financial Overview

9.7.5 Hanger, Inc. News/Recent Developments

9.8 Etonic Worldwide llc.

9.8.1 Etonic Worldwide llc. Overview

9.8.2 Key Stakeholders/Person in Etonic Worldwide llc.

9.8.3 Etonic Worldwide llc. Products Portfolio

9.8.4 Etonic Worldwide llc. Financial Overview

9.8.5 Etonic Worldwide llc. News/Recent Developments

9.9 Drew Shoe Corp.

9.9.1 Drew Shoe Corp. Overview

9.9.2 Key Stakeholders/Person in Drew Shoe Corp.

9.9.3 Drew Shoe Corp. Products Portfolio

9.9.4 Drew Shoe Corp. Financial Overview

9.9.5 Drew Shoe Corp. News/Recent Developments

9.10 Hush Puppies

9.10.1 Hush Puppies Overview

9.10.2 Key Stakeholders/Person in Hush Puppies

9.10.3 Hush Puppies Products Portfolio

9.10.4 Hush Puppies Financial Overview

9.10.5 Hush Puppies News/Recent Developments